Record amounts of Bitcoin leave stock exchanges in readiness for contagion

Market turmoil from the FTX collapse has triggered record volumes of Bitcoin leaving global exchanges.

Bitcoin Magazine Senior Analyst Dylan LeClair noted that 136,992 BTC had been withdrawn for the past 30 days, adding that the event was “historic.” The figure corresponds to 0.7% of the circulating supply.

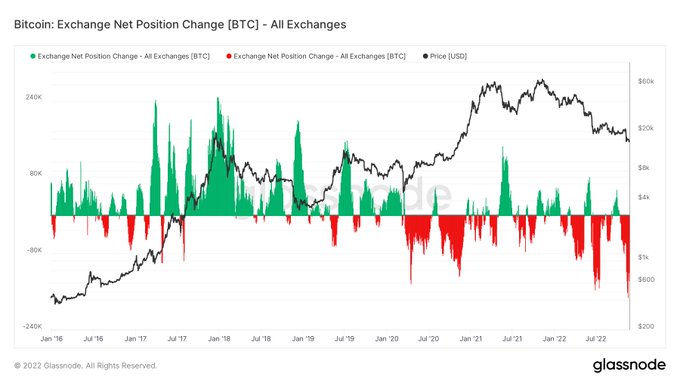

With the message, LeClair included an Exchange Net Position chart illustrating the extent of the exodus. The chart below shows net outflows from global exchanges at their highest since 2016.

The previous outflow peak was around June, at the height of the Terra implosion, which saw roughly 120,000 tokens leave exchanges.

Referring to the outflow trend, LeClair further commented, “Drainage. Them. Everyone.“

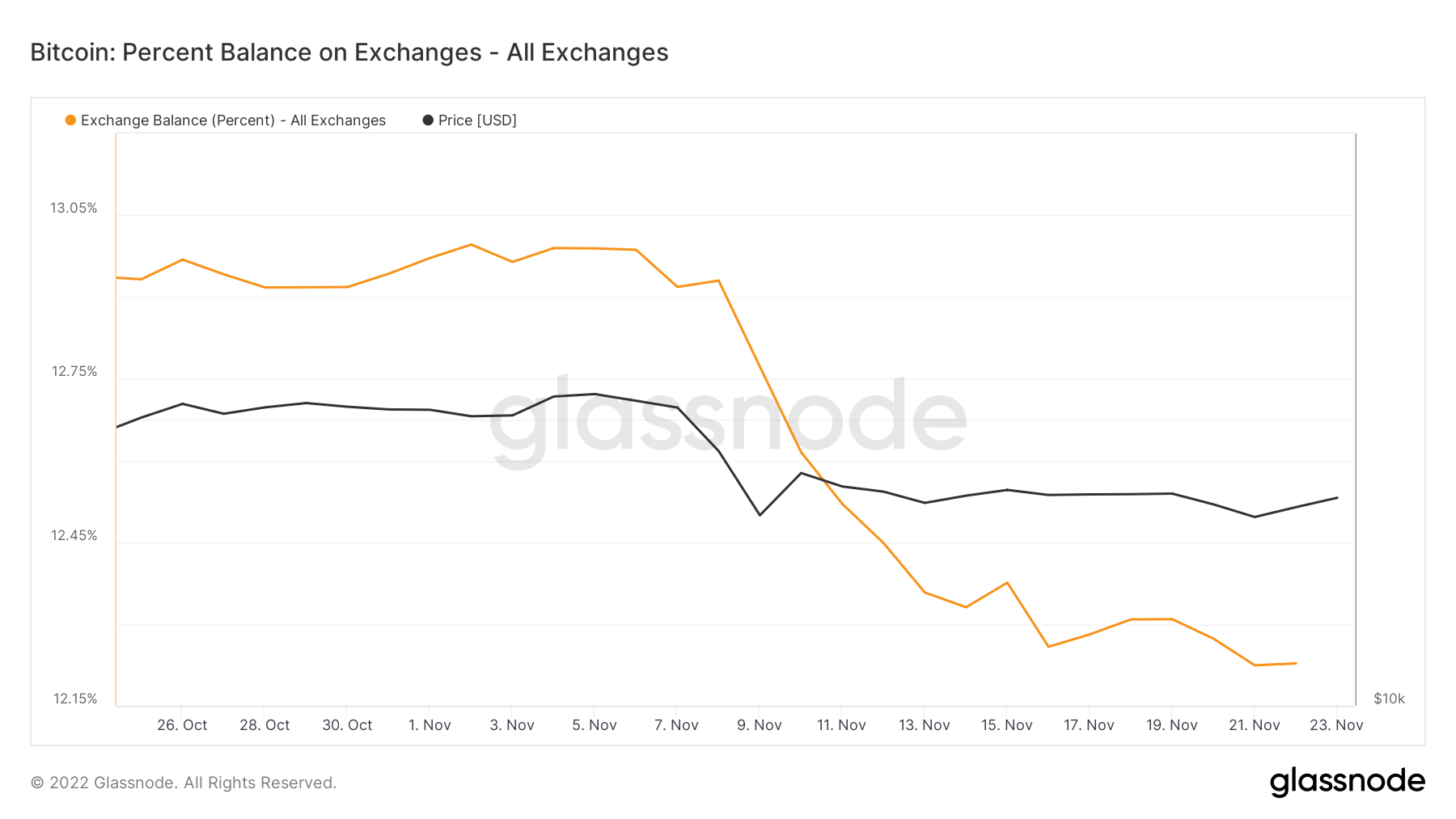

Data per Glassnode shows that holders are heeding the warnings as the percentage of Bitcoin held on exchanges falls from 13% to 12.2% since rumors of problems at FTX first broke.

Can Bitcoin Build on Recent Gains?

As news of the FTX mismanagement filtered into the public domain, Bitcoin prices saw a sharp selloff in response to the allegations.

The top-to-bottom move saw a 28% pullback for the leading cryptocurrency, with a local low of $15,500 hit on November 21.

Since the bottom, signs of a price rally have appeared, with Tuesday closing 3.8% up on the day. Meanwhile, today saw a continuation of the buying pressure as BTC grew 5% over the past 24 hours at press time.

However, macro conditions remain the same, meaning the likelihood of bulls building on current price action to make a meaningful strike back above $20,000 and beyond is slim.

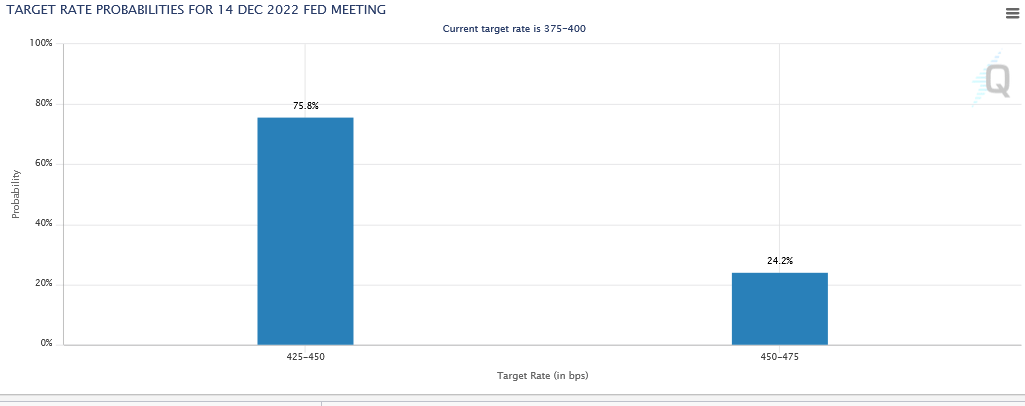

Investors are currently bracing for a reversal in the Fed’s rate hike policy before deploying capital. Fed Chair Jerome Powell approved a fourth consecutive 75 basis point hike on November 2, bringing the Federal Funds rate to 3.75-4%.

The markets are currently three to four in favor of a 50 basis point hike next, and are thus optimistic that the Fed will reduce the pace of rate hikes.

The FOMC will announce the outcome of its next meeting on December 14.

Risk of infection

In the midst of the FTX contagion, crypto brokerage Genesis warned that it needs $1 billion in capital to stave off bankruptcy. The firm is considered a significant Bitcoin OTC desk.

To date, after turning to Binance and Apollo for help, the struggling brokerage has yet to raise the money it said it needed to stay solvent.

A complete overview of what went wrong is currently unknown. But, Leigh DrogenThe CIO of investment management firm Starkiller Capital, claimed that the source of Genesis’ problems stemmed from a loan agreement with parent company Digital Capital Group (DCG).

Basically what I’m hearing from Genesis clients is that Barry did something similar to Sam, he took a close loan between Genesis and DCG and he’s in a big hole now

— Leigh Drogen (@LDrogen) 21 November 2022

Nevertheless, DCG CEO Barry Silbert has recently played down the scale of the liquidity crisis, saying Genesis is due $575 million from DCG in May 2023 and that group revenue of $800 million is expected this year.