Riot Blockchain (NASDAQ:RIOT) on track to achieve record hash rate

Blockchain miner Riot Blockchain (NASDAQ:RIOT) continues to witness a significant increase in hash rate capacity with the accelerated deployment of high-tech and new generation miners. Riot is engaged in building, supporting and operating blockchain technologies and is one of the largest US-based publicly traded Bitcoin (BTC-USD) miners in North America.

Pleased with the operational progress, Riot CEO Jason Les said, “Our team has expanded Riot’s total deployed fleet by 9,070 miners and increased our hash rate capacity to an all-time high of 5.6 EH/s… In the In the coming months, we will remain focused on aggressively increasing our distributed hash rate as we work toward our goal of reaching 12.5 EH/si in the first quarter of 2023.”

Riot’s BTC Mining Drops, But Hash Rate Jumps

In September, Riot produced 355 bitcoins, a decrease of around 13% compared to September 2021, and lower than August’s production of 374 BTC.

By the end of September, Riot produced and held approximately 6,775 bitcoins. During the month, it sold 300 BTC, generating $6.1 million in net proceeds. The company currently has a deployed fleet of 55,728 miners and a hash rate capacity of 5.6 exahash per second (EH/s).

Regarding the progress of the deployment, Riot stated that they have received 14,755 last generation S19 series miners. In particular, regarding the deployment of the staged miners, Riot expects the hash rate capacity to soon reach approximately 6.4 EH/s.

Interestingly, aside from hosting self-mining, Riot also hosts around 200MW of institutional bitcoin mining customers.

What is the target price for the RIOT share?

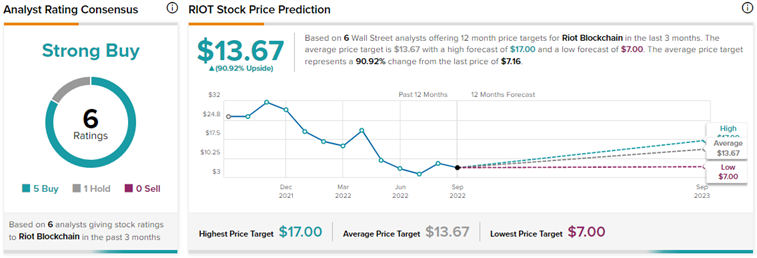

On TipRanks, the average Riot Blockchain target price is $13.67, implying an impressive 90.9% upside potential to current levels. With five Buys and one Hold rating, Riot stock has a strong Buy consensus rating. Amidst the decline in the value of cryptocurrencies, RIOT stock has lost 68.5% so far this year.

Final note – Persistent headwinds haunt crypto stocks

Crypto stocks, including blockchain miners, face several headwinds, including the ongoing crypto winter, intense competition, regulatory hurdles and a generally weak macro backdrop.

Furthermore, hackers and fraudsters continue to siphon off billions of dollars from the crypto market. Yesterday, a WSJ the report stated that crypto exchange Binance was robbed of $100 million in a “cross-chain bridge” hack on the Binance Smart Chain blockchain network. The company immediately suspended transactions and money transfers on its network.

These challenges continue to affect the production capacity of miners, as well as limit their financial performance. Nonetheless, analysts remain highly optimistic about Riot Blockchain’s long-term stock trajectory with accelerating hashrate capacity and further mining progress once the headwinds are clear.

Mediation