SoFi: Inevitable Reassessment May Be Here – Still Your Next-Gen Fintech Play

Parradee Kietsirikul/iStock via Getty Images

The inevitable reassessment may be here

We had previously covered SoFi Technologies (NASDAQ:SOFI) in the recent banking crisis here. Our deep dive then bolstered our confidence in its forward execution and profitability, significantly sweetened of its rapid growth so far. With minimal uninsured deposits and excellent risk management, we believed that SOFI could provide better long-term results.

In the recent FQ1’23 earnings call, our investment thesis had been further confirmed. SOFI reported an exemplary double beat, with revenues of $460M (+3.8% QoQ/ +43% YoY) and adj. EBITDA of $76M (+8.5% QoQ/ +744.4% YoY). This resulted in reduced losses at GAAP EPS of -0.04 USD (inline QoQ/ +63.6% YoY).

Most importantly, the bank grew its deposit base to $10.08 billion by last quarter (+38% QoQ/ +582% YoY), likely attributed to the amazing 4.20% APY on its savings accounts and 1.20% for checking accounts. These figures were significantly higher compared to national average of 0.39% and 0.06%, respectively, as published by the FDIC.

In addition, SOFI went a step further and increased its FDIC insurance limit on March 22, 2023, from the usual $250K to $2M instead, based on the SoFi FDIC Insurance Network program. This strategy likely boosted member confidence, triggering its safe haven status during the recent turmoil, with 97% of deposits insured at the end of the quarter.

The bank also posted a stellar ROTCE of 23% in FQ1’23, equal to JPMorgan Chase’s (NYSE:JPM) 23%, but higher than Bank of America’s (NYSE:BAC) 17.4% and Ally Financial’s (NYSE:ALLY) of 12.5%.

These strategies/results indicated that SOFI management’s execution had been stellar, demonstrating its clear path to GAAP profitability by FQ4’23, despite the rising interest rate environment.

Management has also provided excellent guidance going forward, with FQ2’23 revenues of $475M (+3.2% QoQ/ +33.4% YoY) and adj. EBITDA of $55M (-27.6% QoQ/ +175% YoY) at midpoint. For FY2023, it expects to achieve revenues of USD 1.98 billion (+28.5% YoY) and adj. EBITDA of $278 million (+94.4% YoY).

On the one hand, investors need to note SOFI’s growing debt of $6.12 billion in the last quarter (+11.6% QoQ/ +24.6% YoY), mainly attributed to the storage facilities of personal and student loans of $3.39 billion (+24.9% QoQ/ + 38.3% YoY).

While FQ1’23 detailed figures were not yet available, the bank recorded 3.01% (+1.56 points YoY) interest on its $2.37B (+16.1% YoY) warehouse facilities, triggering annual interest charges of $71.7M (+143% YoY) ) in FY2022, thanks to the Fed’s continuous hike so far.

On the other hand, SOFI earned $772.4M (+118.7% YoY) of interest income at a rate of 7.14% (+1.61 points YoY) on total interest-earning assets of $10.81B (+69.4% YoY ) then.

With a positive net effect on the profitability of Net Interest Income [NII] of USD 584 million (+131.5% year/year) and net interest margin [NIM] at 5.4% (+1.45 points YoY) in FY2022, the interim outlook remained robust, especially given the tremendous growth in the deposit base, as discussed above.

The same cadence was observed in SOFI’s truncated FQ1’23 report, with total interest income of $371.56 million (+213.7% y/y) compared to total interest expense of $135.55 million (+477.5% y/y /year), resulting in NII of $236 million (+148.6% year).

Combined with the reduced provision for credit losses of $8.4 million (-35.1% YoY) by the last quarter, likely attributed to its members’ outstanding median FICO score of 749, it was not surprising that net losses had also reduced.

As a result, we remain cautiously bullish on SOFI’s term performance, with the stock temporarily compressed due to heightened recession fears and the recent failure of First Republic Bank (NYSE:FRC).

So, is SOFI Stock A Buy, sell or hold?

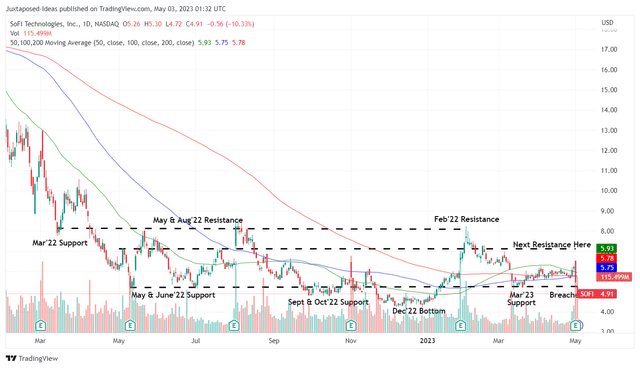

SOFI 1Y Share price

Trade display

SOFI stock has been trading with a range limit for the past few quarters, one that is similarly experienced by SPY, to be honest. With the recent banking crisis, it is no surprise that the stock has performed as it has since the beginning of March 2023.

In addition, we assume that some of the headwinds from the uncertain student loan forgiveness plan may have put further downward pressure on the stock for a moment.

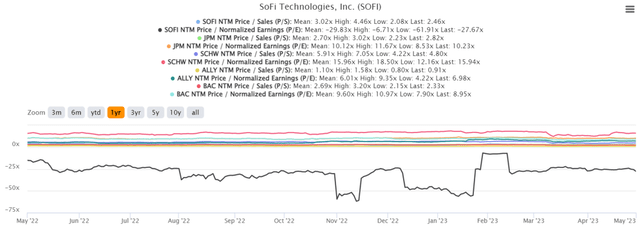

SOFI, JPM, SCHW, & ALLY 1Y Price/Sales and P/E values

S&P Capital IQ

Furthermore, due to SOFI’s increased focus on the bank to reduce funding costs, Mr. Market could potentially re-rate the stock from a fintech company to a bank instead, likely lower than its big bank counterpart like JPM/BAC, but similar to its online banking counterpart , ALLY.

Currently, SOFI is trading at NTM price/sales of 2.46x, relatively bullish compared to JPM at 2.82x, BAC at 2.33x and ALLY at 0.91x. While the former has yet to achieve sustained GAAP profitability, Mr. Market may also revalue the stock closer to its banking companies’ P/E average of 7.25x as well, versus JPM at 10.23x, BAC at 8.95x, and ALLY at 6, 98x.

Combined with market analysts’ projected FY2025 GAAP EPS of $0.24, it’s not surprising that the stock has underperformed, as pessimism may already be baked into today’s price.

Assuming that, adding SOFI here could disappoint investors looking for quick gains, as the stock could continue to trade sideways under the uncertain macroeconomic outlook through 2025.

However, we continue to rate SOFI stock as a buy here for investors with a long-term trajectory, as management has demonstrated its ability to cut losses at a time of high recession fears, one that could accelerate fintech profitability going forward.

Additionally, we remain optimistic that fintech can retain its premium valuations compared to its big bank and online banking peers, due to its high growth stage and well-diversified vertically integrated offerings as highlighted in our previous article here.

This is a trait shared in part by Charles Schwab (NYSE:SCHW), a value-added banking and lending brokerage that provides clients with online trading platforms. The stock currently trades at an NTM price/sales of 4.80x and P/E of 15.94x, at a notable premium compared to its major banking and online banking peers.

Therefore, assuming SOFI, as a well-diversified fintech with investment offerings (including active investment accounts/ robo-advisory accounts/ digital asset accounts/ brokerage accounts), re-rates closer to SCHW, we could see the former eventually hitting our long-term price target of $22.50, if not more.

This is based on market analysts’ FY2030 EPS estimate of $1.50 and an approximate P/E of 15x. Naturally, the price target suggests an excellent 350% upside potential from current levels, improving investors’ margin of safety.

As a result of this ambitious estimate, the stock is only suitable for those with greater conviction and a higher risk tolerance, given the stock’s massive volatility over the past year.