Sleeping giant wakes up, Bitcoin sees an increase in transactions over $ 1 million

Bitcoin has slowed down its bullish momentum during today’s trading session, but the crypto market continues to push upwards. BTC’s price continues to record profits over the last 24 hours and 7 days at 3% and 3.3% respectively.

Related reading | Bitcoin breaks above realized price again, bottom finally in?

The cryptocurrency was probably affected by a decline in the inheritance market. In recent months, Bitcoin has shown a high correlation with the S&P 500 and Nasdaq 100.

The S&P 500 has seen significant gains since the beginning of July 2022 after a large bearish price action took it from around 4800 to current levels of around 3800. Over the past week, the index took a bearish turn that appears to be contributing to BTC’s lack of price to break resistance at $ 22,000.

On the other hand, the crypto market has seen a positive development. The second crypto after market value Ethereum has a date for its highly anticipated event, “The Merge”, investors have absorbed the selling pressure without BTC’s price losing its 2017 all-time high in high time frames, there is far less influence in the crypto market.

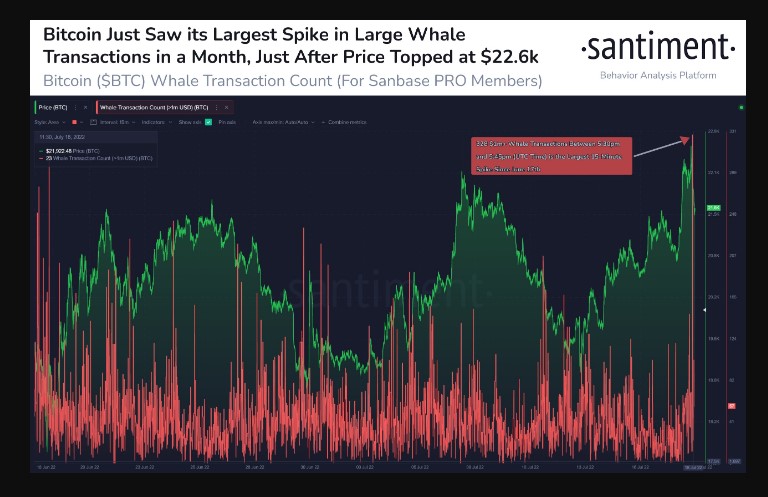

In addition, the analysis company Santiment registers an increase in the activity of Bitcoin whales. These large investors have triggered networking activity as they appear to be accumulating BTC at current levels. At today’s price campaign, Santiment stated the following while sharing diagram under:

About three hours ago, the number of #Bitcoin transactions increased to a value of over $ 1m to the highest value in over a month. Whale movements are busy today, and peaks like this can often be a precursor to changes in price direction.

As NewsBTC reported, the BTC whales have been more active, it seems that BTC has fallen to its current levels. Addressees with more than 10,000 BTC added 30,000 to their holdings.

Bitcoin networking activity needs more fuel

Data from Mempool.Space indicate that an increase in Bitcoin network activity has led to major rallies. This activity is measured by transaction fees, and how much users pay to send a BTC transaction.

This calculation has had a downward trend since mid-2021, but has begun to show potential signs of recovery over the past month. Bitcoin transaction fees have been increasing over the last 30 days, potentially suggesting more network activity and increasing the change in future value increase.

Related reading | Liquidations pass $ 230 million as Ethereum barrels past $ 1400

However, network activity remains low in higher time frames. Additional data from analyst Ali Martinez records a decline in the number of new BTC addresses. This calculation is at a low point for 11 months with a sharp increase in the BTC supply sent to crypto exchanges. This often leads to sales pressure. The analyst so:

In general, a steady decline in the number of new addresses created on a given blockchain leads to lower prices over time.

#Bitcoin | Almost 32,000 $ BTCworth about 672 million dollars, has been sent to known #krypto change wallets in the last four days. pic.twitter.com/lXcKeturRLK

– Ali Martinez (@ali_charts) July 18, 2022