Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of economics and cryptography.

all about cryptop referances

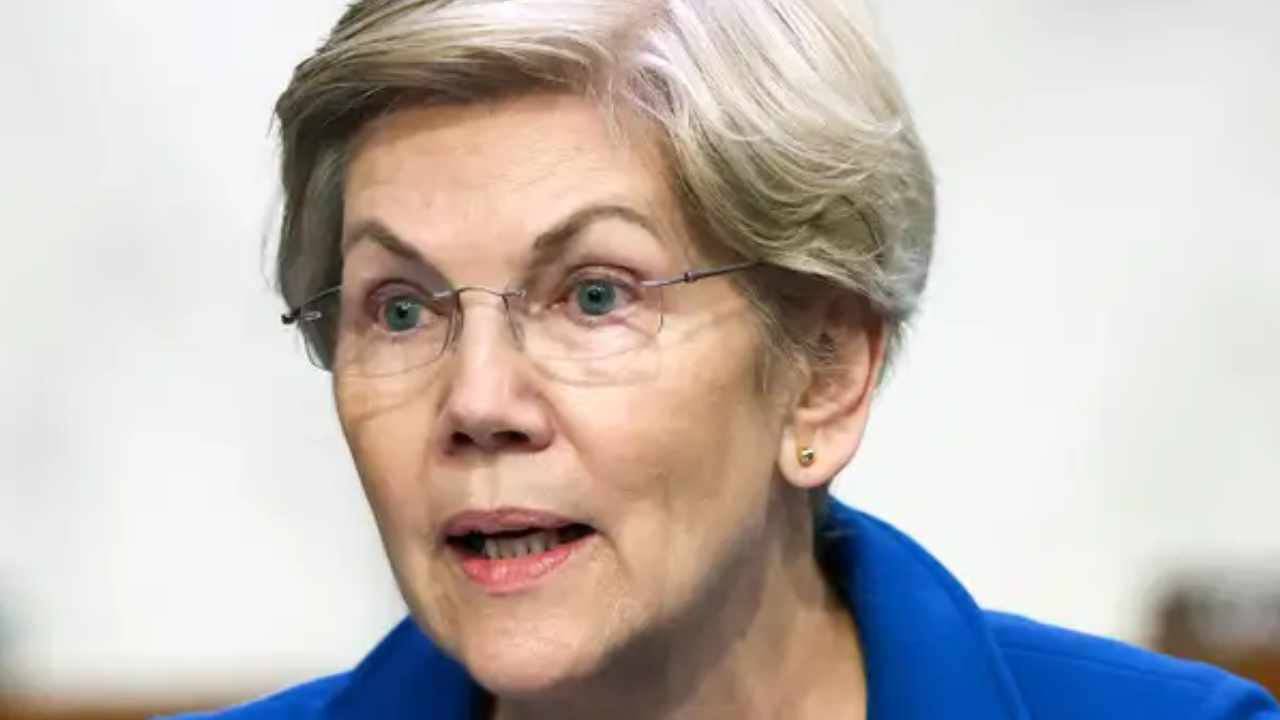

US Senator Elizabeth Warren claims that Signature Bank failed because it “bought into its get-rich-quick narrative” and “embraced crypto customers with inadequate safeguards”. The senator stressed that the bank took “excessive risks”, and demanded answers from the CEO of Signature Bank regarding “the financially disastrous outcomes you created”.

US Senator Elizabeth Warren (D-MA) has attributed the failure of Signature Bank to its acceptance of crypto customers without adequate safeguards, Yahoo Finance reported on Thursday. Signature Bank was seized by the New York State Department of Financial Services last Sunday, becoming the third largest US bank to fail.

In a letter to Signature Bank CEO Joseph DePaolo, Senator Warren wrote:

You owe your customers and the public an explanation for the financially disastrous results you created: you worked hard to weaken the rules, promised they would “bode well” for your bank – and then destroyed it with bad decision-making and excessive risk-taking.

“Congress and the public must learn from the failure of Signature Bank,” the senator stressed.

The lawmaker claimed that Signature Bank supported efforts to reduce capital requirements set out in the Dodd-Frank Wall Street reform law, the publication said, adding that the bank also directed thousands of dollars in campaign contributions to leaders of efforts to ease banking regulations in Congress.

“Despite assurances given to Congress that mid-sized banks like Signature Bank would be able to handle risk independently, it has since become clear that your bank was fully equipped to do so, and that its failure led to its closure and taken over by the authorities,” the senator told DePaolo.

Senator Warren further alleged that Signature Bank took on “excessive risks” to boost its bottom line by servicing crypto clients such as Nasdaq-listed crypto exchange Coinbase, blockchain infrastructure platform Paxos and collapsed crypto exchange FTX. Last December, crypto customers made up about 30% of Signature Bank’s total deposits. Warren stated:

Signature Bank bought into its get-rich-quick narrative … Signature Bank was caught short because it embraced crypto customers with inadequate safeguards.

According to Bloomberg, the US Department of Justice (DOJ) and Securities and Exchange Commission (SEC) were already investigating Signature Bank’s work with cryptocurrency clients before regulators seized the bank last Sunday. The news agency noted that the DOJ focused on whether the bank had taken adequate steps to identify potential money laundering activities by its clients.

What do you think about Senator Elizabeth Warren claiming that Signature Bank collapsed because it embraced crypto clients without adequate safeguards? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.