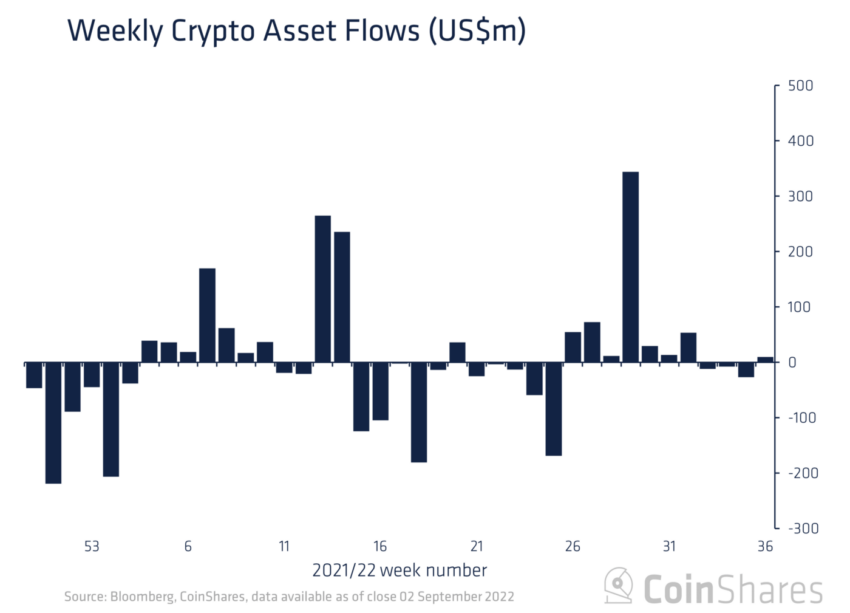

Short Bitcoin products continue to dominate low-volume supply

Investment products involving shorting Bitcoin-dominated inflows in the past week, totaling $9.2 million.

These inflows were characterized by low trading volumes, similar to recent weeks, many of which saw their lowest in several years, amounting to just $915 million.

According to the latest CoinShares report, total assets under management (AuM) have now shrunk to $27.9 billion, the lowest since early July, after starting the year at $64 billion.

Regionally, Europe represented the persistently divergent sentiment, with Switzerland and Germany’s $1.7 million and $1.6 million in respective inflows almost negated by Sweden’s outflows of $2.6 million.

Meanwhile, although the Americas all topped inflows, with Canada getting $4.7 million and Brazil $3.2 million, the US inflow of just $800,000 belies the dominant influx of short-Bitcoin investment products.

This was likely due to the recent comments made by Federal Reserve Chairman Jerome Powell in Jackson Hole. Although Powell’s rhetoric has been hawkish for some time, the report suggested that investors had found these recent comments unexpected.

Coin flows

Short Bitcoin investment products saw the most inflows last week, amounting to a record $18 million, bringing year-to-date inflows past $110 million and assets under management to another $158 million. On the other hand, Bitcoin-based products experienced their fourth week of outflows, this week amounting to $11 million, but only a total of $70 million.

Multi-asset products continued to prove popular, seeing inflows of $3.3 million. Alternatively, among altcoins, Solana and Avalanche saw smaller inflows, each totaling $500,000, while XRP and Cardano breached $200,000 and $100,000 respectively.

Ethereum products

Ethereum-based crypto investment products saw their second consecutive week of outflows, according to the CoinShares report. After last week’s minute outflow of $900,000, this week they totaled $2.1 million, bringing year-to-date outflows to just $300 million.

In anticipation of the upcoming merger, when the Ethereum blockchain will migrate to a proof of stake consensus mechanism, trading in Ethereum derivatives has grown 10% in the past month.

For the month of September 2022 to date, the total derivatives volume traded for Ethereum is about $87 billion, compared to about $67 billion for Bitcoin, according to data from Coinglass.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.