SoFi Stock: Playing Offense With Wyndham Acquisition (NASDAQ:SOFI)

Justin Sullivan

Share of SoFi (NASDAQ:SOFI) has experienced new upside momentum recently after shares have bounced back from the sell-off in the community banking market. Late in March, I recommended that investors buy the dip in SoFi because the company continues to grow its customer base rapidly and FinTech delivered a strong EBITDA forecast for FY 2023. In addition, SoFi just announced that it is acquiring a FinTech mortgage lender to complement its core lending products. I think the transaction can create new excitement for the SOFI share!

SoFi goes on the offensive and buys Wyndham Capital

The personal finance company announced yesterday the acquisition of Wyndham Capital, a FinTech mortgage lender, in an all-cash transaction. Although specific deal terms have not been released, the acquisition is set to increase SoFi’s presence in the mortgage market.

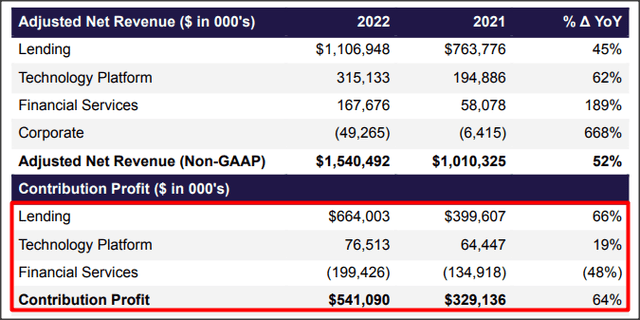

Mortgages are already a profitable business segment for SoFi and the lending business as a whole has seen strong growth over the past year. SoFi’s lending operations have grown steadily over the years, but not as quickly as the financial operations. SoFi’s FS product category achieved 189% top-line growth in FY 2022 and grew 4.2x faster than the lending category. However, the lending business (which includes mortgages, student loans and personal loans) is very profitable and almost all of SoFi’s profits come from this segment. Lending generated all of SoFi’s contribution profit in FY 2022 (while FS lost money), so the Wyndham Capital acquisition is set to boost the firm’s revenue and contribution margin growth in FY 2023. SoFi has not detailed the acquisition’s impact on its financials, saying only that it expects the transaction “will be active within six months.”

Source: SoFi

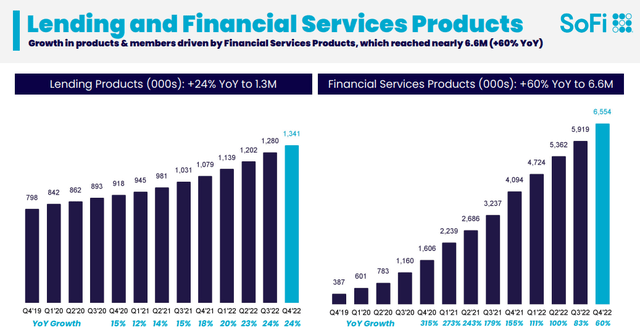

Acquisitions shift the focus to well-performing lending operations

The Wyndham Capital transaction, in my opinion, could create some new excitement about SoFi’s potential for profit growth in FY 2024. Since the acquisition is in the most profitable operating segment for SoFi, I think investors may be more inclined to focus on the firm’s lending business going forward. Financial services have been key to the company’s growth in recent years, and SoFi has aggressively launched new products to expand its ecosystem. Financial services mainly include banking, investment, insurance and crypto services. This product category has mainly driven SoFi’s growth in recent years. With investors now more inclined to look at profitability measures due to slowing post-pandemic growth, I believe SoFi’s acquisition could drive a revaluation of FinTech stocks.

Source: SoFi

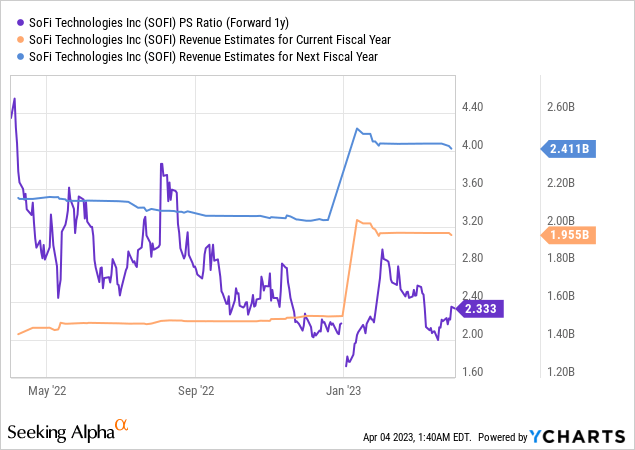

SoFi’s valuation

SoFi’s stock isn’t cheap as investors are paying for the firm’s continued excellent growth prospects. While SoFi isn’t cheap, investors today won’t have to pay anywhere near the high prices in 2021 and 2022. SoFi is expected to see 27% revenue growth this year and 23% growth next year, resulting in a forward price- to sales ratio of 2.3X. Investors are paying for SoFi’s growth, but if you believe, as I do, that SoFi can maintain its acquisition momentum and that the company will continue to add millions of new customers to its ecosystem over the In the next few years, shares of SoFi definitely have attractive prospects for valuation upside. Investors are now paying less than half the multiplier factor they were paying a year ago, and SoFi is on track to become profitable.

Risks with SoFi

The biggest commercial risk for SoFi, as I see it, is a decline in the company’s top line and membership growth. As an innovative FinTech company shaking up the competition with its one-stop banking solutions, SoFi’s valuation is mainly driven by the potential for revenue growth. If FinTech disappoints with growth, this is likely to be reflected in SoFi’s valuation factor. What could also be a risk for SoFi is the current financial crisis, which may have led to the withdrawal of some deposits.

Final thoughts

I think the acquisition of Wyndham Capital is positive for SoFi and the stock. The transaction takes place in SoFi’s most profitable segment, lending, which has taken a back seat to the much faster growing financial services segment. As investors have recently become more concerned with the profitability of FinTech companies due to slowing post-pandemic growth and compression of stock multiples, I believe SoFi made a strategic decision that boosts its core mortgage business. By buying up Wyndham Capital, SoFi also shows that they are playing offense in a market that has become increasingly concerned with moderating growth. Shares in SoFi remain attractively valued, in my opinion, despite a 10% price increase since the previous article. I continue to recommend SoFi as a strong buy in the FinTech space!

There is a risk that members will move some of their SoFi deposits to other banks in an attempt to reduce perceived deposit risk. While the FED did put a deposit backstop recently, I think the risk of deposit flight is generally very overstated. The much bigger risk to SoFi, as I see it, is a slowdown in top-line growth and the possibility that current market conditions lead to a revision of FinTech’s adjusted EBITDA measure.