Robot known for outperforming crypto markets increases allocation to Ethereum, Polygon and several smart contract competitors

A robot that has gained a reputation for outperforming the crypto markets is revealing its latest portfolio allocation as the early July rally winds down.

Every week, the Real Vision Bot conducts surveys to create algorithmic portfolio assessments in accordance with a “hive mind” consensus.

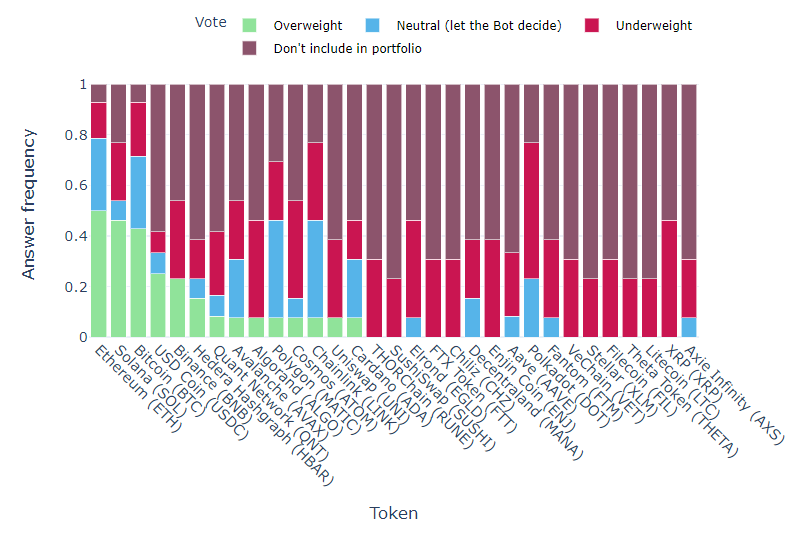

The bot is the freshest data finds that traders’ risk appetite remains about the same as last week, with most market participants voting to overweight their portfolios with a dozen altcoins in addition to crypto-stable Ethereum (ETH) at 50% and Bitcoin (BTC) at 43%.

Ethereum competitor Solana (SOL) pushed into second place with a 46% heavyweight allocation, and rounding out the top five with 30% boosts each were US dollar-pegged stablecoin US Dollar Coin (USDC) and popular cryptocurrency exchange Binance’s native token BNB.

“Real Vision Exchange Crypto Survey Latest Results. Solana Takes Bitcoin and USDC Exposure Increased.

1. Ethereum 50%

2. Solana 46%

3. Bitcoin 43%

4. USDC 30%

5. Binance 30%”

In sixth place with a 15% preponderance was decentralized application creation protocol Hedera Hashgraph (HBAR), followed by enterprise-class interoperability solutions provider Quant Network (QNT) with 8%.

A lucky number seven cryptoassets all received a 7% heavyweight allocation, including smart contract platforms Avalanche (AVAX) and Algorand (ALGO), plus layer-2 scaling solution Polygon (MATIC), scalability and interoperability ecosystem Cosmos (ATOM), decentralized oracle network Chainlink ( LINK), decentralized financial protocol Uniswap (UNI) and ETH challenger Cardano (ADA).

Regarding the latest survey-based exchange portfolio allocationsays Real Vision,

“Both survey participants and Bot reduce risk by increasing USDC exposure.

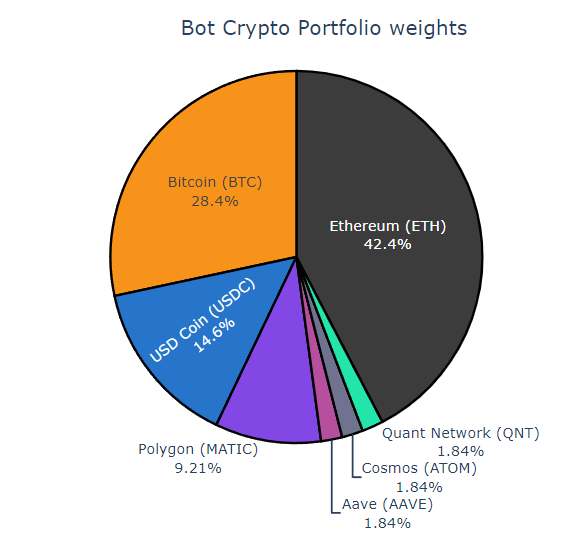

In addition, we are seeing a shift towards tokens with large values such as Bitcoin, Ethereum and Solana. The bot still likes Polygon.”

The survey’s portfolio breakdown was 40.6% ETH, 24.4% BTC, 20.3% SOL and 14.8% USDC.

The bot was a bit more adventurous, adding four other altcoins to his portfolio while not opting for SOL.

Real Vision Bot was developed by quant analyst and hedge fund manager Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macroeconomics expert Raoul Pal has called the bot’s historical performance “amazing,” saying it outperforms a combined bucket of the top 20 cryptoassets on the market by more than 20%.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/alexdndz