Solana NFTs enjoy some limelight, but SOL prefers to lurk in the shadows

- Solana’s NFT ecosystem has witnessed growth over the past week

- Market indicators revealed an ongoing battle between the bulls and the bears

Solana Daily, a Twitter account that posts updates related to Solana [SOL] ecosystem, recently revealed the evolution that occurred in Solana’s NFT marketplace in the last week.

For example, Magic Eden launched its new Open Creator Protocol (OCP). It is a code-free solution that will enrich the utility of a token and customize token actions.

Solana NFTs Highlights (Week 50)

@MagicEden launched the Open Creator Protocol (OCP)

MagicEden collaborates with @stripe

@metaplex Update of royalties

@Stepnofficial Genesis Shoebox Giveaway

@DegenerateNews will be the first to create on Magic Eden’s launch pad#SolanaNFTs @solana pic.twitter.com/cehRVZFLSP

— Solana Daily (@solana_daily) 10 December 2022

Read Solana’s [SOL] Price prediction 2023-2024

In addition, Magic Eden partnered with Stripe to help the community trade NFTs more easily. Interestingly, Magic Eden also topped the list of the top Solana marketplaces in user growth last month. Mean Dao and Saber Labs completed the top 3.

Top Solana Marketplaces with User Growth Last Month@MagicEden@meanfinance@Saber_HQ@rarible@raydiumprotocol@MercurialFi@solendprotocol@dappradar #Solana #NFT $SOL pic.twitter.com/LEfoBsXo3l

— Solana Daily (@solana_daily) 9 December 2022

More good news!

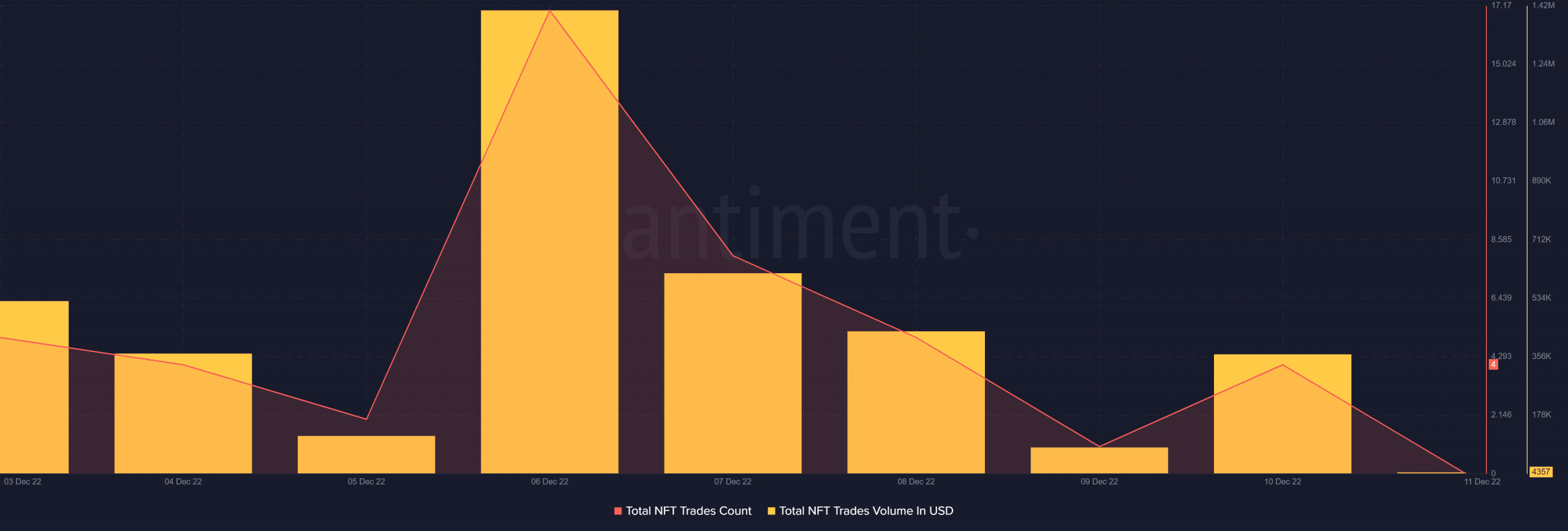

Santiment’s data revealed that apart from the aforementioned developments, SolanaThe NFT ecosystem also experienced growth in terms of volume. Its total NFT trade numbers and total USD NFT trade volume increased last week.

Source: Sentiment

According to DeFiLlama’s data, Solana’s total value locked (TVL) also registered an increase in the last two days. Interestingly, Solana ranked fourth on the list of top projects as far as TVL is concerned.

Top projects by total input value

9 December 2022#Ethereum $ETH #ETH $ADA #BNBChain $BNB #BNB $SOL #Avalanche $AVAX #AVAX $POINT $MATIC #THRONE $TRX #TRX $ATOM $ICP $CAKE $ALGO $NEAR #NEAR $FLOW $EGLDSource: @StakingRewards pic.twitter.com/iOEBu65L4p

—

CryptoDep #StandWithUkraine

(@Crypto_Dep) 9 December 2022

Solana recently announced the launch of DVT-1, Saga’s developer unit program, providing early access to a limited group of developers. The new program gave developers access to an early pre-production version of Saga so they could build, test and refine it on actual hardware.

Calling all developers!

We’re launching DVT-1, Saga’s developer unit program, and providing early access to a limited group of developers

If you are committed to building the future of Web3 on mobile, join us and build

Reserve your DVT-1 at

1/ of

pic.twitter.com/81sh9qeFVj

— Solana Mobile (@solanamobile) 9 December 2022

All of these developments looked promising for the blockchain and had the potential to drive another bull run.

What should Solana investors expect?

However, things did not turn out to be favorable for Solana in terms of his performance on the list. SUN failed to satisfy its investors as it only registered over 1% in weekly gains.

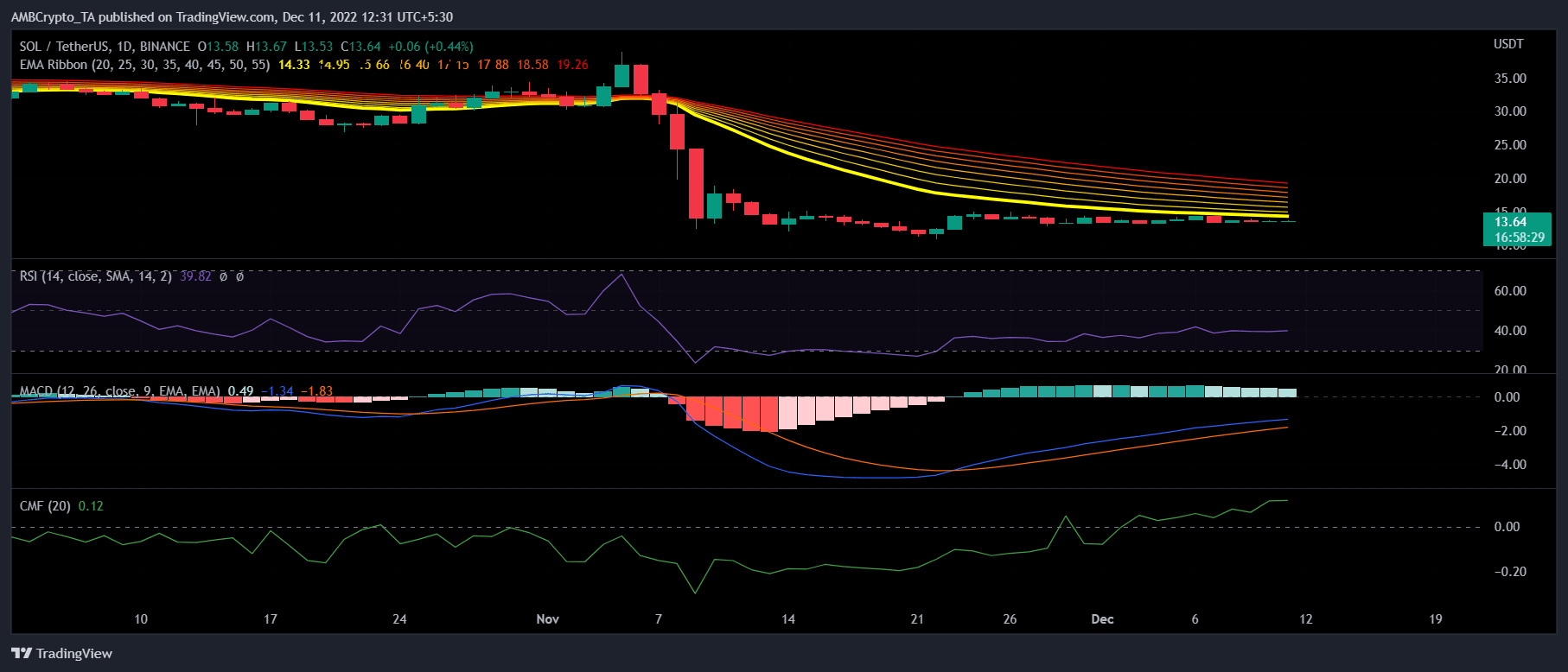

As per CoinMarketCapat press time, SOL was trading at $13.64 with a market capitalization of more than $4.99 billion.

A look at SOL’s daily chart painted an ambiguous picture. A few market indicators were in favor of SOL, while others suggested a price drop. The Exponential Moving Average (EMA) Ribbon, for example, revealed sellers’ market advantage. The Relative Strength Index (RSI) also rested below the neutral mark, which was a bearish signal.

Nevertheless, the Moving Average Convergence Divergence (MACD) recorded a bullish crossover, giving investors hope for a price rally in the coming days. Chaikin Money Flow (CMF) was also relatively up, which was a positive sign.

Source: TradingView