Silk Road Bitcoin Stash On The Move, Is Uncle Sam Selling?

Wallets linked to US government law enforcement seizures, including those from the Silk Road marketplace, have begun moving Bitcoin. Concerns are increasing about whether the storage is about to be sold.

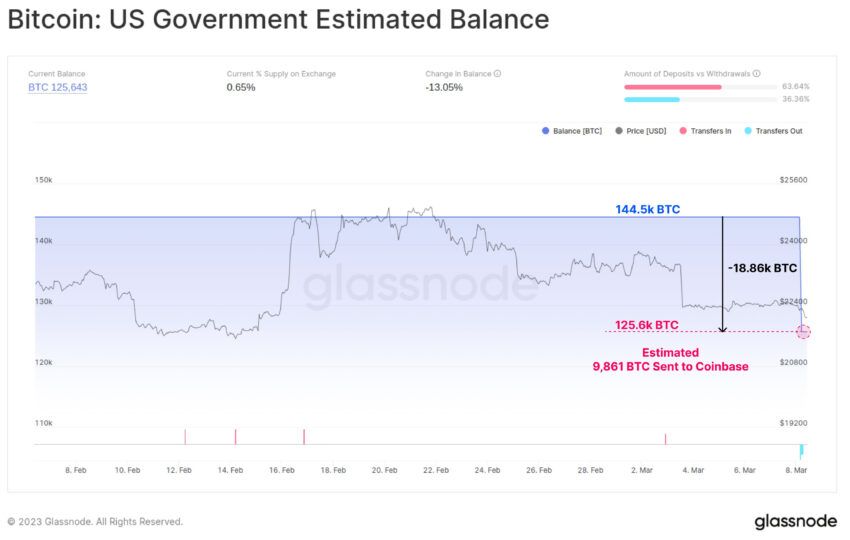

The big Bitcoin move was noted by blockchain analytics provider Glassnode who reported it on March 8.

According to Glassnode, the US government’s estimated wallet balance was 144,500 BTC until the recent move.

Further, it fell to 125,600 BTC as 18,860 coins worth an estimated $418 million were on the move. The Mempool tracker indicates that as many as 40,000 BTC were moved in the transaction, with around a quarter going to Coinbase.

Glassnode confirmed that an estimated 9,861 BTC worth around $219 million was sent to Coinbase. These were seized from the Silk Road hacker, according to Glassnode.

Silk Road Bitcoin Stash on the Move

In November 2022, the US Department of Justice announced that James Zhong pleaded guilty to wire fraud nine years after stealing more than 51,000 BTC from the dark web platform Silk Road.

An affidavit at the time supported the government’s seizure of the massive stash worth more than $3.3 billion at the time.

Silk Road was shut down by a massive police operation in late 2013, which led to the arrest of creator Ross Ulbricht.

Bitcoin prices have already lost 1.5% since the move as concerns over a major sell-off begin to mount. “The elites are doing everything they can to dump the price of BTC,” was one response to the data.

Impact of BTC Hits Markets

However, the slide is more likely to be linked to the Federal Reserve’s latest action. Fed Chairman Jerome Powell said on March 7 that the Open Markets Committee may need to raise interest rates beyond initial estimates.

Higher interest rates make cash savings more attractive than risk-based assets such as crypto.

Markets have responded by falling 1.3% to $1.06 trillion in total capitalization. Furthermore, BTC is down 1.6% on the day, trading at $22,125 at press time.

As reported by BeInCrypto, volume and sentiment are slowing. This could lead to more short-term losses for the king of crypto.

Bitcoin is currently down more than 9% in the last two weeks. It appears to be headed for support at the mid-$21,000 level.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.