SLNHP: DeFi-level return at Bitcoin-level risk

them10

Introduction

Based on our coverage of Soluna Holdings (SLNH) so far, we have categorized SLNH under companies with compelling stories but are not compelling investments. SLNH sells investors a means of earning returns by solving limited renewable energy. SLNH solves reduced energy by building facilities around areas with reduced energy. This is beneficial for both SLNH and the energy supplier. SLNH would get energy supply at lower prices while the energy supplier can ensure demand at full capacity.

In an early study, our findings suggest that the primary threat to SLNH’s business model is the increasing resources invested to solve constrained energy in a transition away from non-renewable energy. This impact is twofold: less curtailment means less opportunity for SLNH; Less restrictions also mean higher energy prices and lower SLNH profitability. We also argued that SLNH could potentially have a conflict of interest against the public where energy costs could have been lower or that the energy could have been used for other productive purposes.

In recent coverage, we expanded on our initial thesis and found more evidence to suggest limited upside:

- Over-centralization: 60% of mining by Q4 (90% in the longer term) will be centralized in Texas, a state known to suffer from frequent blackouts and near-blackouts.

- Mining is not one of the lowest claimed where the cost of revenue (mining, excluding depreciation) is at the industry average, while the all-in business cost is 2x the industry average.

- Lack of mining capacity and Bitcoin (BTC-USD) reserves to benefit significantly from an upcoming Bitcoin recovery phase and bull market.

- Heavily charged with a 9% preferred dividend on liquidation of $25 on 3 million preferred shares outstanding.

In short, we believe that the main benefit SLNH investors can gain from a mining Bitcoin is not the massive upside, but simply a lower risk of insolvency. That is why we maintain our assessment that there is insufficient value in investing in SLNH.

Apparently, there is a way to take advantage of SLNH’s lower insolvency risk without giving up very high returns. And that is by investing in SLNH Preferred Shares (NASDAQ: SLNHP).

DeFi-level returns with Bitcoin-level risk

Decentralized finance is known to give speculators extremely high returns from stakes where annual returns typically exceed 100%. The problem with this staking is that staking returns are usually paid in the form of another token with very little utility. The lack of utility means less demand for the token, and the token price often eventually collapses, reducing returns with it. In contrast, returns paid in well-established coins/tokens have much lower returns.

On the other hand, the SLNHP is a 9% cumulative Series A perpetual preferred stock of $0.001 par value and $25 liquidation price. 9% dividend is paid on the $25 liquidation price which equals $0.1875 (= $25 *9% / 12 months). These dividend payments have continued through 2022 until September, and October is still pending.

At the time of writing, SLNPH is trading at $4.08, which implies a monthly return of 4.6% or a 71.5% annual return compounded monthly. This return is respectable and even higher than most returns at DeFi’s biggest return-farming protocols (PancakeSwap (CAKE-USD), Aave (AAVE-USD), Uniswap (UNI-USD) or pure stake at Binance (BNB-USD) and other major exchanges such as Crypto.com (CRO-USD), KuCoin (KCS-USD) and Huobi (HT-USD).

Is this dividend too good to be true? No, this high return is necessary because of the risk involved in investing in SLNH.

From our perspective, SLNH’s primary risk is insolvency. On a per BTC basis, SLNH’s all-in business spend equates to $74,000 per BTC mined (more than 2x the industry average). With Bitcoin trading near $20,000, SLNH suffers $50,000 per BTC mined. SLNH has not stopped operations because Bitcoin is still trading above the cost of revenue (mining, excluding depreciation). As mentioned above, SLNH’s mining costs (excluding depreciation) are only industry average at best, which is $13,000 to $14,000 per BTC. Should Bitcoin follow its final leg down to $10,000 as shown by the halving cycle, SLNH will have to stop mining, hence the insolvency risk.

Therefore, SLNHP is by no means a safe investment, only safe at Bitcoin level (which is risky by general definition). But when it comes to cryptocurrency and DeFi yield farming, Bitcoin is the safest. SLNHP’s dividend yield with Bitcoin level security is very respectable. We perceive SLNPH as the safest because we perceived Bitcoin as the safest cryptocurrency. Bitcoin is the first and has been around the longest.

Moreover, investors can lock in this level of return forever as long as Bitcoin trades just above SLNH’s breakeven cost per BTC. Bitcoin doesn’t even have to “go to the moon”. Based on our long-standing Bitcoin thesis [1][2], we (base case) expect Bitcoin to reach $10,000 by November before spending the next 2 years (2023-2024) regaining its $70,000 all-time high and eventually $115,000 during the following 1- annual bull market (2025). At $115,000 per BTC by 2025, Bitcoin will return 575% in 3 years or 158% annually. In the same period, SLNHP will give 134% annually compounded monthly (= [1.046^36 -1] / 3 years), very similar to our 3-year Bitcoin base case, even without capital gains. If SLNHP were to reclaim the liquidation price, SLNPH would return an additional 525% (=$25/$4-1) over however long it takes.

There are also other drivers to reduce SLNHP’s risk.

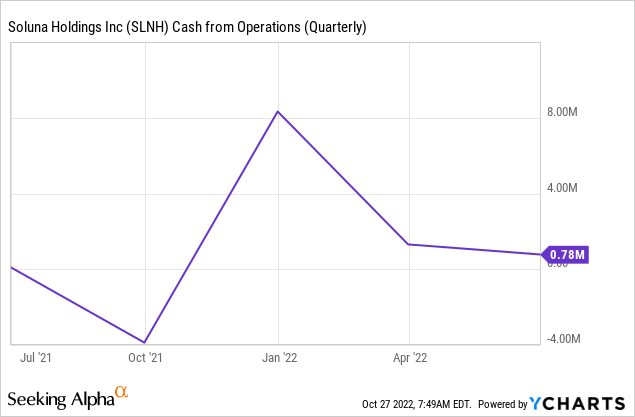

In terms of cash flow, SLNH is still cash flow positive despite being unprofitable. In the case of non-dividends, the SLNPH is cumulative, meaning that all previously unpaid (responded) monthly dividends accrue and must be repaid in full in the future.

In the worst case (bankruptcy), preferred shareholders have priority over ordinary shareholders when liquidating assets. This is very important because SLNH’s book value may be overstated (valuation of intangible assets, liquidity liquidity, underestimation of depreciation of assets, etc.). SLNH now trades at a 0.15 price-to-book (‘PB’) ratio, which provides a good margin of safety in the worst case scenario. To be even more conservative, we will reduce fixed asset values (PP&E and prepaid) by 50% (to reflect liquidity challenges and risk of underestimation of depreciation) and exclude intangible assets (which contributed 28% of total assets and may be realizable as cash). These conservative measures bring the PB ratio up to 1.5 (=$18.32mil Market Cap / [$4.63mil cash + $87mil PP&E * 50% + $10.7mil Prepaid * 50% – $41.4mil Total Liability]). This means that prioritizing assets during liquidation is very important.

At best, SLNHP shareholders may be able to convert SLNHP into SLNH shares in the future. We believe this is the best of both worlds.

Fig 1. SLNH is operating cash flow positive (YCharts)

Conclusion: Yield or Call Options?

Is there a better opportunity for dividend income in the crypto space? We repeat SLNH’s statement:

To our knowledge, Soluna is the only public company in the sector that has paid its investors a dividend as we have done for the preference share (SLNHP). Some investors have asked if they could take all or part of their monthly cash dividends in Soluna shares. If we were to consider this, it would be at the investor’s discretion on the registration date

Although we shy away from investing in SLNH, we find SLNPH’s level of risk and return respectable enough to make us invest. Based on the thesis posted in this article, we have converted part of our Bitcoin holdings to SLNHP. The dividend payouts will be used to buy long-dated call options (read here to find out why – hint: 13.6x expected return with limited downside should Bitcoin reach $115,000 in 3 years).