Regulations and artificial intelligence are hindering the NFT sector’s growth globally

Dark clouds do not seem to disappear completely when it comes to the digital asset sector. Although blockchain technology is considered to be the next revolution after the internet, some of the biggest blockchain-based projects, including non-fungible tokens (NFT), are getting what it takes to grow in the market. In addition, the rise of artificial intelligence (AI) is becoming a challenge for the industry.

Biggest variables in NFT growth: Regulations and AI

Recently, Irreverent Labs, a game developer, announced that they are shutting down their NFT-based game in June 2023. The NFT game, MechaFightClub, was supposed to be powered by the non-fungible token sale. However, things did not go according to plan and the ‘indefinite hibernation’ decision was made.

The company blames the Securities and Exchange Commission’s (SEC) tight regulations on the sector. As a US-based entity, it becomes difficult for them to operate amid unclear guidelines. The organization says that they cannot create an in-game economy in such a scenario. In addition, AI hinders market growth as a whole.

Irreverent Labs also emphasizes artificial intelligence. It could be an example of how AI can affect the NFT sector. The biggest names in technology, including Microsoft, Google, Meta among others, are experimenting with AI tools at an almost frantic pace. Google has recently stepped up its efforts to fight back after the failure of Bard, their answer to OpenAI’s ChatGPT.

Generative AI is used to create artwork that is turned into non-fungible tokens. It may be mouth-watering, but it also takes away creativity. Or at least, that’s the biggest debate right now with regards to AI and NFT – creativity. AI can disrupt the NFT market as unique art will now not be limited to experienced painters or musicians, but anyone with an internet connection!

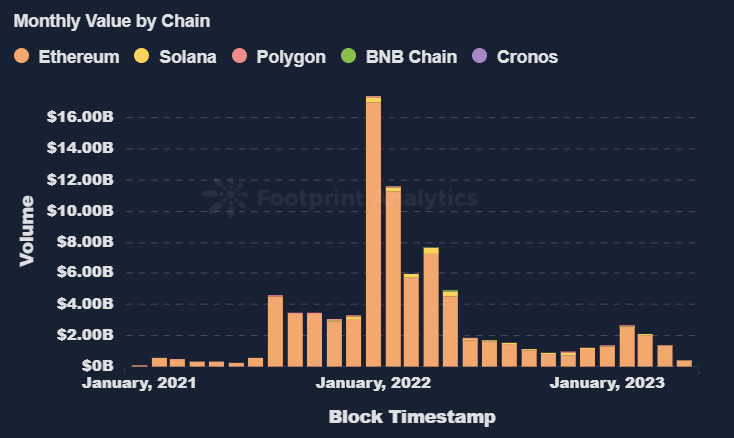

Ethereum remains the dominant force in the market

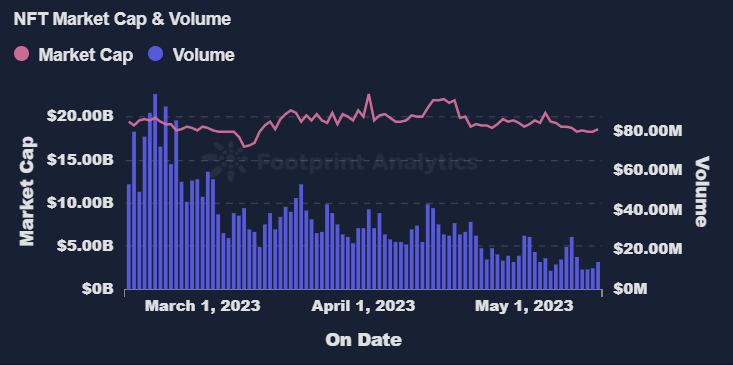

A recent report from Footprint Analytics, an NFT data aggregator, shows that market volume has experienced a sharp drop over the past 4 months. Daily sales have dropped from $98.78 million in February to $9.87 million in May 2023. However, the industry’s market cap has remained stable, hovering between $17 billion and $20 billion over the period. According to CoinMarketCap data, the market cap for NFT is around $19.1 billion at the time of publication.

While several blockchains have debuted over the years, Ethereum (ETH) continues to be the most preferred network. A majority of NFT initiatives prefer the Ethereum network. It became even more attractive after it migrated to its proof-of-stake-based Beacon Chain to offset its carbon emissions, making it a perfect chain for deploying projects in a relatively clean way.

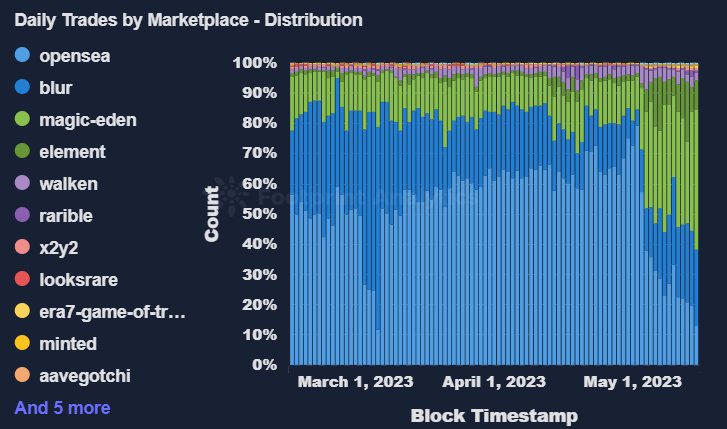

Similarly, OpenSea has maintained its position as the largest NFT marketplace at present. However, the arrival of Blur, another online marketplace for non-fungible tokens, increased competition in the market. While OpenSea has maintained its dominance in daily trades, Blur outshines it in terms of daily value.

Although the regulatory scenario may act as a hindrance to the NFT market, the fact that agencies including the Secret Service and the Regional Enforcement Allied Computer Team or REACT task force believe that blockchain technology, due to its decentralized nature, can be a force multiplier in the fight against crime. Law enforcement agencies appreciate blockchain’s ability to track transactions to lift the curtain on criminal activities taking place using virtual currencies.

The global crypto market capitalization fell by over 1.58% while Bitcoin has regained the $27K mark. As of now, the crown crypto asset changed hands at $27,030 at the time of writing.