SEC, Binance and Crypto Keanu

Crypto News: We give you an overview of what has happened in crypto this week. And it’s more of the same. The Securities and Exchange Commission (SEC) cracks down (again), questions are raised about Binance’s finances (again), and MATIC falls for a Ponzi.

Like a tightly welded spring, the Securities and Exchange Commission (SEC) exploded last week, targeting the stablecoin sector. And just when we thought the attack was over, the agency has now set its sights on Terraform Labs and CEO Do Kwon.

On Thursday, the SEC accused the firm and its chief of “orchestrating a multibillion-dollar crypto-asset securities fraud.” The agency alleges Terraform and Kwon “raised billions of dollars from investors by offering and selling an interconnected package of crypto-asset securities, many in unregistered transactions.”

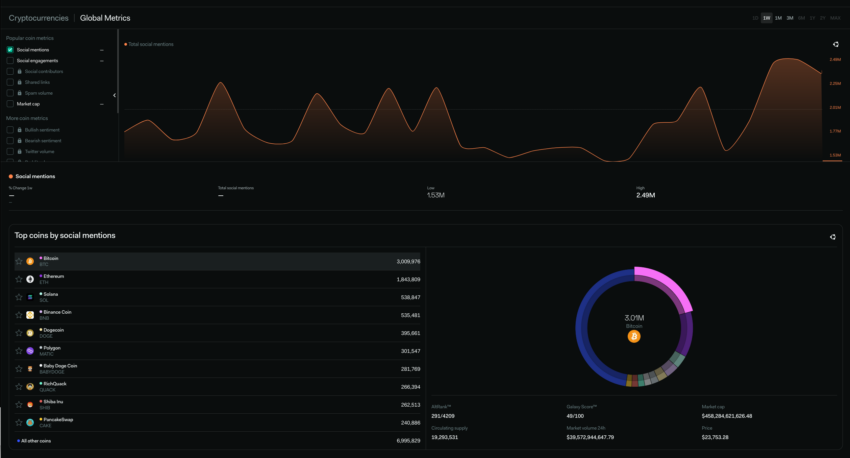

Crypto – socially speaking

Binance: Every day I mix

It wouldn’t be this week in Crypto News without a Binance story. This week, the Changpeng Zhao-led exchange was accused of transferring $400 million from its Binance.US account to one believed to be linked to CZ himself – all without the then-CEO of Binance.US knowing.

The fear is that the shuffling of funds between entities and accounts mirrors what happened with FTX. The now-bankrupt exchange was involved in moving and exchanging funds across accounts managed by a single entity. Binance declined to comment on the report

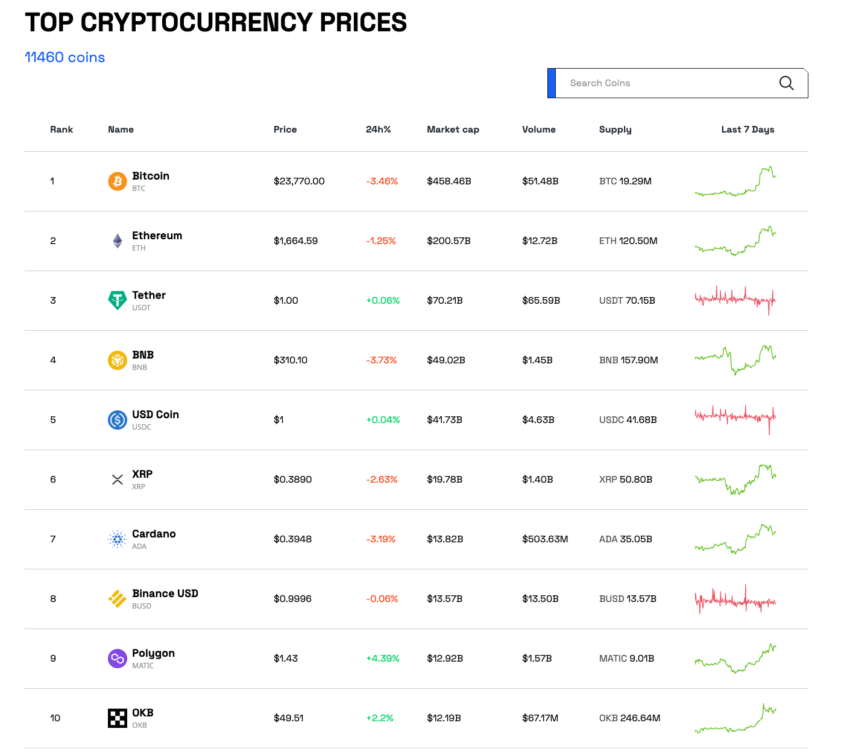

News about crypto coins

Topping the crypto charts this week was Astar (ASTR), which saw its prices skyrocket with a 46% rise. Mina (MINA) and BinaryX (BNX) weren’t far behind – both up 44%.

The biggest struggle was Frax Share (FXS), which fell 14%.

Life is a gas

On Monday, we reported how a Chinese multi-level marketing (MLM) project has become the fifth largest holder of MATIC. According to PeckShield data, the holder has accumulated 122 million in MATIC, surpassing even Binance’s hot wallet. Little is known about the “Avatar” project. Apparently, a referral betting protocol offers suspiciously high rewards.

To the annoyance of MATIC holders, the address has consumed over 100,000 MATIC in gas tax. The number of transactions reached 117,000 and caused fees to cross the 700 gwei mark.

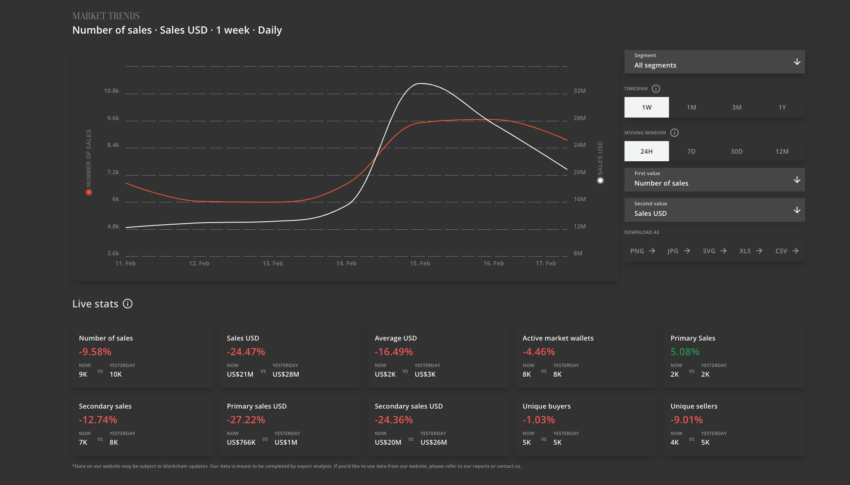

This week in NFT Sales

The frenzied excitement surrounding Blur.io shows no signs of abating. Global sales of non-fungible tokens (NFTs) reached over $300 million in the past seven days, with over 30% of volume on Thursday. The blur token airdrop on Tuesday likely led to the trading rally.

Crypto Keanu

The latest convert to the crypto stuff comes in the form of actor Keanu Reeves. The John Wick star said the principals behind cryptocurrencies are “fantastic tools for exchange and distribution of resources.” Which is quite fitting for someone who starred in one of the first films to explore a persistent online world, The Matrix.

Reeves argued that a corporate agenda is driving the replacement of creatives with computers. “We’re already listening to music made by AI in the style of Nirvana, it’s NFT digital art … But there’s a corporatocracy behind it that wants to control these things,” he observed.

Digging deep for Turkish earthquake victims

Earlier this month, a devastating earthquake struck Turkey and Syria, leaving over 40,000 dead and many more injured or displaced. It was encouraging to see the community put aside their differences and come together to support those in need.

Ripple pledged as much as $1 million in its initial coin XRP. The company first donated $250,000 in XRP and then backed it up with a pledge to match all donations to the Crypto for Charity fund 2:1, with a cap of $750,000.

And Ethereum co-founder Vitalik Buterin has sent over $228,000 in ETH to two Turkish earthquake relief organizations. The charity has raised over $75 million so far. If you want to help, you can find the details on the Ahbap website.

Top Doge

Senior analyst Valdrin Tahiri provides his Dogecoin (DOGE) price analysis, which shows a bullish weekly time frame and a large bullish divergence between the RSI and the price.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.