Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of economics and cryptography.

all about cryptop referances

The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, has explained why he buys bitcoin. Citing inflation, he described pension funds investing in cryptocurrency, adding that they know “fake” money, stocks and bonds “are toast.”

Rich Dad Poor Dad author Robert Kiyosaki shared why he’s buying bitcoin in a pair of tweets on Friday.

Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times bestseller list for over six years. More than 32 million copies of the book have been sold in over 51 languages in more than 109 countries.

In a tweet, author Rich Dad Poor Dad described that he buys bitcoin because pension funds buy the cryptocurrency. He referred to an article published by Forbes, entitled “Your State Pension Is Now Gambling On Cryptocurrency”, which contains a survey showing that 94% of US state and local government pensions invest in cryptocurrencies. Kiyosaki tweeted the article to his 1.2 million followers, writing:

Why I buy bitcoin. Pension funds are the largest investment companies in the world.

The survey is part of the latest Investor Trust Study, published in April by the CFA Institute, the global association of investment professionals. The study showed that institutional investors have become bigger adopters of cryptocurrencies, with two-thirds saying they are currently invested in these products. In addition, government pension schemes are most likely to be invested in crypto assets.

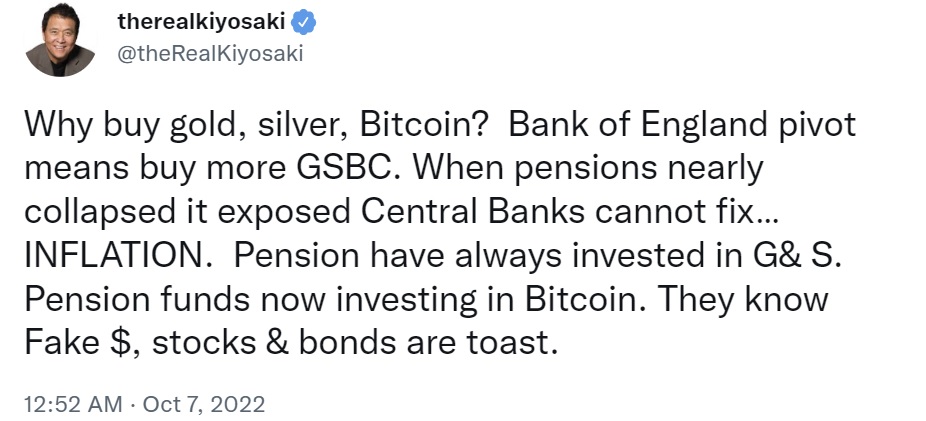

In another tweet, Kiyosaki elaborated on why he has recommended buying gold, silver and bitcoin. The famous author explained that when pensions almost collapsed, it revealed that central banks cannot fix inflation. He noted that pensions have always invested in gold and silver, and now they are investing in bitcoin.

Last week, the Bank of England told lawmakers that a number of pension funds were hours from collapse when they decided to intervene in the UK bond market following a massive sell-off in British government bonds.

Kiyosaki also stated in his tweet that pension funds know that fake money, stocks and bonds “are toast”. The famous author recently warned that the end of fake money is here, and is urging investors to invest in “real money”, naming gold, silver and bitcoin.

The renowned author has been recommending buying bitcoin along with gold and silver for some time. Last month, he urged investors to get into crypto now, before the biggest crash in world history hits. He noted in June that he is waiting for the price of bitcoin to test $1,100.

Last week he said that as the Federal Reserve continues to raise interest rates, there will be buying opportunities in gold, silver and bitcoin. He also predicted that the US dollar will crash by January next year after the Fed swings.

What do you think of Rich Dad Poor Dad author Robert Kiyosaki’s reason for investing in bitcoin? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.