Solar Power Drives Bitcoin Mining Profit – Bitcoin Magazine

This is an opinion piece by Ali Chehrehsaz, a mechanical engineer with 16 years of experience in the energy industry.

This article will outline how collecting solar energy and storing it can provide a powerful dynamic for bitcoin mining by outlining that:

- Hybrid power plants that combine electrical generation, especially solar energy, with batteries are growing rapidly

- Bitcoin mining will be incorporated into these facilities along with batteries, for the same reasons

- Incorporating bitcoin mining as well as batteries requires proper sizing of deployed assets, and also sharing energy between batteries, mining and the grid in a way that optimizes revenue

- The way forward will not be technically or commercially easy, but the opportunity is massive

Hybrid power plant

There is a new type of power plant on the rise: batteries are being co-located with wind, solar cell (“PV”) energy, fossil fuels, etc. to create what is referred to as “hybrid power plant.” Among these hybrid power plants, solar-plus-battery systems are the fastest growing segment.

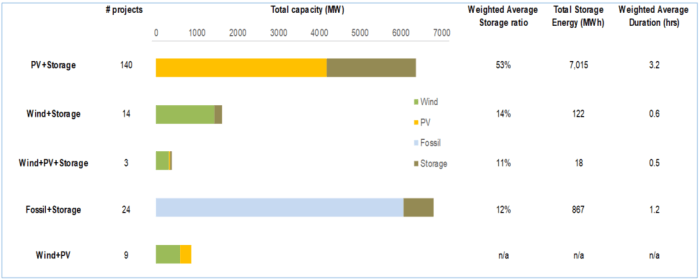

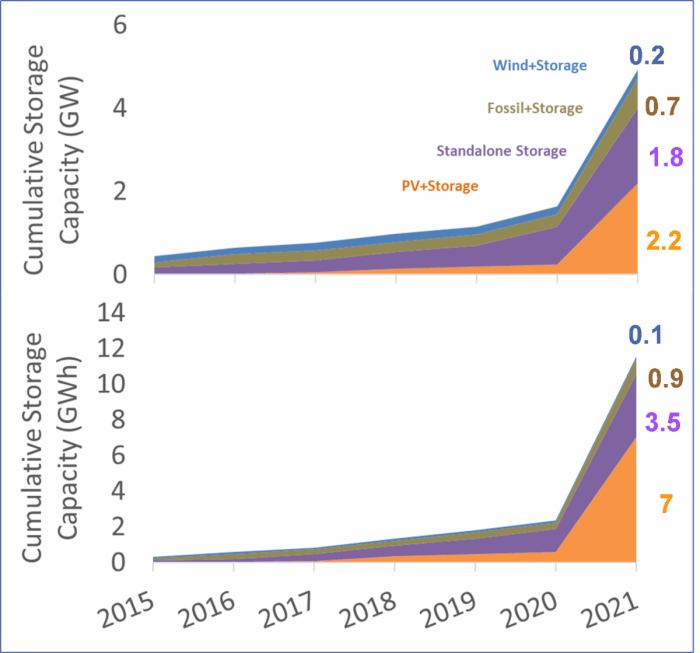

Lawrence Berkeley National Labs (LBNL) recently published findings in a briefing entitled “2021 was a big year for hybrid power plants – especially PV+storage.” In the article it mentioned: “Among the operational generator+storage hybrids, PV+storage dominates in terms of plant number (140), storage capacity (2.2 GW) [gigawatts]/7.0 GWh [gigawatt hours]), storage:generator capacity ratio (53%) and storage duration (3.2 h). “

The briefing goes on to state that: “Last year was a breakout year in particular for PV+storage hybrids: 67 of the 74 hybrids added in 2021 were PV+storage. By the end of 2021, there were more GW of battery capacity in operation in PV +storage hybrids (2.2 GW) than as standalone storage facilities (1.8 GW). Much of the battery capacity added in hybrid form in 2021 was a retrofitting of a battery to an already existing solar system.”

This last point is noteworthy and we will return to discuss it later.

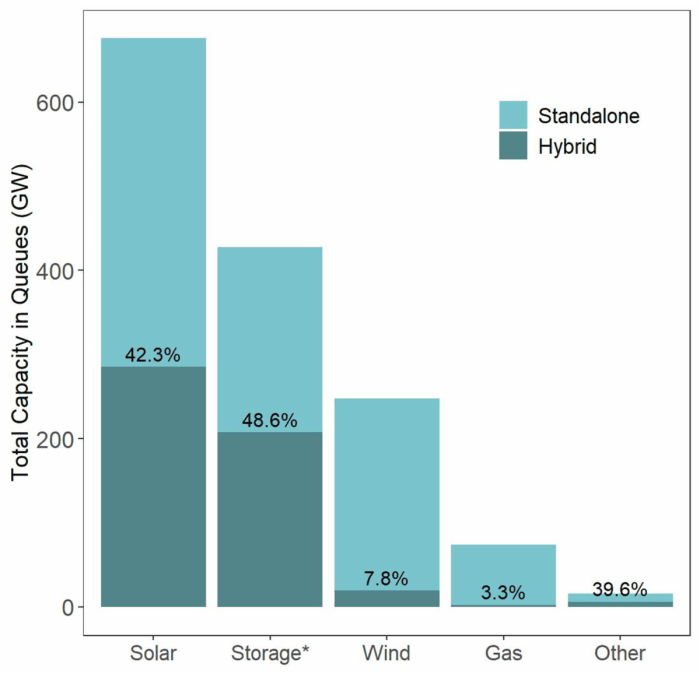

This trend continues, and as the article points out, there were more than 670 GW of solar installations in the interconnection queues in the US by the end of 2021.

Prisoners of time and geography

Why are batteries added to solar systems at such a high rate? There are two factors at play: deflation in the value available for solar and the ever-increasing competitiveness of the solar industry.

Problem 1: Solar Value Deflation

What is solar value deflation? The LBNL briefing gives a hint: “…[PV+storage] can be found in large parts of the country… although the largest such plants are in California and the West…” In short: geography.

Solar power in places like California, Nevada and Arizona suffers from an anti-grid effect. The anti-grid effect of solar occurs in a market when solar penetration at a location reaches a market-specific tipping point, after which the addition of new solar capacity reduces the benefit (ie, the value of solar generation) for all solar systems in that market. In its 2021 “Utility Scale Solar” report, LNBL demonstrates this issue in more detail.

As solar penetration on a grid increases, the value that solar energy can capture decreases. This leads us to another hint: time. The hours that a given solar generator can produce electricity are, by definition, the same hours that all other solar generators in the vicinity can produce electricity, which end up being the hours the market is oversupplied and prices are lower.

This is why renewable energy is, in a sense, prisoners of time and geography. See the California example outlined by LNBL: At 22% penetration, solar can only capture 75% of the value of generation with a 24/7 baseload power profile. The problem is already visible in other markets at penetrations as low as 5%.

All markets are heading in this direction. Owners of existing or planned solar projects must find ways to hedge this risk and diversify their revenue streams.

Problem two: Extreme competition

The second factor is the success of solar energy, creating an extremely competitive industry that now challenges further growth.

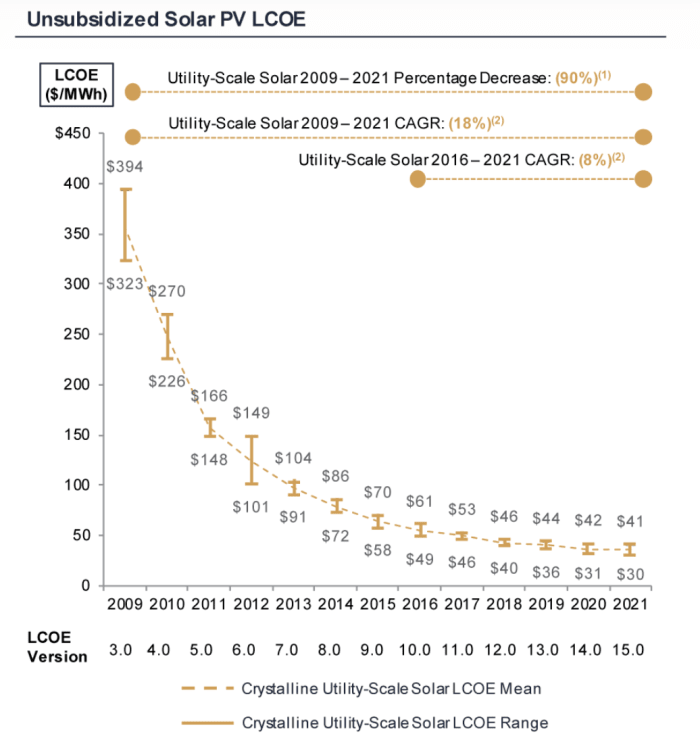

The solar industry started much later than other power generation industries and has had to catch up to earn its share of the power generation mix. The industry has used equalized energy cost (LCOE) calculation to compare costs with coal, natural gas and other generation sources.

Solar became the lowest LCOE form of generation over the past decade, and this has fueled the incredible growth of solar capacity. But competition with other generation sources continues within the industry itself, creating a race to the bottom that erodes returns for solar investors. The following chart is from an article by Lazard titled “Levelized Cost Of Energy, Levelized Cost Of Storage, And Levelized Cost Of Hydrogen” that shows the rapid drop in levelized solar costs:

A continued reduction in solar LCOE translates into a downward trajectory for revenues from solar installations. As such, investors in solar energy are looking for ways to increase profits within the confines of the power market. Batteries are one such technology that provides a path to higher revenues through arbitrage, demand response and ancillary services.

The Roadmap for Bitcoin Miners

What is the opportunity for bitcoin miners? The way storage has meshed neatly into the solar value stack provides a useful roadmap for bitcoin miners to follow. Bitcoin mining can also provide similar opportunities for solar power plants to access higher profits by acting as a flexible resource for the grid.

But because batteries have a fixed storage capacity and provide a short-term opportunity for energy arbitrage against the local power grid, in the end even a battery must take the local grid market prices. Bitcoin mining has no storage limit (allowing long-term arbitrage) and can provide arbitrage anywhere on the globe (more on that topic: “Bitcoin is the first global market for electricity”).

The coupling of bitcoin mining and solar energy is simple in principle, but making the physics and economics work in practice is not easy. To create increased returns, Bitcoin miners must accurately size their deployments when co-locating with solar and battery hybrid plants. The co-location strategy requires understanding and predicting the volume of electricity production from the solar plant and the associated value of each unit of energy produced by the plant. This must be done on both a long-term and short-term (almost real-time) basis, to support design/investment and operation. In addition to the probabilistic solar production volume, one must understand the value of energy at each interval (eg, five-minute period); For example, the value can vary widely and at times can reach $0 per kilowatt hour (kWh) due to curtailments.

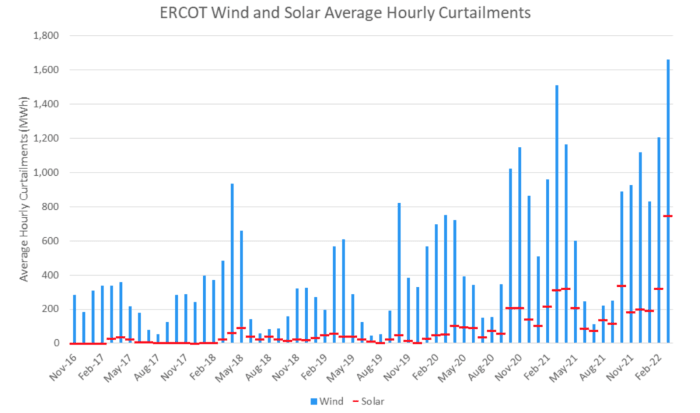

A side note on wind and solar curtailments: Below is a chart from BTU Analytics showing that wind and solar curtailments are increasing as more intermittent renewables are deployed on the Electric Reliability Council of Texas (ERCOT) grid. The most affected wind and solar power plants were reduced by 29% and 21% respectively of their total annual production in 2021 to 2022!

Co-optimization for bitcoin mining integration is a challenge worth solving for miners given the rise of solar and battery hybrids in the mix of new generation sources. This trend is likely to grow at an exponential rate.

In summary, increasing deflation in value and increase in competition of solar energy has encouraged the interconnection of batteries with existing solar systems. Now there is a new incentive that will accelerate the growth of battery-paired hybrid plants.

What we have seen to date has taken place in the era before the Inflation Reduction Act (IRA). The IRA recently allows a 30% investment tax credit (ITC) incentive for stand-alone batteries over the next ten years, which will increase conversion of existing solar systems to become hybrid plants.

As mentioned earlier, retrofitting batteries to existing solar systems is a growing segment. This segment will grow even faster over the next decade with the new ITC incentive. The new incentive plus the investment in US-based solar and battery manufacturing is poised to make the US the leading nation in solar and storage power plants. Bitcoin miners have a huge opportunity to tap into one of the fastest growing forms of energy production by figuring out the physics and economics of co-location with solar and storage power plants.

This is a guest post by Ali Chehrehsaz. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.