Rising popularity of cash-margined Bitcoin futures suggests crypto ‘liquidation cascades’ may become rare

The Bitcoin (BTC) derivatives market has undergone a significant structural change over the past 18 months, making the asset class less vulnerable to volatility-inducing liquidation cascades.

The cash-margin contracts, which require traders to deposit US dollars or dollar-linked assets such as stablecoins as collateral to take leveraged bets, now account for a record 65% of total open positions (or open interest) in the BTC futures market, according to data tracked by the research firm Glassnode.

That is significantly higher than the 30% seen in April 2021, when the crypto-margined contracts dominated futures market activity. The crypto-margined contracts, also known as reverse contracts, require traders to deposit a cryptocurrency as collateral. According to Glassnode, the growing popularity of cash margin contracts represents an improvement in the health of the derivatives structure.

“This works to reduce the likelihood of an amplified liquidation cascade, while demonstrating the growing market demand for stablecoin security,” Glassnode analyst James Check said in a weekly note sent to subscribers.

Liquidation refers to the forced closing of all or part of a bullish/bearish (long/short) futures position when the trader cannot meet the margin or collateral requirements for a leveraged position.

A liquidation cascade occurs when an event leads to sudden bullish or bearish price action, triggering mass forced closings of long/short positions, which in turn exacerbates price turbulence and leads to further liquidations. In other words, a small move becomes larger as exchanges liquidate positions with margin shortages, causing a feedback loop.

Large liquidation cascades were quite common before mid-2021, when crypto-margins were more popular than cash-margins.

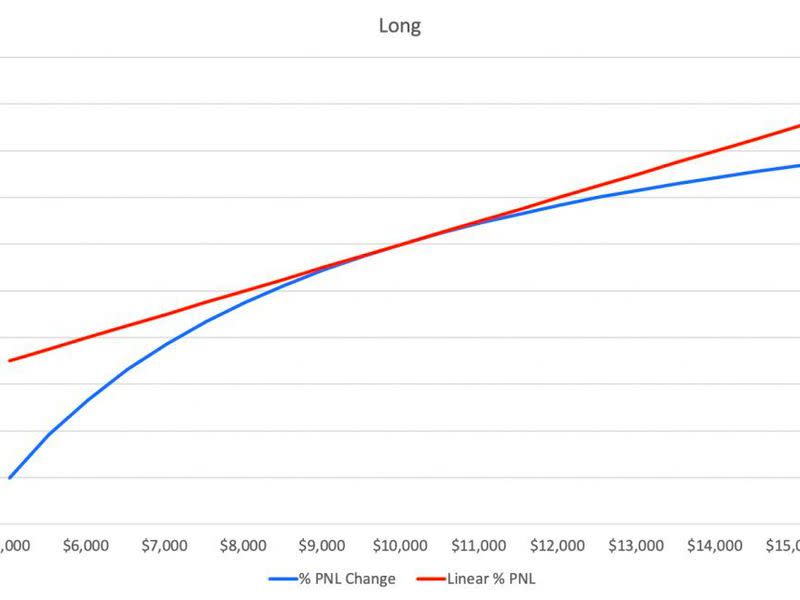

These contracts are quoted in USD, but margined and settled in cryptocurrencies. It is the case that collateral is as volatile as the position, exposing the trader to liquidations. For example, suppose an entity takes a long position in a BTC/USD inverse contract, representing 1 BTC, collateral and settled in BTC and quoted at $10,000 at press time.

If the price rises by 10% to $11,000, the $1,000 profit will be paid in BTC valued at the current market price ($11,000). In other words, the trader will earn a profit of 0.09 BTC or 9% on one BTC. On the contrary, if the market falls by 10% to $9000, the trader will lose $1000, which is equivalent to a loss of 0.11 BTC or 11% of a BTC.

Essentially, the long position bleeds faster as bitcoin becomes cheaper against the USD. Furthermore, the security, BTC, also loses value, compounding losses. As such, the margin required to hold the position increases greatly. If the unit does not yield the same, the position is liquidated.

“Your margin requirements increase in a non-linear fashion, which is why bulls blow their positions quickly when the market falls,” said Arthur Hayes, co-founder and former CEO of crypto spot and derivatives exchange BitMEX in an explanation.

The blue line, which represents the percentage of profit and loss from a long position in a crypto-margined contract, shows a non-linear gain. In this case, the trading entity loses more when the market falls and earns less when the market rises. The latter happens because, after the market rally, BTC itself becomes more expensive against the USD.

“Currency margin contracts are convex when calculated by USD, which brings relatively higher liquidation risk and potential user losses (below the USD benchmark),” Griffin Ardern, a volatility trader at crypto-asset management firm Blofin, told CoinDesk.

Cash margin contracts overtook crypto margin contracts in terms of market dominance a year ago. “The rate of decline of coin-margined futures has already begun in 2021. The reason is that the influx of a large number of US dollars not only inflates the market value of the entire crypto market, but also reinforces the original convexity of coin-margined futures,” Ardern noted.

Cash or stable coin margin contracts have a linear payout, with gains and losses measured and paid in dollars. This makes them somewhat less vulnerable to liquidations.

“Cash margin contracts are relatively concise and not mathematically convex, making them easier for retail investors to understand and easier for exchanges to liquidate.”