Rising popularity of Ethereum stakes keep a lid on returns

Ethereum staking seems to be the new favorite way for crypto traders to capture returns – so popular, in fact, that it’s driving returns lower.

That’s a consequence of the formula used to calculate returns under the Ethereum blockchain’s months-old proof-of-stake model: Stake returns are awarded in ether (ETH), the native cryptocurrency of the Ethereum blockchain. And the total amount of Ether available for staking returns is divided between all the staking accounts. So the more ether sent to the blockchain for staking, the lower the percentage available to each player.

According to Coinbase Institutional, the post-merger return on investment appears to be around 4% – 5%, well below the 9% -12% that analysts originally predicted.

One problem for now, according to cryptoanalysts, is that investors can’t cash out the ether immediately – so they’re stuck with the protocol even if stake rates continue to drop. The withdrawal option won’t really become available until Ethereum’s next significant upgrade, “Shanghai”, which is expected to happen in 2023.

“You can only deposit holdings, but not withdraw,” said Nick Hotz, vice president of research at digital asset management firm Arca Funds.

So unlike in traditional bond markets, where returns can rise or fall based on supply and demand, the Ethereum venture is not “responsive”.

“In the future, it will be responsive and it will look much more like a bond market, where more interest is generated if more happens in the economy,” Hotz said.

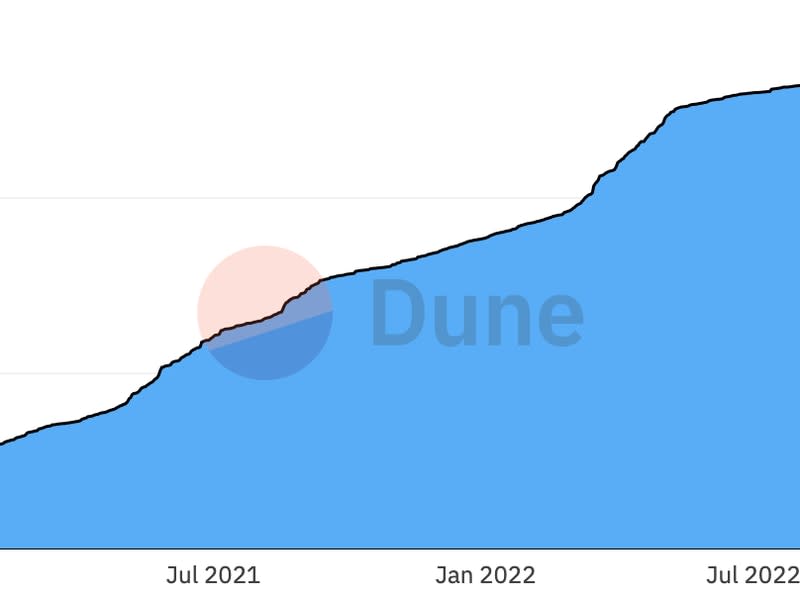

According to data from Dune Analytics, more than 14 million Ether (ETH), worth over $2 billion, are currently being staked on the Ethereum blockchain, including an increase in deposits during the third quarter as the transition to proof-of-stake . the model came into effect, known as the merger. This amount of ether that has been staked is up 7.5% from the end of the second quarter.

The merger was intended to make the Ethereum blockchain more energy efficient than the previous proof-of-work model – also the same system used by the Bitcoin blockchain.

Under the proof-of-stake system, the blockchain’s security—ensuring that transactions go through as intended and that the cryptocurrency is safe—is provided by “validators” who stake the ether as a sort of guarantee. Becoming a validator or staker requires at least 32 ETH (roughly $50,600 worth) to be unlocked on the blockchain.

But as more players rush in and more ETH is deposited, the returns are spread out more thinly.

Hotz said Ethereum’s staking return is typically determined by four variables: gross ETH issuance, transaction fees generated per day by Ethereum, burn rate, and the amount of ETH staking.

The denominator is growing

It’s a formula, actually. The annual return on investment is: [annual gross ETH issuance + annual fees * (1-% of fees burned)]/average ETH stake during the year.

In other words: The amount of staked ether is in the denominator of the fraction. So as the number gets bigger, the returns shrink.

At current levels, the return on Ethereum stakes is roughly on par with the yield on the 10-year US Treasury bond yield, which peaked at 4.2% this year, the highest level since 2008.

The takeaway is that stakers are apparently content to collect about the same return by plugging their money into the Ethereum blockchain as by investing in triple-A-rated U.S. Treasuries, considered among the world’s safest investments.

The rate increase is “a sign that traders are finding it a reliable alternative to the traditional markets,” Alan Goldberg, market analyst at BestBrokers, said in a note.

“Making a deposit for a year without access to your funds is a risky move, especially if the funds are in crypto,” Goldberg said. “But traders continue to bet… It just proves that many traders feel safe with Ethereum.”