Silvergate: A Crypto Stock Trading That Surpasses (NYSE:SI)

JuSun

Produced with Avi Gilburt and Ryan Wilday

This article will delve into a high-quality technical setup under development at Silvergate Capital Corp. (SNEEZE:NYSE:SI).

Silvergate Capital provides solutions for lending, payments and financing to a growing range of companies in the digital space exchange space. They also offer financial services such as business banking and lending to commercial companies.

So while Silvergate has risen and fallen in sympathy with the crypto market as it is deep into the digital currency services space, its fate is not entirely tied to movements in Bitcoin.

That being said, regarding Bitcoin, although the trajectory predicted in the various “Moonpath” articles published over the past few months has clearly been wrong, our expectations are still quite positive over the next 1-3 years. We continue to see BTC move significantly higher, rewarding investors with longer time horizons.

While not exciting in itself, SI is down about 38% year-to-date as of this writing, while BTC is down about 58%. From the 2022 low, which was hit in July, SI is up over 82% compared to BTC, which is up about 10% from the June low.

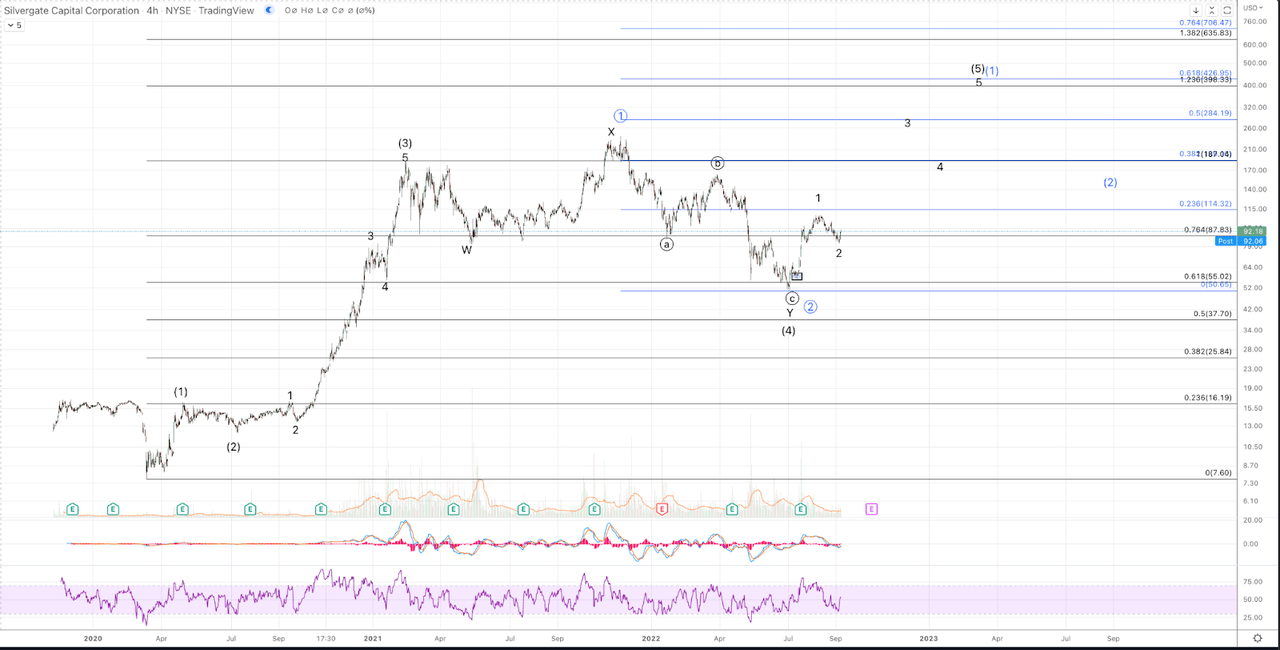

Please see the charts below as a visual aid for the technical analysis:

SI Daily Chart (Jason Appel (Crypto Waves))

First, start with the daily chart. Our larger perspective is that SI has moved impulsively from the 2020 low. The November high can count as a wave (5), thus completing a full 5 waves up as shown in blue. However, within an impulse, waves (1), (3) and (5) should all be 5 wave moves, and although the rally from the May 2021 low to November exceeded the February high, it did not do so as a clear 5 wave. As such, we are open to the possibility that the recent low has completed a wave (4) of the initial (expected) 5 waves up from the 2020 low; or that the last low point constitutes Primary Wave 2 of a much larger degree 5 up in formation. Given a clear corrective move from the high (whether counted from February or November 2021) to the July 2022 low, and now an impulsive rally from the low, expectations are that significantly higher levels will come in both cases: either as a wave (5 ) ) in black or wave (1) of circle 3 in blue.

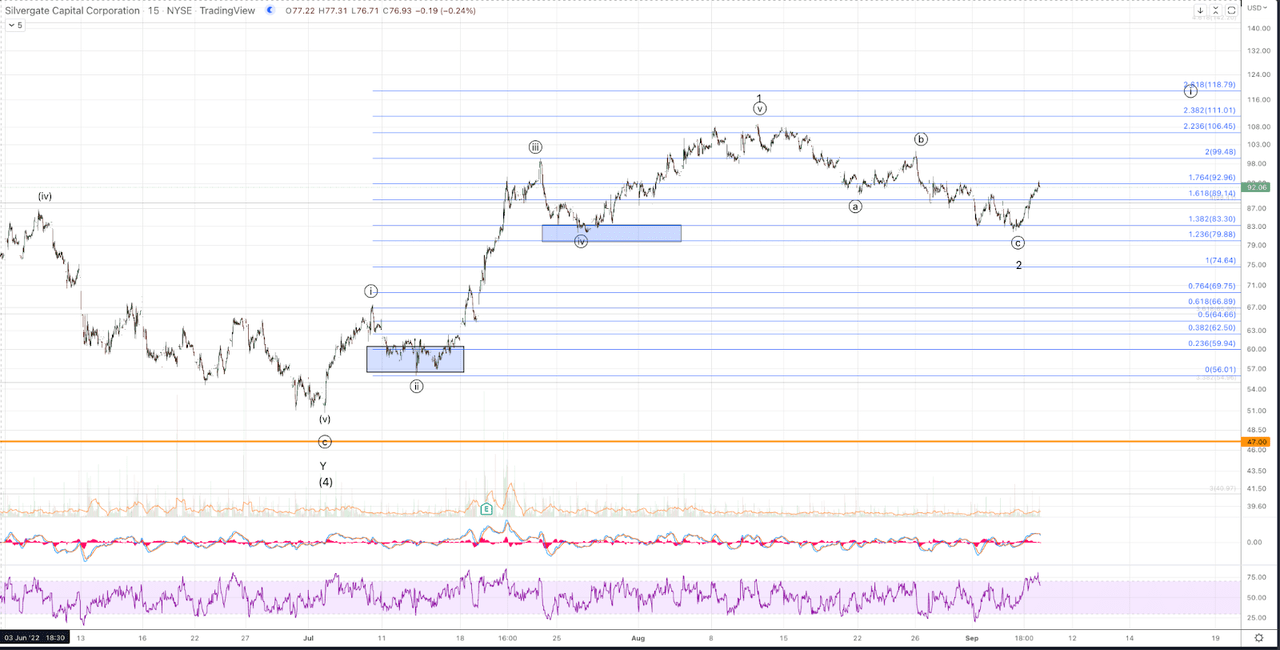

SI Micromap (Jason Appel (Crypto Waves))

Next, let’s observe the micro chart (above) which shows a detailed view of the wave structure since the July 2022 low. In this case, we have a clear 5-wave structure with appropriate proportions in length among the waves and each of the motif sub-waves, i, iii and v are all fractal impulses of lesser degree. In our Fibonacci Pinball methodology, after an initial 5 waves up, in this case wave i, expectations are for a corrective pullback that only retraces part of the initial advance. After the initiation move and first pullback i.e. i-ii, an impulse follows with a 5 wave move which ideally should exceed the 1.382 extension of the initial wave i. That is our wave iii and in this case the SI reached almost 2.0- the extension of wave i before wave iii.

Following the completion of wave iii, price is expected to retrace a small portion of the wave iii advance and should ideally hold well above the wave high. SI did just that, pulling back in support of wave iv in late July. From there, the completion of the impulse depends on the price forming a new micro 5 wave rally, surpassing the wave iii high and ideally doing so with only a few Fibonacci extensions before topping. As you can see, the SI followed this structure very well for all 5 waves that composed wave 1.

The significance of the 5 wave movement is that in Elliott Wave we have observed that these impulse movements tend to suggest that after a partial correction the price will continue in the direction of the trend.

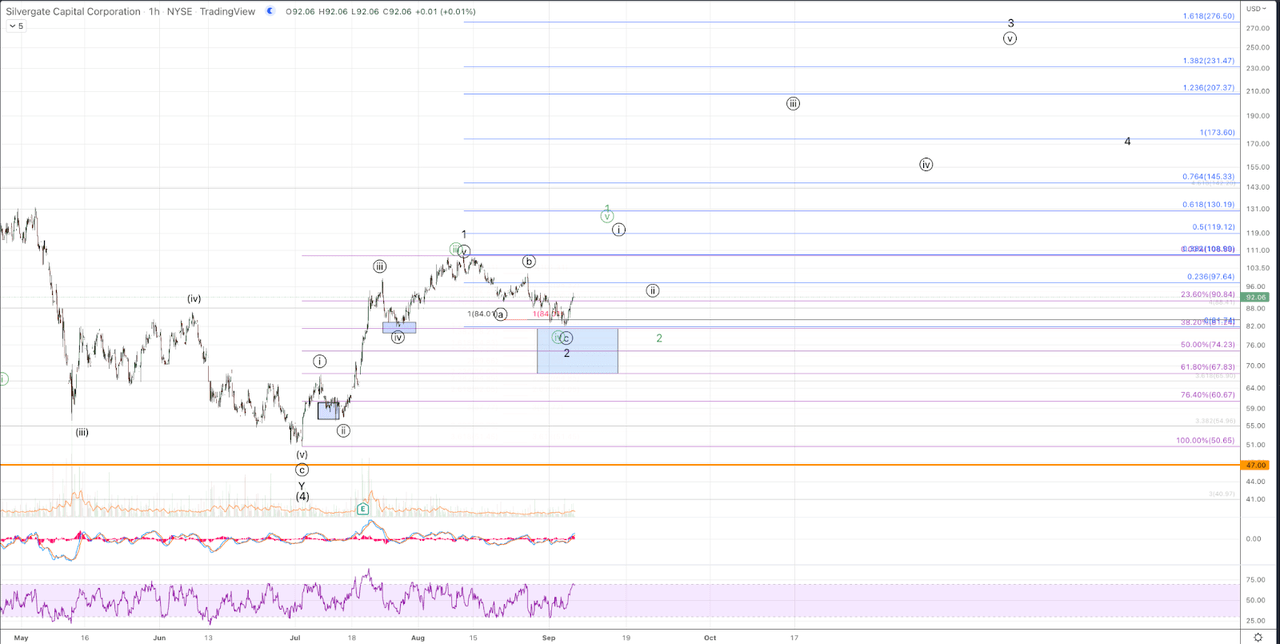

Finally, let’s examine the one-hour chart:

SI 1h Chart (Jason Appel (Crypto Waves))

The SI has a clear 3-wave move down from the August high to this week’s low, right into the standard retrace support region, noted by the blue box on the chart. Furthermore, the rally from this week’s low has surpassed initial resistance, suggesting a potential bottom has been hit in wave 2. Should price head south to form a lower low, note that standard expectations for continuation higher indicate that .618 retrace should ideally hold. It is at the $67.83 level. As such, we consider support to range all the way down to about $67 should this week’s low be breached. Should $67 break, while not invalidating the larger setup presented, it would cast more doubt on the prospects for upside follow-through.

As long as this week’s low is not broken, the expectation is that a much bigger move upwards has started to target $200+ only for wave 3. The initial wave circle in is expected to minimally target the August high, but reaching $120+ would be preferable . Our alternative hypothesis is that the price is heading up to $120 to complete a major 5-wave move from the July low. This path is also quite bullish and ultimately foreshadows much higher targets to come, but it could mean that a bigger and deeper wave 2 pullback is needed first before the liftoff, as shown in the chart.

In summary, we see SI as a very attractive setup from today’s level. Initial targets are in the $110-$120 region and intermediate targets for the next 9-18 months are in the $200+ region