Rise Of Fintech 2.0 – Building a future-ready Fintech

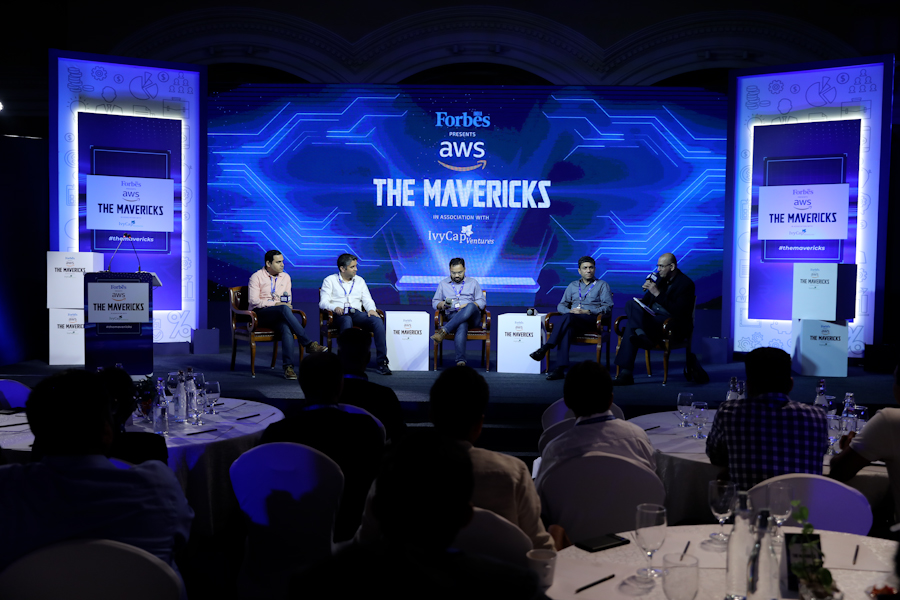

Forbes India, AWS in partnership with IvyCap Ventures organized an event ‘The Mavericks’ focusing on the theme: ‘Rise of Fintech 2.0’ at ITC Windsor in Bengaluru to delve deeper into the evolving Fintech ecosystem in India and the evolution of innovation within this sector. Numerous panel discussions and founder talks enlightened the audience on how to develop a Fintech organization that is focused on the future.

Forbes India, AWS in partnership with IvyCap Ventures organized an event ‘The Mavericks’ focusing on the theme: ‘Rise of Fintech 2.0’ at ITC Windsor in Bengaluru to delve deeper into the evolving Fintech ecosystem in India and the evolution of innovation within this sector. Numerous panel discussions and founder talks enlightened the audience on how to develop a Fintech organization that is focused on the future.

The event’s theme- Rise of Fintech 2.0 aimed to educate the audience on the various aspects of building a Fintech organization as well as adapting to technological innovations. In addition to this, business and management aspects were touched upon to provide an all-encompassing overview of the industry.

Welcome remarks by Manu Balachandran, Associate Editor, Forbes India

In his welcome letter – Manu Balachandran, Associate Editor at Forbes India, discussed how India is home to over 6,000 Fintechs and the Fintech industry is estimated at over $30 billion. Being recognized as the largest Fintech ecosystem globally, Indian fintech players have tapped into this lucrative opportunity.

The most promising fintech giants are changing the landscape and shaping the industry with their innovative solutions and plans to make it future-proof.Founder panel: Building a future-ready Fintech

As the event highlighted several eye-opening points, the Founders Panel was moderated by Harichandan Arakali, Editor – Tech & Innovation, Forbes India, speakers like Bhupendra Kumar, Head, Growth Business, DNB, AWS, Anshul Rai, Co-Founder & CEO, Happay, Rajeev Agrawal, founder and CEO, Innoviti Technologies, and Sashank Rishyasringa, co-founder and MD, Axio, among others, discussed the rise of innovation in FinTech and the importance of cloud computing in this industry.  (Left to Right)- Bhupendra Kumar- AWS | Siddharth Patnaik- Upstox | Narendra Babu- PayU India | Karthikeyan Krishnaswamy- KreditBee | Anshul Rai- Happy | Sashank Rishyasringa – Axio | Rajeev Agrawal- Innoviti Technologies | Satinder Singh- AWS | Ashish Wadhwani- IvyCap Ventures.

(Left to Right)- Bhupendra Kumar- AWS | Siddharth Patnaik- Upstox | Narendra Babu- PayU India | Karthikeyan Krishnaswamy- KreditBee | Anshul Rai- Happy | Sashank Rishyasringa – Axio | Rajeev Agrawal- Innoviti Technologies | Satinder Singh- AWS | Ashish Wadhwani- IvyCap Ventures.

Credit is essential

Credit is seen as one of the potential opportunities in this industry along with technological innovations. Speaking on how technology is impacting credit and changing the Fintech landscape, Sashank Rishyasringa said, “Credit is an imperative. We have the vision of being a $5 trillion economy, but no one has done it without the simultaneous expansion of personal credit. If you look in India has we a credit gap of 70% between demand and supply among the top 20% income owners. In terms of problems to solve, it is a problem to scale. In this regard, technology has been a game-changer, because they have crashed acquisition costs and underwritten risk to customers who have not received a loan before. The second problem is how to make this credit work for the population. Technology has helped us design quality credit products by being transparent, linked to a use case, and combined with financial behavior for the next sets of customers.”

Emergence of cooperative trade

Fintech is seen as a digital and cloud-based company. Collaborative commerce is an emerging area in the Indian fintech landscape. Rajeev Agrawal said, “At Innoviti Technologies, we strive to provide solutions that help businesses reduce the cost of acquisitions. Behind every purchase you make, there is a purpose. The purpose puts customers at the center of the transaction. You cannot change the fact that acquisition costs are increasing , but what you can change is the different businesses targeting the same consumers, can they come together and target the consumer together?

Dependence on technical tools and their impact

Sharing his thoughts on the technological tools that can be trusted and what technological innovations are driving the fintech industry, Anshul Rai said, “Major banks in India still run on a massive setup to process transactions. Technology has enabled us to run everything on the cloud and significantly reduce the cost of processing. The third party cannot integrate with the bank’s existing system and bring innovation. There is ambiguity in the regulations that we solve. However, technology solves this challenge such as payment stacks, banking layers, licenses, security, etc.”

The promise of the cloud from renting storage and computing has evolved into a rich ecosystem across multiple verticals. Talking about the AWS Blueprint for Fintech customers, Bhupendra said, “AWS and everyone is bullish on this sector. Looking at the scalability of businesses, India’s UPI segment has seen massive growth. We expect to reach the 5.2% penetration mark to become a major insurance market globally. When we talk about AWS Blueprint, the company offers more than 200 features such as isolation networks, secure cloud services, etc.”

Conclusion

The next decade will see massive growth for the Fintech industry. The sophisticated technology and enablers will drive the future of the Fintech landscape in India.

Check out our festive offers of up to Rs.1000/- off website prices on subscriptions + gift voucher worth Rs 500/- from Eatbetterco.com. Click here to know more.