Reimbursement and spend management platform PayEm secures $220 million in equity and debt • TechCrunch

When Itamar Jobani, a software developer by trade, worked for a healthcare company, he dreaded doing expense reports every month using his employer’s preferred reimbursement tool. Jobani looked for an alternative, but couldn’t find one – so he built it himself.

PayEm, as it became known, launched in 2019 – Jobani partnered with fellow developer Omer Rimoch to get the idea off the ground. Creating a consumption and acquisition platform from scratch may have been a big risk, but it seems to have paid off for Jobani, who claims that PayEm now has “hundreds” of customers and rapidly growing revenue (up 550% recently the year) ).

To lay the foundation for further growth, PayEm has closed a $20 million Series A equity round and taken out a $200 million line of credit, the company announced today. Viola Credit, Mitsubishi Financial Group, Collaborative Fund, Pitango First, NFX, LocalGlobe and Glilot+ are among those who contributed $220 million in funding, which Jobani says will be used to expand PayEm’s card business, serve larger customers and improve employee experience within the core digital product.

Why the decision to raise debt versus equity? Jobani says it came down to a question of timing – and flexibility. PayEm chose warehouse lending, where the lender set up a facility that PayEm can access and use to start its own loan origination. As more customers borrow from PayEm, both PayEm and the lender profit from the lending.

Inventory lending is relatively common within fintech. Buy now, pay later startup Afterpay had five warehouse facilities at the end of 2022.

“To continue and support the expansion of our customers, we are using a credit facility … to fund our customers’ short-term payments,” Jobani told TechCrunch via email. “A credit warehouse is a perfectly structured tool to support our customers’ payment activity and provide them with monthly payment terms so they can keep their business afloat as our business continues to grow. The size of this credit intake reflects the growing volume of monthly transactions on the PayEm platform.”

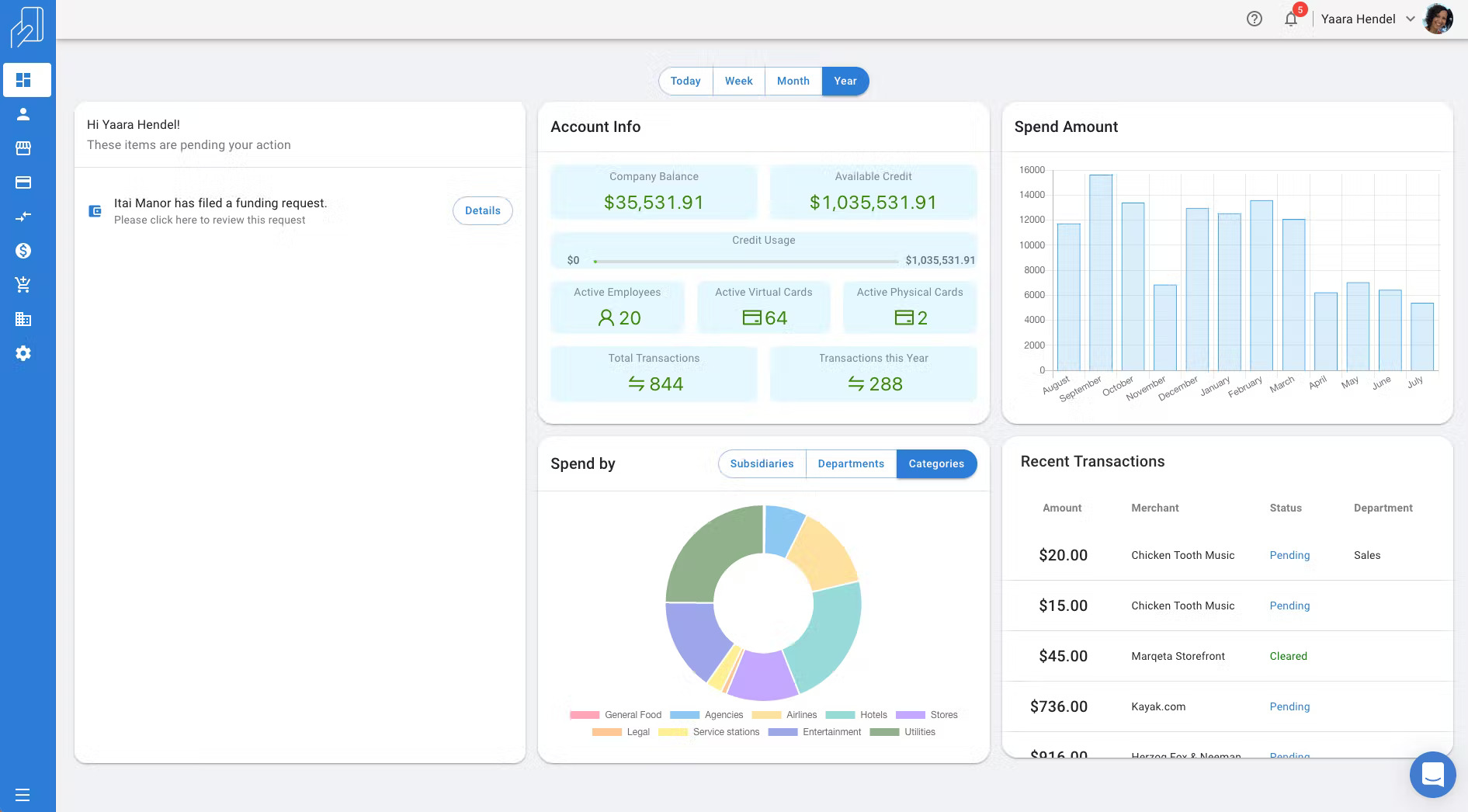

Image credit: PayEm

PayEm offers procurement tools and workflows for expense approval automation, creditor automation, purchase order creation, expense reimbursement and credit card management. Its “record-to-report” platform captures employee expense requests, engages relevant stakeholders for approval based on the data collected and provides budgeting capabilities for budget oversight.

“[With PayEm,] CEOs and CFOs gain full control and visibility into real-time usage at the subsidiary, department and even employee levels to ensure 360-degree efficiency,” said Jobani. “Meanwhile, VPs of procurement get everything from inquiry to reconciliation, all in one place, and employees gain real-time visibility and control over all aspects of budget spending. PayEm makes it easy to request funds, submit refunds and issue employee-specific corporate cards—all while keeping spending and budget under control.”

Of course, PayEm isn’t the only provider to offer this – and it’s no wonder, given how lucrative the space is. According to Verified Market Research, the overall spend management software market was valued at $1.08 billion in 2019 and could reach $3.97 billion by 2027. Startup Airbase — which partnered with Amex early last year for a corporate card pilot — is valued at $600 million. Tipalti, which automates accounts payable for small and medium-sized businesses, recently secured $270 million. There are also publicly traded Bill.com, Brex (which not long ago snapped up $300 million), Ramp ($200 million in its latest funding round) and Zip (most recently valued at $1.2 billion).

But Jobani points to PayEm’s continued expansion as evidence that it is successfully fending off the competition. The platform now creates invoices and sends payments to over 200 territories and 130 currencies, and in the last year its customer base has grown by close to 300%.

PayEm’s workforce – which is spread across offices in San Francisco, New York and Tel Aviv – is also expanding, now numbering around 100 full-time employees. Recent additions to the C-suite include Chief Revenue Officer Steve Sovik, formerly CRO at Tipalti, and VP of Product Gilad Bonjack, formerly of HiBob and Lightsticks.

“With today’s macroeconomic conditions, it has never been more important for companies to have an efficient and clear lens into their financial health. We are pleased to be the single source of truth for them as they navigate turbulent times, navigate supply chain issues and simply need to do more with less,” added Jobani. to visualize consumption, reduce costs and make the entire procurement-to-pay process simple and transparent.”