SoFi Shares May Move Back Into Penny Stock Territory (NASDAQ:SOFI)

ArtistGND photography

SoFi Technologies, Inc. (NASDAQ:SOFI) saw a significant increase in the share price after the fintech’s earnings in the fourth quarter. SOFI shares are up 18% since the results, mainly due to investors’ positive reaction to the adjusted EBITDA outlook.

Having said that, I continue to rate SoFi Technologies as hopelessly overvalued, given the fintech’s inability to generate positive net income in the fourth quarter.

While it is true that SOFI is experiencing strong customer interest and succeeding in generating a large number of new accounts, I believe that SOFI’s gains are not sustainable given the lack of underlying profitability, and I predict that SOFI will soon be a krone share again.

Where is the competitive advantage?

Fintechs have become popular in recent years as investor capital has poured into the sector, allowing a number of companies to undertake expensive SPAC transactions. This spring In a special case, SOFI was listed through a special buyout vehicle backed by a venture capital investor led by Chamath Palihapitiya.

SOFI gained 12% on its first day of trading to close at $22.65 on investor enthusiasm for fintech companies and their growth prospects. However, since its Nasdaq debut in June 2021, the stock has lost 69% of its value and dipped into penny stock territory in Q4 2022 as growth slowed and investors questioned the valuation they placed on the fintech’s stock.

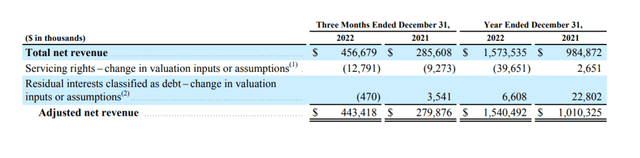

SOFI is expanding its sales and customer base, but this expansion is still costly, even after a 69% cut in value. Importantly, this sales expansion has not resulted in net revenue profitability. SOFI generated $1.57 billion in net sales in 2022, representing a 60% year-over-year increase. In terms of sales, the general trend is positive, and I see no reason to complain.

Net sales (SoFi technologies)

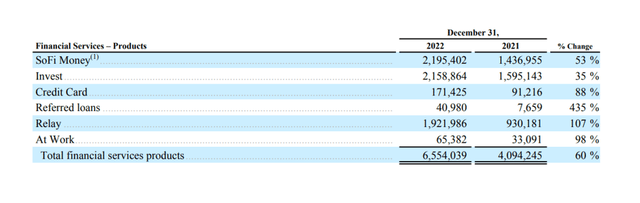

SOFI’s financial service portfolio is expanding, and the fintech is doing a good job of introducing new products to its customers through its mobile app. SOFI Money (Checking and Savings Accounts), investment products and credit cards are all popular products that have received strong customer acceptance in recent years, including 4Q-22.

One of SOFI’s most popular products is its Checking and Savings account, which allows customers to earn 3.75% interest on deposits. However, I see nothing in SOFI’s product portfolio that suggests the company has a unique selling proposition, and while SOFI’s deposit offering is appealing, it’s hardly a product that banks like Bank of America ( BAC ) or Wells Fargo ( WFC ) are losing sleep over. above.

Financial services (SoFi technologies)

What technology does SOFI own, and what specific products does SOFI offer its members that large Wall Street banks, or even provincial banks with a few branches, cannot?

I see no competitive advantage for SOFI, and as we shall see, SOFI’s financial performance does not justify a premium rating.

Sales multiples not justified in view of sustained net losses

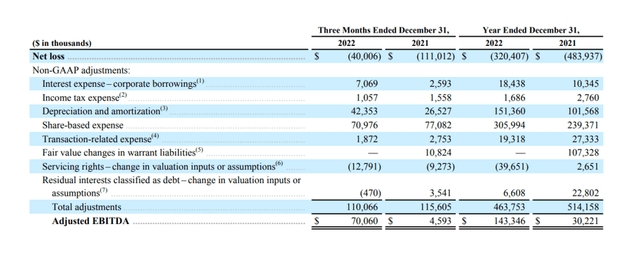

What worries me is that SOFI’s business is still losing money. Correct me if I’m wrong: SOFI is profitable on an ‘adjusted EBITDA basis’, which includes significant equity-based expenses as well as other expenses such as interest on corporate loans and valuation changes in servicing rights.

SOFI lost $320.4 million in net income in 2022, increasing the fintech’s accumulated losses to $1.50 billion. This figure, $1.50 billion, shows how much money the company has lost in its history as a going concern. SOFI was founded in 2011 and has yet to generate a positive net income.

Even more concerning than the lack of underlying profitability is the fintech’s equity-based spending, which totaled $306 million. SOFI pays a lot of money to incentivize top executives, as do many “sexy” companies that are good at selling investors a traditional business model for a technology valuation. Given that SOFI is still losing money, I believe the amount of equity-based expenses is too great.

Net loss (SoFi technologies)

SOFI is set to become a penny stock again

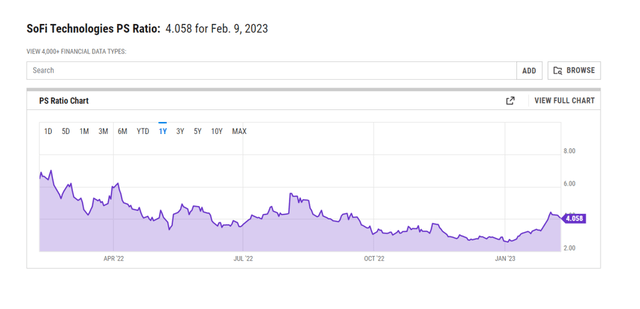

SOFI’s stock is valued at 4.1x sales, which I believe is overstated given fintech’s lack of a moat compared to big banks like Bank of America, Citigroup or Wells Fargo.

SOFI is growing its customer base faster than any of the big banks, but this is not enough to justify valuing a traditional banking business with a mobile app at 4.1x sales.

SOFI predicts 25-30% sales growth in 2023, with fintech potentially reaching $2.0 billion in sales. That said, I believe SOFI remains overvalued due to a lack of underlying profitability and competitive advantage.

PS relationship (YCharts)

If I had to bet, I’d say SOFI will close the post-earnings gap and return to at least $6. Enthusiasm for SOFI’s sales growth guidance has already begun to wane, and I believe SOFI will eventually return to penny stock territory (under $5). SOFI will be valued at 2.9x at a $5 valuation, which is still very high.

SOFI share price (Finviz)

Why SOFI could achieve a higher value

Buyout speculation could boost SOFI’s share price, but I doubt many banks would pay such a high premium for SOFI’s customer book and sales growth.

Banks like Wells Fargo or Bank of America also have much larger customer bases, so buying out an overpriced fintech at 4.1x sales and a relatively small customer base of 5.2 million would probably make little sense.

Another factor that can increase fintech’s share price is a significant increase in profitability.

My conclusion

SOFI’s share rose after 4Q-22 earnings, but in my opinion the rise is neither justified nor sustainable. Despite strong sales growth, the fintech failed to achieve net income profitability in the fourth quarter, and accumulated losses grew even larger.

SOFI is still overvalued and I think investors jumping on the bandwagon here to make money are making a mistake.

I think we’ll see some gap closing, which could drive the stock down to $6, and I wouldn’t be surprised if SOFI moves back into penny stock territory.

Without a moat and without a technology that stands out, growth alone will not sustain SOFI’s share price for long.