SoFi Stocks: Do I Think Fintech Company Shares Will Make Me Rich? (NASDAQ:SOFI)

skodonnell/E+ via Getty Images

I bought SoFi (NASDAQ:SOFI) to make money, didn’t we all? Therefore, the fall on the back of a major curtailment of market appetite for “risky” assets in peripheral sectors such as fintech has not been large. This is especially like the company has continued to meet financial guidance with underlying demand for its financial solutions as strong as ever. SoFi offers a range of financial products to its now over four million customers, including checking accounts, personal loans, insurance and car loan refinancing. The company has aggressively expanded into new verticals after student loan refinancing, previously its magnum opus and reason for its founding, was disrupted by what now appears to be a nearly 3-year extension of the student loan repayment moratorium.

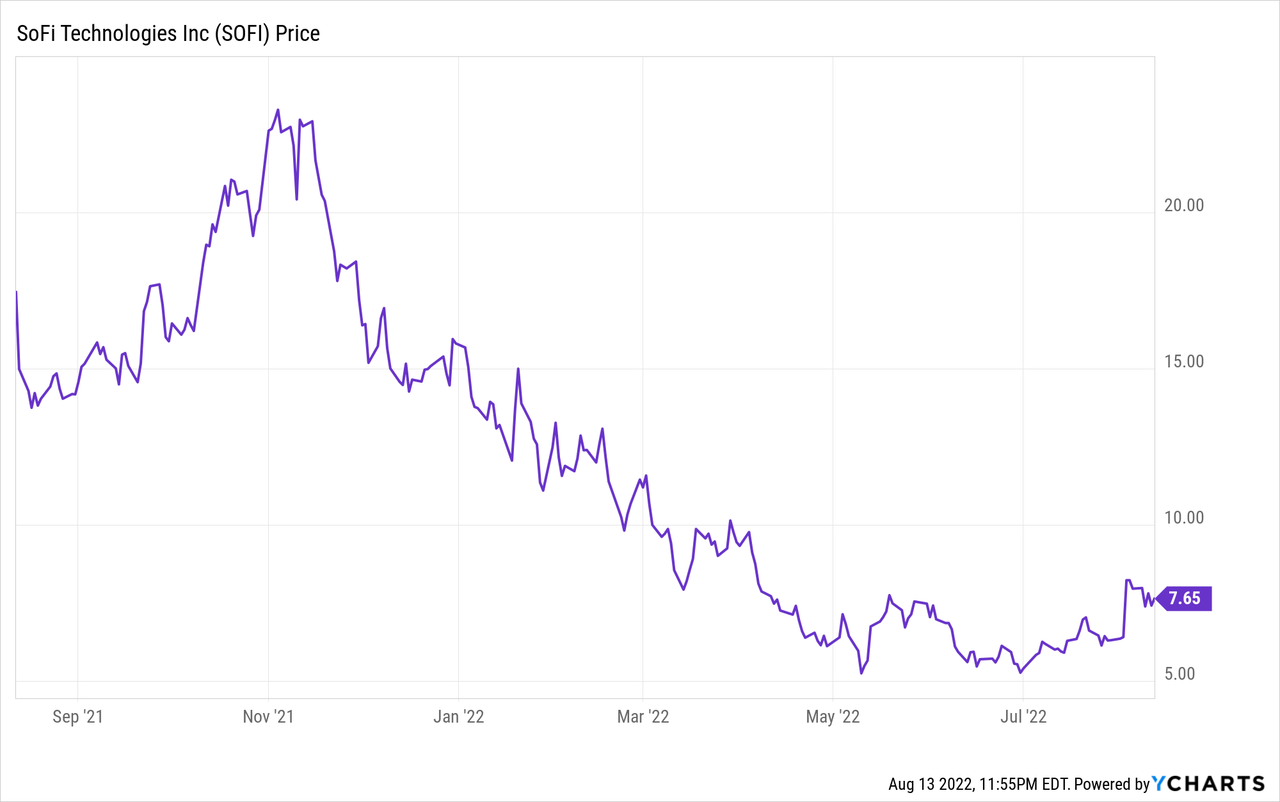

This market is effectively crippled and being used for political football. That’s why I was surprised when SoFi reported its fiscal 2022 earnings and the stock price responded by rising 28% for one of the highest intraday moves in the company’s history. Just a few weeks ago, the same market had driven the shares to new lows. This was odd as SoFi had applied for a national banking charter, introduced new products to diversify its revenue stream and doubled down on underwriting quality credit.

But with Japanese multinational conglomerate SoftBank ( OTCPK:SFTBY ) moving to sell some or all of its 9% stake in SoFi, the stock has pulled back a bit from its newfound 3-month high. Investors would be best placed to focus not on short-term fluctuations in the share price, but on the long-term implications of SoFi’s healthy revenue growth and improved profitability. SoftBank’s move to sell its stake is part of a broader move by the company to strengthen its balance sheet after posting a loss of about 2.93 trillion Japanese yen ($21.68 billion) on its investment unit Vision Fund.

Fiscal 2022 Guidance increased as net finances come in ahead of estimates

SoFi’s bulls were right that the bank charter has led to a multifaceted improvement in fundamentals. The company recently posted earnings for the second quarter of fiscal 2022, which saw revenue come in at $356.09 million, up 50% from the year-ago quarter and $11.62 million short of consensus estimates. This came on the back of the number of members growing to 4.3 million when SoFi gained 450,000 new members during the quarter. This was year-on-year growth of around 69% as new products are added, the total number of lending and financial services chosen by members grew by 79% to 6.56 million.

Adjusted EBITDA for the period was positive at $20 million, up from $11 million in the prior-year quarter and up 122% sequentially. Since this was versus guidance of $5 million to $15 million, it represented a $5 million beat on the high end. This meant SoFi raised its 2022 revenue guidance to between $1.508 billion and $1.513 billion, $3 million above previous guidance. Adjusted EBITDA was also adjusted up to between $104 million and $109 million, $4 million above previous guidance.

It is important to note that the new guidance assumes that the student loan repayment moratorium remains in place for the rest of the year. It may well be extended until March 2023, but a further upward adjustment of the guidance may occur if the moratorium ends earlier. The current guidance assumes that it will be extended until the end of December 2022.

Closing the chapter on student loan repayment remains a strong catalyst for SoFi. That would revive momentum in a division that was SoFi’s largest with about $2 billion in originations in the first quarter of 2020. New users would also be driven to the platform, accelerating SoFi’s flywheel and boosting underlying profitability. Banking, which saw deposit growth of $1.56 billion or about $120 million per week, would also get a boost. Fundamentally, SoFi’s coup for national banks and the upcoming end of the moratorium set the stage for adjusted EBITDA to continue to rise as the company’s funding costs fall. In fact, the company replaced $1.2 billion of more expensive inventory debt during the quarter.

SoFi likely has a bright alpha-generating future ahead

The SPAC boom that brought SoFi public is all but dead, stocks in growth stocks have collapsed, and the economic outlook is downbeat. It would be easy for one to sell their shares and move on, but I am optimistic that the company has the mechanisms in place for continued revenue growth and future profitability.

The student loan moratorium saga will have to be settled eventually, and will represent a huge revenue boom when it does. I continue to be long SoFi and will continue to accumulate shares below $10.