Side chains and how they help Blockchain scalability

Since its inception, blockchain technology has always struggled with the issue of scalability. In order for a transaction to be confirmed, several nodes on the network must agree on its validity. This works fine until the traffic on the network starts to increase. Then nodes are overworked, resulting in a bottleneck of transactions and delayed confirmations.

If we were to try to speed up transactions (improve scalability), we would have to compromise on the security or centralization of the blockchain. But since these take precedence over scalability, we end up with slow blockchains, such as Bitcoin, which can only process five transactions per second (TPS). This is slow compared to Visa’s 24,000 TPS. This is where side chains come in.

Side chains are independent blockchains designed to solve the problem of scalability. They work in parallel with the main block chain and reduce the transaction load. They communicate with the main block chain or ‘parent block chain’ through a ‘two-way peg’. The two-way pin ensures that the data remains synchronized between the two chains at all times (more on this later).

Also read:

By using this two-way pin, we can redirect the processing power out of the main chain and onto the side chain. This reduces the transaction load and improves the scalability of the main chain.

Let’s see how this works.

First, side chains have their own nodes and are designed to be more centralized. This can pose a safety risk, but it is limited to the side chain itself and does not endanger the main chain. The side chain may also have its own consensus mechanism, which may be different from the main chain. Proceeding.

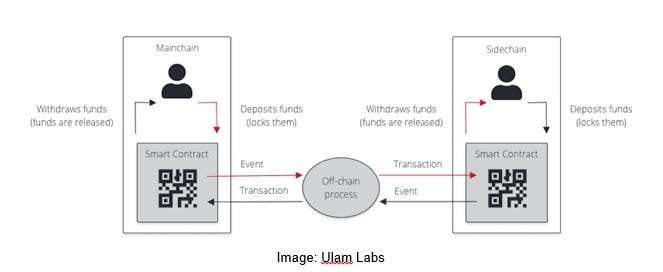

Before a user can start trading, he must lock in funds through a smart contract on the side chain. A process outside the chain addresses this, creates an “event”, verifies it and transfers it to the main chain via the smart contract and the pin.

When the main chain confirms the existence of this validated event, it broadcasts the information across the network. This is when the nodes confirm it and ask the blockchain to lock the mentioned amount of BTC on the network.

The stick then forwards the update to the smart contract on the side chain, which releases a proportional value in its original tokens to the user. So an actual exchange of assets never happens. A specific value of assets is blocked on one blockchain, and a corresponding value of tokens is released on the other. When this is done, the smart contract is updated and ends the event.

Here is an illustration of the same.

The smart contract plays a very critical role in this process. It is the only thing that enforces the blockchains at both ends to behave honestly and ensure a fair transaction. Only when the smart contract communicates to both chains that impartial validation has been performed, the tokens are blocked and released, respectively.

The effect on scalability:

Lightning Network is an example of a side chain network connected to the Bitcoin blockchain. Here’s how it works: Two transaction partners commit (lock in) a quantity of BTC to Lightning Network. After this, they can make as many transactions as they want within the amount of BTC they have committed to.

Lightning Network creates a channel between two transaction partners. Once this channel is established, the two parties can immediately send BTC to each other at minimal cost. These transactions are not transferred to the Bitcoin blockchain.

Once the parties have completed their transactions, the channel is closed. The final amounts are sent to participating parties according to the transfer history registered on the channel – this is the only transaction stored on the Bitcoin blockchain.

Therefore, as you can see, the Lightning Network side chain greatly reduces the amount of transaction data transferred to the main chain. This helps improve the scalability of the Bitcoin blockchain. Similarly, there are several such side chains, each with its own unique features and characteristics. Rootstock is another example of a Bitcoin side chain, while Polygon is an example of an Ethereum side chain.