Riot Blockchain’s Middle Child Syndrome

Klaus Vedfelt/DigitalVision via Getty Images

Introduction

So far we have covered almost every major Bitcoin (BTC-USD) mining company listed in the US. We found that mining companies adopt different capital structures to maintain operations and growth. In our previous coverage of Riot Blockchain (NASDAQ:RIOT), we found that RIOT’s operations and growth are sustained through dilution, which led RIOT to increase its outstanding shares by 40% since 2021. We did a similar observation in Hut 8 Mining (COTTAGE) too, where HUT increased outstanding shares by 89% in the same period and will increase by 75% more in the coming quarters.

On the other hand, CLSK did not take on debt nor dilute its shareholders, but sells Bitcoins mined to cover expenses. MARA is the opposite of HUT and RIOT where MARA takes on debt to finance operations and growth. Both MARA and CLSK have the highest targeted mining capacity by the end of 2023 (23 EH/s and 22.4 EH/s respectively). Since there is no dilution, as long as they remain solvent, a long-term investment time horizon can be justified.

Our final conclusion for HUT was the timing of the market is better than the timing of the market, despite trading well below book value. Given the similarities between RIOT and HUT, this article aims to examine the uniqueness of RIOT’s investment value proposition in the Bitcoin mining sector.

Varying balance policy

Although both HUT and RIOT dilute shareholders for operations and growth, the severity of the dilution varied due to balance sheet policies. HUT is committed to a 100% Bitcoin HODL strategy. It means that HUT will not sell Bitcoins mined:

In line with our long-standing HODL strategy, 100% of self-mined Bitcoin in September was deposited into escrow

HUT has not sold a single Bitcoin mined at least since 2021Q1. On the other hand, RIOT has started selling Bitcoins mined:

- 250 Bitcoins (of 508 or 50%, to raise $10 million) sold in April

- 250 Bitcoins (of 466 or 54%, to raise $7.5 million) sold in May

- 300 Bitcoins (of 421 or 71%, to raise $6.2 million) sold in June

- 275 Bitcoins (of 318 or 86%, to raise $5.6 million) sold in July

- 350 Bitcoins (of 374 or 93%, to raise $7.7 million) sold in August

- 300 Bitcoins (of 355 or 85%, to raise $6.1 million) sold in September

Naturally, RIOT doesn’t need to dilute shareholders as much because of the cash flow generated from the sale. As a result, RIOT’s Bitcoin reserve grew only marginally compared to HUT (Table 1). Despite having 60% more mining capacity than HUT, HUT’s Bitcoin reserve has exceeded RIOT’s since 2022Q2 and is second only to MARA (10,670 BTC) in size.

Table 1. Bitcoin reserve growth over time

| QR | RIOT | COTTAGE |

| 2022Q3 | 6,775 | 8,388 |

| 2022Q2 | 6,653 | 7,406 |

| 2022Q1 | 6,320 | 6,460 |

| 2021Q4 | 4,884 | 5,518 |

| 3rd quarter 2021 | 3,995 | 5,053 |

| 2021Q2 | 2,687 | 4,240 |

| 1st quarter 2021 | 1,771 | 3,522 |

Source: Author

RIOT’s investment value proposition

We previously determined that HUT shareholder value will be highly sensitive to Bitcoin reserve value because its Bitcoin reserve alone is already worth 46% (= $20,000 per BTC * 8,388 BTC / $364mil market cap) of HUT’s entire market cap.

On the other hand, RIOT’s Bitcoin reserve value represents only 14% of its market capitalization. That said, RIOT is on par with HUT when considering other valuable assets. RIOT’s market cap ($982mil) to adjusted book value ($1.05bn = $270mil cash + $411mil PP&E + $20,000 x 6.775 BTC Bitcoin reserve + $376mil prepaid – $147mil total liability) is 0.935, compared to HUT9’s (ratio). $364mil market value / $404mil adjusted book value).

RIOT therefore has a similar value proposition to HUT when it comes to equity.

When it comes to mining profitability, RIOT outperforms HUT in every important aspect. RIOT’s current and near future capacity are both higher than HUT by 82% and 260% respectively, while the cost of revenue (excl. depreciation) per BTC and all-in business cost per BTC are lower than HUT by 35% and 30% respectively (Table 2) .

Table 2. Profitability measurements

| RIOT | COTTAGE | |

| Current capacity | 5.6 | 3.07 |

| Capacity in the short term (2022Q4/2023Q1) | 12.5 | 3.5 |

| Cost of Revenue (CoR) (excl. depreciation) per BTC | $13k = $18mil / 1395 BTC | $20k = $19.1mil / 946 BTC |

| All-in-business cost per BTC | $35k = $49.3mil / 1395 | $49.5k = $46.8mil / 946 BTC |

Source: Author

What is counterintuitive, however, is that both RIOT and HUT offer the same upside potential. RIOT can justify a $3 billion valuation (200% upside) compared to HUT’s $1.1 billion valuation (200% upside) based on the following assumptions:

- Q2 all-in business cost base: RIOT $35k per BTC, HUT $49k per BTC

- Q2 asset and liability level

- Bitcoin regains all-time high (‘ATH’) at $70,000 per BTC

- P/E ratio of 5

- 422 EH/s Bitcoin network hash rate by the end of 2023 based on 2021 and 2022 growth rates.

- 12.5 EH/s / 3.5 EH/s near future capacity will be fully realized.

Therefore, RIOT’s superior profitability could not give it further upside.

These results suggest that there are no significant differences in the investment value between RIOT and HUT. What we can take away from these observations is:

- A large part of RIOT’s 2.5 times higher future capacity has already been priced in. RIOT’s market cap is already 170% higher than HUT’s.

- RIOT’s upside potential was lost due to the sale of mined Bitcoins. As a result, RIOT’s smaller Bitcoin reserve has less to gain from the Bitcoin recovery.

Verdict

Investors are not short of options when it comes to choosing a Bitcoin mining company: CLSK would be ideal if a smaller Bitcoin reserve in exchange for low dilution and low leverage is desired; MARA would be ideal if higher leverage in exchange for a larger Bitcoin reserve and low dilution is desired.

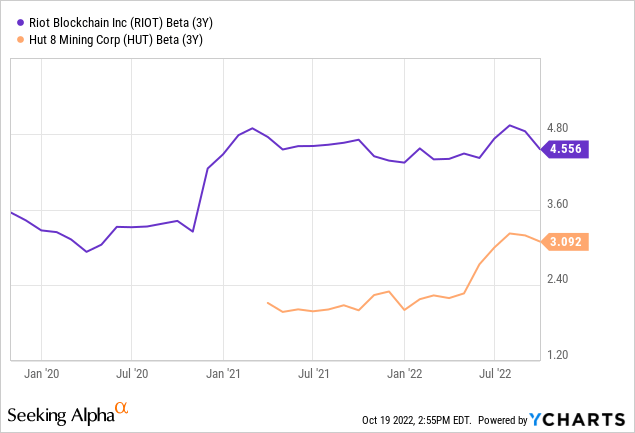

But when it comes to more severe dilution in exchange for a larger Bitcoin reserve and low leverage, both HUT and RIOT offer very similar propositions in terms of equity multiples and upside. What will give HUT an advantage is that HUT is not as volatile. Since risk is defined as volatility, HUT has a lower risk. Therefore, if severe dilution in exchange for a larger Bitcoin reserve and low leverage is desired, HUT is ideal.

Fig. 1. Volatility comp (YCharts)

What about the highest expected capacity in the short term? RIOT’s 12.5 EH/s still trails MARA’s 23 EH/s and CLSK’s 22.3 EH/s. What about mining efficiency? RIOT’s $13,000 CoR per BTC and $35k all-in enterprise cost per BTC also trail MARA’s $6,240 CoR per BTC and $31,700 all-in enterprise cost per BTC. Furthermore, RIOT recently sold Bitcoins mined as CLSK, but continues to risk a similar level of dilution as HUT (eg RIOT’s recent filing for a $500 million IPO in Q2).

In summary, RIOT fails to fit a particular profile exceptionally well. As a result, RIOT risks being excluded, ignored or neglected by investors.