Six Ways Bitcoin is Transforming Utilities – Bitcoin Magazine

This is an opinion editorial by Dan Luddy, a mechanical engineer and energy consultant with 15 years of experience in high-performance building design.

The energy we use to heat our buildings is a major contributor to global greenhouse gas emissions and is a focus of decarbonisation initiatives. By reusing waste heat, Bitcoin mining can be profitably integrated into commercial and residential buildings and be a catalyst for electrification renovations that will improve building performance and reduce global carbon emissions.

Reduce emissions from buildings

A significant part of the energy use in buildings is in the form of heat, most of which comes from burning natural gas.

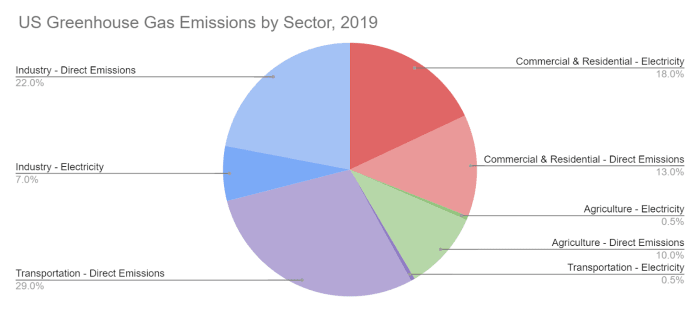

Emissions linked to commercial buildings and homes account for over 30% of the US’s greenhouse gas emissions. Source: EPA Greenhouse Gas Inventory 2019

As a substitute for gas, electric resistance heating is a simple technology and eliminates on-site emissions. But it is 3-5 times more expensive than gas at average consumer prices and is only as clean as the power plant that generates the electricity.

A more efficient solution is heat pumps, which absorb and compress heat from outside air, water or from a geothermal well. Heat pumps are a much more efficient alternative, so running costs are comparable to gas. However, most heat pumps need electrical backup in very cold temperatures (

Eliminating greenhouse gas emissions from the built environment is a cost constraint: New equipment, new infrastructure and minimal returns in operating cost savings. This economic challenge is where bitcoin mining can change the equation by providing heat as a byproduct.

Electrification with Bitcoin Mining

Almost all the power drawn by a mining ASIC is converted into heat, which must be removed from the machine. Air-cooled ASICs have fans that blow the heat out. This can be used to heat the surrounding air, but is difficult to compress, transport or store for other uses.

Liquid-cooled ASICs (water or dielectric fluid) offer a better opportunity for integration with building systems. By connecting liquid-cooled ASICs to hot water systems with pipes, a pump and a heat exchanger, mining provides a source of hot water that can be used in a building. In addition, the ASICs can run 80% faster and 5% more efficiently than air-cooled equipment.

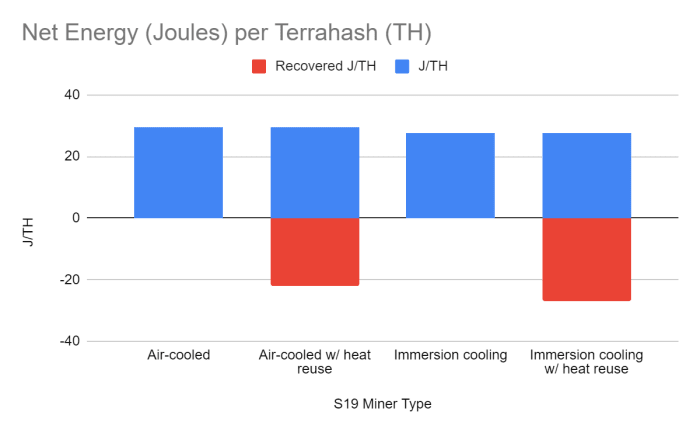

Liquid-cooled ASICs use about 5% less energy than air-cooled ASICs for the same TH. Furthermore, liquid cooling allows more efficient capture of heat energy to offset the energy costs of mining. Source: Author

The hot water generated by Bitcoin mining can be used for a variety of applications within different building typologies, including space heating, domestic hot water, pool heating and industrial use. There are many buildings that have both large electrical services and year-round hot water needs, including hotels, multi-family buildings, laboratories, university buildings, manufacturing facilities and more.

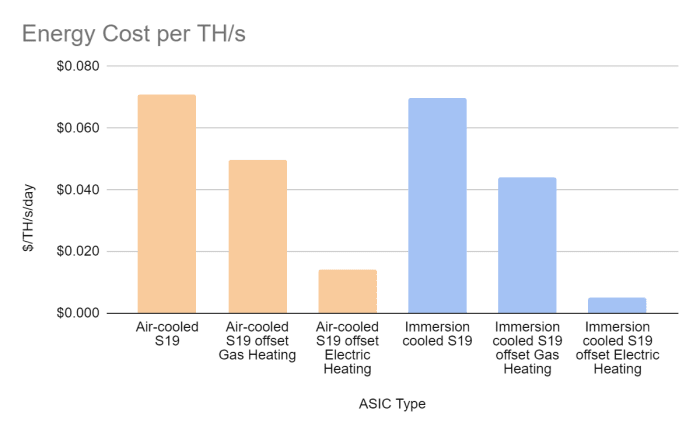

When used to replace gas heating, reused waste heat can offset ~33% of mining costs. Since the water-cooled equipment runs more efficiently, the miners can run profitably even with electric prices by running faster and selling the excess heat. Furthermore, the building then eliminates fossil fuel emissions on site linked to heating.

Reuse of heat in the building can cover a significant part of mining’s energy costs. The chart above assumes an average electricity price of $0.10/kWh. Source: Author

Solar integration

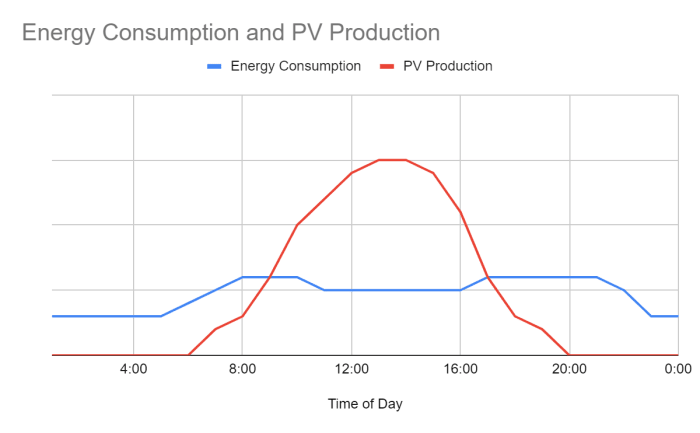

Reusing waste heat makes an economic case for integrating bitcoin mining into building systems, but it would be more attractive if one considers the integration of on-site solar (PV) generation. PV panels on rooftops or integrated into parking roofs have dropped significantly in price over the past decade, leading to higher levels of adoption. Depending on the supply provider and connection, electricity generated by the solar panels in excess of the building needs can either be sold back to the grid via net metering, stored on site or, in the worst case, wasted.

On-site solar installations can produce excess electricity during peak conditions. While some utilities allow consumers to sell power back to the grid (net metering), it may be more profitable to use this power for Bitcoin mining, depending on market conditions. Source: Author

An on-site Bitcoin mining system presents another opportunity to utilize excess solar generation. Depending on the difficulty adjustment and the network metering agreement, it may be more profitable to use the excess energy to mine bitcoin than to sell it back to the network. This additional revenue option encourages building owners to maximize on-site PV arrays, generate additional capacity and reduce reliance on electricity generated from fossil fuels.

Demand an answer

Many utilities offer demand response programs to mitigate excess demand during periods when the grid reaches maximum capacity, such as during a heat wave. In many of these programs, building owners can receive incentives or payments from the utility to modify operations during peak conditions to remove a certain percentage of the load and stabilize the grid when needed.

A building modified to operate with a bitcoin mining system can respond positively within these programs. Mining rigs can be shut down almost instantly, showing a significant reduction in peak demand, helping to shift electrical resources to more essential life and safety resources. Participation in these programs can generate additional income, essentially providing payments for the building to not mine at certain times.

Decentralization

One of the fascinating features of bitcoin mining is its scalability. Depending on the price of electricity, the potential to reuse heat and access to infrastructure, single ASICs can operate cost competitively compared to large miners with massive data centers. Commercial buildings and multi-family buildings provide a mining size that is in the middle of this range. There are thousands of buildings around the world where mining can be successfully integrated, which will further expand the bitcoin network and distribute hashing power.

Potentially, there may come a day when bitcoin miners not only secure the network, but also provide hot water to affordable housing units, heat schools and offices, and absorb excess solar energy from rooftops.

Future scenario – low carbon house with Bitcoin mining

Consider an apartment complex that has chosen to install a liquid-cooled unit in the basement of the room that used to house a gas-fired boiler. The retrofitting of the electrical system and mining equipment is financed and installed by a mine operator who will share the revenue with the building owner.

The mine heat provides hot water for showers, sinks, dishwashers and washing machines. In winter, the miners work overtime to provide heat for the apartments. On summer days, a newly installed rooftop solar system supplies excess power back to the miners to keep them running at low cost. The building participates in local grid demand response programs and shuts down mining operations as needed to respond to peak conditions and generate additional revenue.

As a result, the owner has additional capital that can be invested back into the building to improve maintenance, increase property value and improve the experience for tenants in the building, all while reducing carbon emissions. The same approach can be scaled and implemented across commercial and residential portfolios, presenting a triple win for bitcoin, buildings and the environment.

This is a guest post by Dan Luddy. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.