South Korea has tracked USD 1 billion worth of fake crypto transactions this year

A staggering USD 1 billion worth of fake crypto-related transactions was identified in South Korea in the first half of 2022, new data shows.

According to Asia Kyungjae, the numbers were compiled by Korea Customs and made public by legislator Kang Byung-won.

The data records all crypto-related transactions flagged as fraudulent by customs officials from 2017 to June 2022.

The figures show that customs officials have flagged a total of over $2.8 billion in crypto-related transactions since 2017. Over $1 billion of this figure has been flagged in the first half of this year (January to June). This dwarfs the figure for the whole of 2021 (USD 600 million). However, this is likely due to the fact that Customs have stepped up their policing of the sector over the past year as part of what they have called a “crackdown” on crypto-related fraud.

All of these transactions involve cross-border fiat bank or wire transfers – or cases where individuals have been caught carrying notes to and from overseas locations.

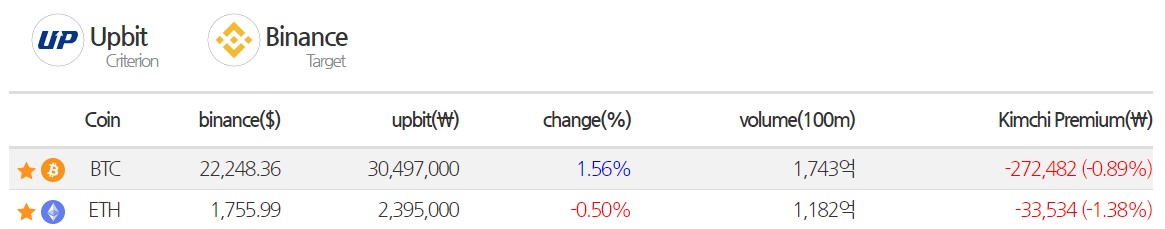

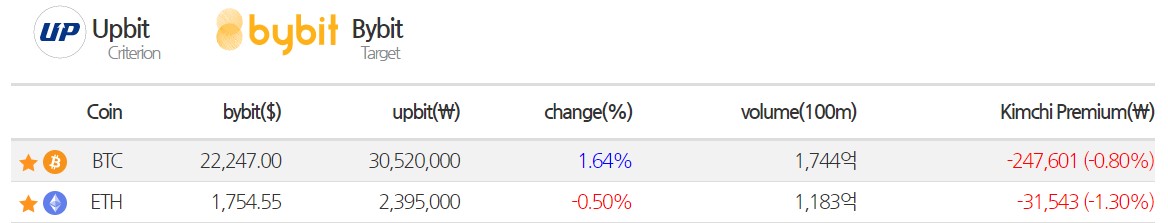

Customs officials appear to have indicated that in many cases the money has been linked to over-the-counter crypto trading and “kimchi premium” trading. The latter refers to scenarios where the price of bitcoin (BTC) and other tokens is higher in South Korea than elsewhere in the world. In cases like these, some traders have tried to buy “cheaper” BTC abroad and then dump coins on domestic exchanges – for a profit of up to 30%.

These types of transactions violate South Korean foreign exchange laws – and both customs officials and prosecutors have waged war on suspected perpetrators.

USD 1 Billion in Fake Crypto Transactions – Incoming Political Backlash?

Kang is a member of parliament for the Democratic Party, which has a large majority in the National Assembly. He is also a member of the assembly’s political committee.

He and other lawmakers have indicated they will push for changes to the law — and Kang called on regulators to respond.

Kang was quoted as saying:

“It is necessary to strengthen the crackdown on [crypto crime] by finding a way to allow the financial authorities, such as Financial Services Commission and Financial Supervisory Service, to work directly with investigative agencies. We also need to improve our technical capabilities [to help fight crime like this].”