Sea Limited: Garena and Fintech Priced at Zero at Current Valuations (NYSE:SE)

cook

As someone who loves to look for contrarian ideas, the current stock market is an ideal environment, especially in markets and companies that have such negative sentiment that the downside is protected while the upside can be significant.

When the market becomes overly pessimistic about a stock, that’s when I would start increasing my positions. This is the basic idea that with bad sentiment surrounding a stock, most if not all of the bad news and perhaps even more has been priced into the stock. In fact, I believe that fear and negative sentiment is a clear sign that the stock is actually very much less risky compared to a stock with high valuations and overly optimistic projections.

Investment thesis

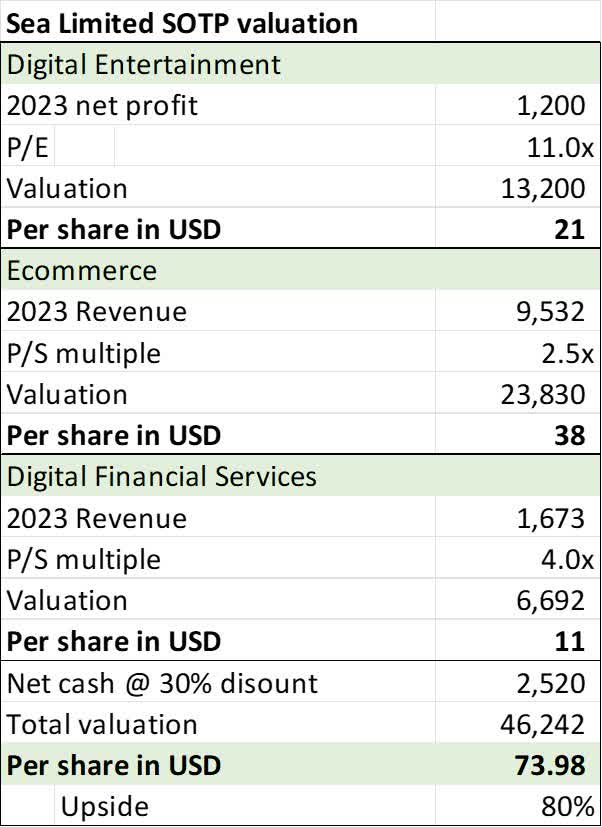

I believe that the sale in Sea Limited (NYSE:SE) is exaggerated with the current valuation. To summarize, the market has essentially just priced in the value of Shopee, Sea’s e-commerce business, into the share price. Based on my sum-of-the-parts valuation for Sea, the e-commerce business is worth about $38 per share, which is where the stock price is right now. As a result, the current share price values Seas Garena and fintech business at zero, which to me seems like extremely negative sentiment and thus a contrarian buying opportunity.

At the same time, management is taking the right step to prioritize reaching positive cash flows as quickly as possible in the next 12 months to 18 months and taking several measures to cut costs and improve the operating efficiency of the company.

Cost cutting in overdrive

The main theme in the last year for Sea has been to cut costs, and the company was one of the first to do so, as the top management knows that they must be careful, reach self-sufficiency as soon as possible to eliminate their need for new external capital, which will be difficult to obtain in the short term. This cost cutting is also necessary as the global macroeconomic environment becomes increasingly uncertain, especially for companies like Sea that have benefited enormously from the pandemic.

As mentioned, and continually reiterated by management, Sea’s top priority and main objective for the next 12 months to 18 months is to achieve positive cash flows as quickly as possible.

To signal their intention to drive cost savings from a top-down level, the top management of the company has decided to forgo wages until the company reaches a self-sufficient level.

In addition, there were also some tightenings in the company’s expenses policy, as business trips are now limited to economy class plane tickets, while there are limits on expenses for hotel stays, meals and other travel expenses.

Sea was also one of the first to announce job cuts to improve operational efficiency and balance growth and costs. It announced that it will cut about 3% of its workforce in Indonesia, as well as lay off some of its workers in Singapore and China. Needless to say, these job cuts were necessary to improve and optimize operational efficiency, which is the main focus in the near term.

With cost-cutting measures in overdrive, it was encouraging to see in 2Q22 that the Southeast Asia and Taiwan markets for Shopee achieved an EBITDA loss of US$0.01 per order before HQ costs, which is on track to meet management’s target of positive adjusted EBITDA before HQ costs for Southeast Asia and Taiwan markets for Shopee by 2022. We see Shopee benefiting from operating leverage and operational efficiency improvements as the business scales up and management cuts back on less-than-optimal spending.

Exit non-core businesses to preserve capital

First it was France at the beginning of March, then it was India in the later part of March. It was the beginning of Shopee’s exit from countries and regions it considers non-core, as Shopee management wanted to be disciplined in its approach to exploring new markets, while being careful to ensure that capital is not used unwisely. Since then, Shopee has also announced that it is exiting other markets such as Spain, and reducing some of its operations in Chile, Mexico and Columbia.

In retrospect, management’s early exit from some markets since March shows their commitment to preserving capital and cost discipline, as many of the markets they exited had tough competition or required significant cash outlays, which would have been disastrous if Shopee had continued to hold onto them. markets today.

Furthermore, with its markets as it has retained today, these are the core markets that are seeing better unit economics, increasing operating leverage and efficiency as the business scales up.

As such, the Shopee business looks well positioned to improve its unit economics, efficiency and cash flows in the near term, as these are Shopee’s key markets in which it is largely dominant.

Growth will continue

Most importantly, while costs remain a focus and negative sentiment around Sea casts doubt on future growth in the business, I expect Sea to have multiple growth drivers in the long term and in my view the company can still grow at a 20% revenue CAGR.

For Garena, this is still a fundamentally strong business, although there is a need for a long-term perspective and patience. We will need time for the game pipeline to develop new game releases that will over time drive a more diversified game portfolio, while in the short term I expect the drop in revenue from 2022 to bottom out in 2023.

Shopee remains well positioned in under-penetrated markets such as Southeast Asia and Latin America. With Southeast Asia, the e-commerce market in the region is expected to grow at 15% CAGR over the next 5 years, and I expect that with Shopee’s dominant market position and competitive advantage, it is likely to outperform the industry average over the period. In addition, the fintech business continues to grow very rapidly in the next few years as it starts a small base. The fintech business will drive further growth in the business in the longer term as Sea drives synergies between the Shopee and fintech businesses.

Valuation

A large part of Sea’s investment idea lies in the valuation. I have separately created a DCF model for Sea which implies that current price levels are at a discount compared to intrinsic value. But today, my focus is on the sum of the parts, the valuation for Sea.

The whole idea behind the sum of the parts valuation is that you add up different segments or parts of the business to come up with a valuation for the company. I would typically use this for companies with multiple business segments and would use this sum of the parts valuation model to supplement other methods such as my DCF model or relative valuation.

For Sea, using a sum-of-the-parts valuation, I can price each business at what I think they should be valued at today. For the Digital Entertainment business, I have applied a conservative 11x P/E to the business’s 2023 earnings to derive a value of $21 per share for the Digital Entertainment business. I think 11x is conservative because this is at a 30% discount to the global peer multiple, and with the challenges Garena is facing with its Free Fire concentration, I think this multiple is fair for the business. For Sea’s e-commerce and Digital Financial Services segments, I valued these at 2.5x and 4x price to sales multiple, respectively. These multiples reflect the long-term earnings growth potential of the respective businesses, while accounting for some conservatism in the multiples as I have not applied any premium to these multiples.

Taken together, we can see that the e-commerce business is valued at $38 per share today, which is roughly where the stock price is today. As such, if the stock were to continue to trade in the 40s and even 50s, I believe that the current share price actually undervalues the Digital Entertainment and Digital Financial Services business, which in my view is far too pessimistic like this are businesses with moats and will continue to grow in the longer term.

Sea Limited sum-of-the-parts valuation (author generated)

Risks

Profitability and cash flows

Profitability and cash flows are key, and the management knows it too. Sea must prove to investors that it is able to control costs and grow the business to eventually run a profitable business that generates healthy cash flows. The risk is that Sea may miss expectations for profitability and cash flows when it tilts towards growth as a target. Having said that, management has reiterated that the main goal is cost-efficiency and sustainability, and that growth will be a result of that. It remains to be seen whether Sea can turn the business around to become profitable or generate positive cash flows over the next 12 to 18 months.

Competitive pressure

Today, the e-commerce space is crowded with large companies fighting for market share in the global e-commerce market. Players with large financial resources such as Amazon ( AMZN ) and Alibaba’s ( BABA ) Lazada can continue to operate these e-commerce businesses sustainably given their strong financial position, positive earnings and cash flows. As a result, there is a risk that competitive pressure may increase in Shopee’s key regions, resulting in poorer industry dynamics, lower growth and weaker margins. More importantly, if this is the case, the company may not be able to achieve positive cash flows and profitability in the near term given the potential intense competitive pressure from other large players with strong financial resources.

Concentration risk in the gaming segment

With Garena’s heavy reliance on the blockbuster Free Fire, the company needs to find its next game that can be the next Free Fire. It needs to focus on creating new games to diversify its current game portfolio to ensure that Garena with its steady pipeline of new games can potentially see growth drivers from other newer games as Free Fire matures. Finally, if successful, Garena could have a multiple expansion opportunity given the depressed levels that the gaming business is trading at today. I believe that this diversification of gaming revenue and new gaming pipeline is the key to reducing concentration risk in the gaming industry today.

Political and regulatory risks

While I believe the political and regulatory risk going forward is low for the countries in which Sea operates, the fact that the Indians banned Free Fire brings a certain element of political and regulatory risk to the Sea investment story.

Conclusion

The sum of the parts value shows an opportunity that exists today that actually gives investors a chance to invest in Sea at a discount to fair value. While investors chased Sea when it traded at crazy multiples in 2021, those same investors are now reluctant to invest in Sea when it looks attractive from a valuation perspective.

With where the stock has been trading for the past month near the 40s and 50s, this means that the current valuation only takes into account the value of Shopee, which I estimate at $38 per share. With the implied value of Garena and the fintech business at zero, I find that the stock is under very poor sentiment and the discount that Sea is trading at today presents an excellent opportunity for contrarian investors. Likewise, with weak sentiment surrounding the stock, I believe this makes the stock less risky than it was in 2021, with expectations at the bottom. In addition, I highlighted that the company continues to focus on achieving positive cash flows and improving operating efficiency, while exiting non-core markets to preserve capital. Finally, the stock is trading as if growth has disappeared, but Sea’s business continues to benefit from strong tailwinds in the gaming, e-commerce and fintech segments of underpenetrated markets.

I am starting a marketplace service, Outperformed the marketwhich will be launched on 10 January 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a leveraged portfolio that outperforms the market.

Mark your calendars, because early adopters can reserve a spot as one Senior discount member, which gives you generous introductory rates. Thank you for reading and following my work. See you there!