Revisit BITO and GBTC before the upcoming bull market in Bitcoin

Tevarak

Produced by Ryan Wilday with Avi Gilburt and Jason Appel

Grayscale Investments is locked in a battle with the SEC over turning its Bitcoin (BTC-USD) trust, symbol (OTC:GBTC), into a spot ETF. So far, the SEC has declined Grayscale archiving. They cited that manipulation of the spot Bitcoin market is difficult to detect. But the SEC has already approved a Bitcoin futures ETF (NYSEARCA:BITO), which has a NAV directly derived from the same spot market. So Grayscale has taken its fight to the courts.

Converting the fund to an ETF will give Grayscale the ability to keep the share value equal to the net asset value (NAV) of the Bitcoins held in the fund. While the trust used to trade at a premium to Bitcoin holdings, it fell to a recent 49% discount to that Bitcoin. This has made GBTC a poor proxy for Bitcoin exposure.

Grayscale’s lawsuit had its first day in court on March 7, 2023. The day is considered positive for Grayscale. The judges appeared to question the basis and integrity of the SEC’s arguments. A decision is not expected until later this year. However, GBTC traders wasted no time in closing the GBTC discount. Between the close on March 6th and the 7th, GBTC’s discount to NAV moved from 42% to 35%.

So GBTC holders en masse, which includes me, have been betting that GBTC will be converted. They are sitting on an investment that is a poor proxy for Bitcoin and believe in the potential that gives us an instant 200%+ move to bring it back to par.

I don’t mind having a small amount of money on this bet, but I want a more reliable proxy for Bitcoin exposure. This is all the more important now that we have the first significant bullish move in Bitcoin. My colleague, Jason Appel, is planning a more focused Bitcoin update soon. Look for it. However, I will quickly discuss what I see as bullish via a technical analysis of Bitcoin.

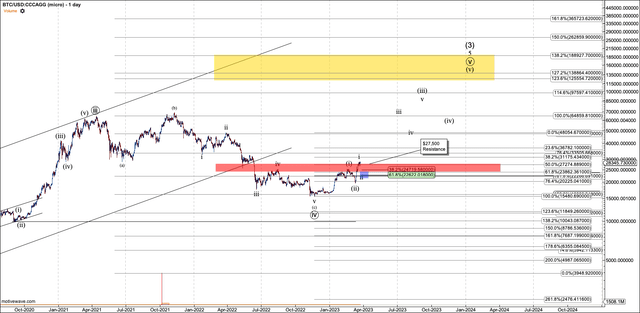

Bitcoin has broken above its wave 4 resistance in what has been my primary count shown in red. From an Elliott Wave perspective, this opens the door to $125K, a goal I’ve been discussing since 2020. But note: Bitcoin will have more to prove as it climbs. This has happened after breaking my critical support at $16K. But that break was only made at $500, leaving us with a now very critical level of $15,500.

Bitcoin Weekly Chart (Motivewave Software)

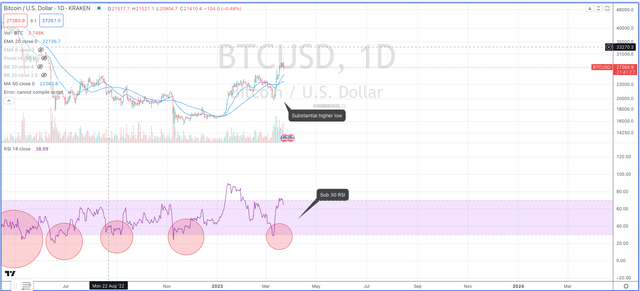

We have the first significant higher low in Bitcoin after an RSI below 30 since the bear market started in 2021. This is a classic technical signal that I have used for over 5 years in my Bitcoin trading. So far it has not disappointed me.

Bitcoin 1D with RSI (Tradingview.com)

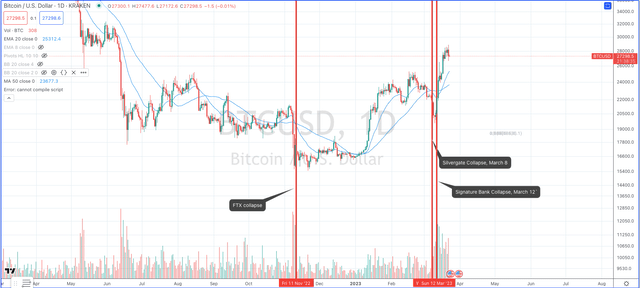

So-called “crypto contagion” has resulted in strong crypto movements. When the FTX (FTT-USD) exchange failed last November, Bitcoin made an important low and has almost doubled since. With two key banks – Silvergate (SI) and Signature (“SBNY”) – supporting the failing crypto industry, Bitcoin surged 40%.

Recent Crypto Related Events (Tradingview.com)

BITO revisited

Now that Bitcoin can turn bullish, interest in the asset will grow, at a time when most people do not have crypto exchange accounts. That’s why I wanted to help readers consider how to gain this exposure in their brokerage accounts. Although there are many Bitcoin trusts, such as GBTC, and a few Bitcoin futures-based ETFs, such as BITO, these two symbols are the most actively traded on brokerage accounts today.

On February 18, 2022, I wrote an article discussing the trade-offs between BITO and GBTC. BITO was very new as a fund.

At that time the GBTC discount was 24%. As I said, my concern with GBTC is that the discount continues to grow as there was no mechanism to close it. Indeed, that discount doubled at its 52-week extreme since that article was written. Over the past year I have suggested to my subscribers that GBTC was not a good place for continued exposure beyond short-term trades and I began actively covering BITO.

Now that BITO has been on the scene for just over a year, we can look back at my earlier concerns. In that article I concluded that BITO was probably a better investment than GBTC, but I will return to my concerns here.

BITO concerns

I noted in the article that it would likely expire relative to the value of spot Bitcoin, because it has futures contracts that are in contango. This maturity is called rolling maturity, as the fund sells forward contracts and rolls to the next contract at a higher price.

BITO maturity

Based on the then short history, I predicted that the decay could be 9% per year. Now that BITO has been around for over a year, this decay has only been about 5%. Furthermore, that decay continues to limit itself. In short, this is less of a problem with BITO than I previously thought.

During the last trading year, I also noticed a distinct advantage of trading BITO. Bitcoin futures tend to wander from contango to a discount versus spot near key lows. While these flips give me a secondary buy signal for Bitcoin, it also creates reverse decay for those buying BITO during these times. It’s like buying Bitcoin at a discount, and it usually reverses when the market falls.

Dividend bonus

Two months ago, I was pleasantly surprised when I reviewed my retirement account. I noticed a dividend paid on BITO worth ten cents per share. That dividend turns out to be monthly. After investigation, it appears that dividends come from the fund’s treasury, rather than cash. It has futures with full security, so it’s not a leveraged fund, and that security pays dividends. Right now, the dividend covers the rolling maturity in the fund and more. But naturally, as BITO increases in value and interest rates fall, the return will be less than what the fund gives today.

Option Income

Finally, in my above-mentioned article, I discussed the potential of selling options on BITO to combat expiration. I have been implementing that strategy for the past year. My first entry into my retirement account involved selling a $20 put in January 2023. I was awarded the shares at expiration while the BITO was at $15, so I was underwater.

Since then, however, I have sold options, both calls and puts. My shares have doubled in number and my costs have dropped to $13.72 per share. At the time of writing, BITO’s last close was $16.42.

Doing exceptionally well with this strategy naturally requires some skill in market timing and options trading. Regardless, provided you are selling cash-backed puts and not using margin, these trades are risk-reducing. But while I’ve benefited from the strategy, fighting roll decay was unnecessary. That was the original intention, but the roll decay is much lower than expected.

BITO technical analysis

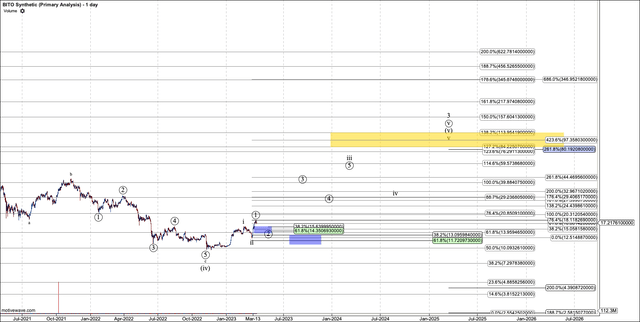

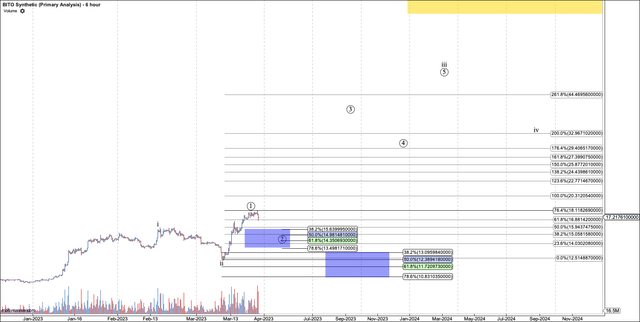

I have been fighting a problem doing Elliott Wave analysis for BITO. It is 99% correlated to Bitcoin, but lacks Bitcoin’s 24/7 price action. Key highs and lows that are critical for a solid count can end up after the stock market’s hours, so missing on the BITO chart. To deal with this problem, I created what I call my synthetic BITO chart. It is basically a Bitcoin chart with a multiplier used to obtain a rough BITO value with the entire hypothetical 24/7 interval. It doesn’t work for determining penny support, but it’s solid for swing trading and long-term forecasting.

The bottom line is that if Bitcoin is headed for $125K, BITO should reach $80, which is about five times its current value. I’m not going to give you a time frame for that projection since my work is not time based. However, this is my expectation in the future.

BITO, Daily Chart (Motivewave Software)

Zoomed in, we can have circle-1 of a third wave in place. Support for circle-2 is in the $13.50 region. If that level breaks, all is not lost. However, Bitcoin will break into the larger degree wave-ii on my chart below. Support for that wave-ii is $10.80. That level is critical. If BITO stays below that, it is likely to come with Bitcoin threatening a breach of the very critical low of $15,500 last November.

BITO micromap (Motivewave Software)

Wrap it up

In conclusion, we have some bullish indications from Bitcoin and it may be about to start another bullish cycle. I wanted to write this article for those who do not trade spot crypto but want to have some exposure in their brokerage accounts. Over the past year I have been both a trader and investor in the Grayscale Bitcoin Trust and the ProShares Bitcoin Strategy Fund. My conclusion is that BITO is the best choice for investors:

-

The futures roll and its resulting decline in the fund has been minimal: 5% over the past year and falling.

-

At the moment, BITO pays an outsized dividend for such a fund while interest rates are high. That dividend is temporarily high, but available in the short term.

-

GBTC’s discount is a risk that investors cannot control. It may reduce – or worsen – but, importantly, it has not been predictable.

Finally, recognize the risks of futures ETFs. We’ve seen some explode, like the failure of the short volatility fund XIV in 2018. It was an event now called “Volmageddon.” Bitcoin futures ETFs do not have the same level of risk as a short-vol fund, but the risks of futures ETFs should be noted.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.