Real claims or false claims?

It has been more than a year since the NFT boom of 2021. According to NFTGO, the market capitalization of NFTs peaked at $36.8 billion in March 2022. As the market subsequently cooled, the trading volume and market capitalization of NFTs began to shrink. This crypto news extended its influence beyond the crypto community and fostered a huge market, which also gave rise to the combination of NFTs and DeFi. The market has witnessed the appearance of NFT lending platforms, NFT aggregators and NFT derivative markets, which constitute the second debut of DeFi Lego enabled by NFTs. However, one wonders whether these products were built to meet real market demands, and whether they have created a false proposition that lacks any value for market participation. Today we will dive into whether NFT-fi is a feasible trend and whether it will achieve market recognition.

It has been more than a year since the NFT boom of 2021. According to NFTGO, the market capitalization of NFTs peaked at $36.8 billion in March 2022. As the market subsequently cooled, the trading volume and market capitalization of NFTs began to shrink. This crypto news extended its influence beyond the crypto community and fostered a huge market, which also gave rise to the combination of NFTs and DeFi. The market has witnessed the appearance of NFT lending platforms, NFT aggregators and NFT derivative markets, which constitute the second debut of DeFi Lego enabled by NFTs. However, one wonders whether these products were built to meet real market demands, and whether they have created a false proposition that lacks any value for market participation. Today we will dive into whether NFT-fi is a feasible trend and whether it will achieve market recognition.

Figure 1: Market value and volume of NFTs | Source: nftgo.com | From 1 June 2022

There are many NFT liquidity solutions and NFT structured products in today’s market:

1. NFT Fragmentation: FT tokens (like ERC20 tokens) that are issued by splitting the ownership of valuable NFTs. NFT fragmentation projects include Fractional.art, NFTX, etc.

2. NFT loan markets: Holders can borrow short-term by pledging NFTs without selling them. Prominent NFT lending markets include BendDAO, NFTfi and Drops DAO.

3. NFT Leasing: Holders earn rent by leasing NFTs to users in need. NFT leasing projects include Double, reNFT, etc.

4. NFT Aggregators: These aggregators, such as Gem.xyz, aggregate the transaction data of multiple NFT exchanges, obtain the best NFT transaction price in one stop, and provide users with increased liquidity and more options.

5. NFT Derivatives: NFT derivatives include NFT options such as Putty, as well as perpetual NFT futures contracts such as NFTprep.

These projects are early attempts to bring NFTs and DeFi together. In particular, NFT fragmentation projects and NFT aggregators address the problems of poor NFT liquidity and high market threshold. NFT’s lending markets and NFT leasing projects also focus on improving NFT’s liquidity and capital utilization. Meanwhile, NFT derivatives are more complex structured products built to improve capital utilization. However, these projects have not been able to achieve large-scale adoption because they face limitations in terms of the underlying NFT logic and development space. Next, we will explore the real demands and false propositions of NFTs.

Real requirements

1. The capital utilization of NFTs needs to be improved so that holders can provide their NFTs for partial liquidity when they run out of cash.

2. The liquidity problem of NFTs should be addressed, so that holders can quickly buy/sell the NFTs they own.

False claims

Did the capital utilization of NFTs go higher?

The problem of NFT capital utilization can be seen in two aspects: 1) Users need to quickly buy and sell NFTs, and the transaction frequency should not be affected by the poor liquidity of NFTs; 2) Users must be able to quickly exchange NFTs for liquidity and obtain cash for other purposes. In the case of FT tokens, capital utilization can be improved through stakes, leverage, etc. However, in the NFT market, there are only a few ways users can improve their capital utilization. In addition, the learning costs of combining economics with NFT increase significantly. Right now, most NFT holders still rely on the “buy low sell high” strategy. Moreover, most such holders are not the target user of NFT lending projects because only blue-chip NFTs with good liquidity and value consensus are accepted.

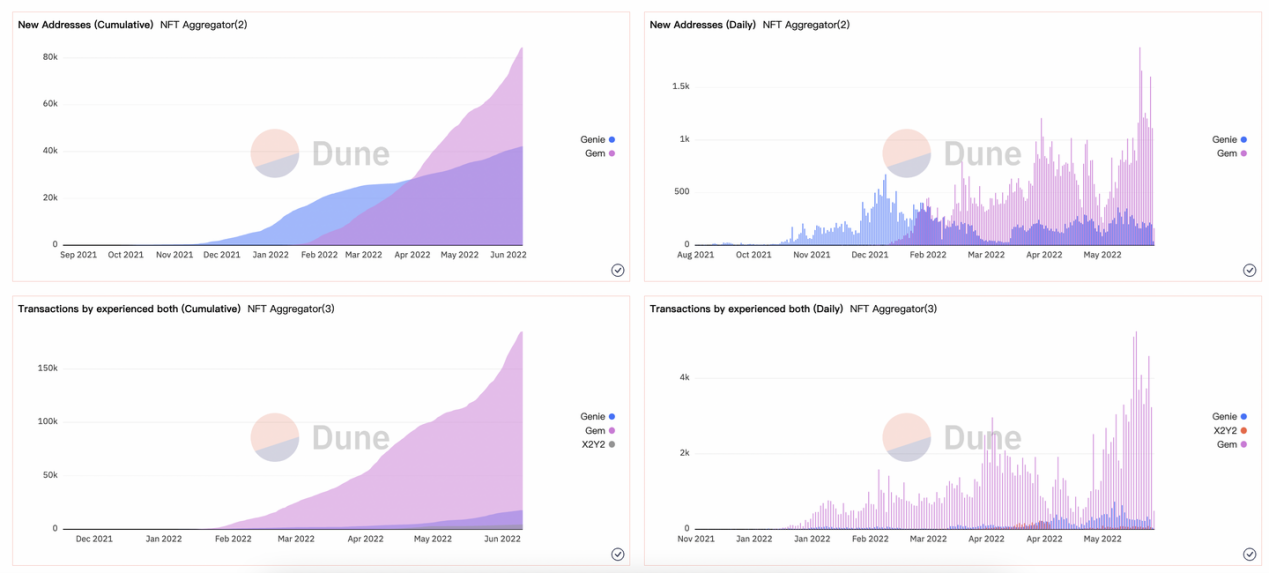

In terms of the overall market scale, most users are absorbed by secondary markets and aggregators with low operating thresholds, and they have not achieved any major improvement in capital utilization. As shown in Figure 2, the number of new addresses for Genie and Gem, two NFT aggregators, has been on a steady increase, with increasingly frequent daily transactions. However, since the trading volume and transaction frequency of the two have been affected by the sluggish market conditions of NFTs, Genie and Gem have not yet reached their maximum potential to improve the capital utilization of NFTs.

Figure 2: New addresses and transactions for NFT Aggregators | Source: Dune @sohwak

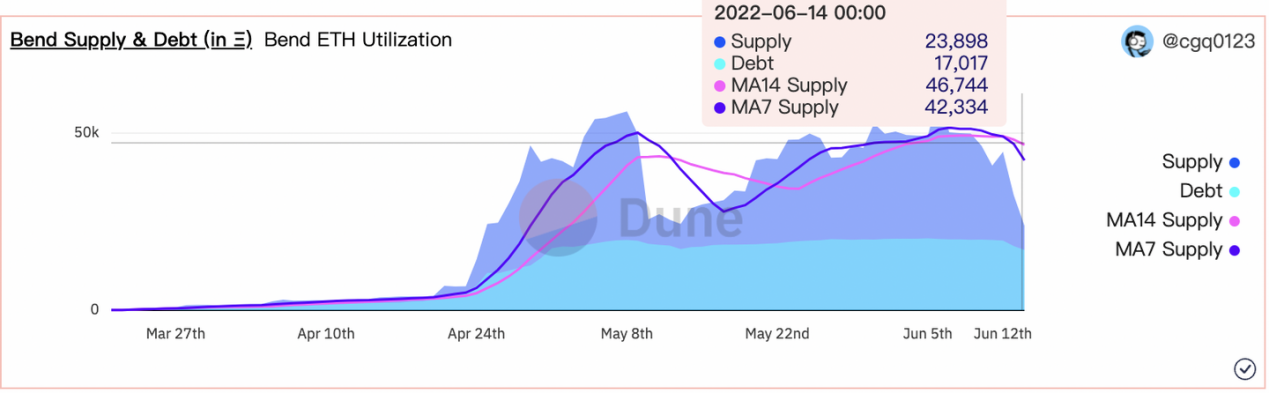

Let’s go to the capital utilization of common lending projects. BendDAO is a lending market based on the liquidity pool model where holders can borrow ETH from the pool after pledging their blue-chip NFTs. Due to recent market fluctuations, a large amount of ETH deposits in BendDAO’s liquidity pool have been withdrawn, resulting in reduced ETH supply. Nevertheless, the ETH loans have remained at around 19,000 ETH, while the MA14 supply stands at 46,000. As such, we can make the rough estimate that BendDAO’s capital utilization is about 41%.

Figure 3: Bend ETH exploitation | Source: [email protected]

Note: MA14 refers to the 14-day moving average, while MA7 indicates the 7-day moving average

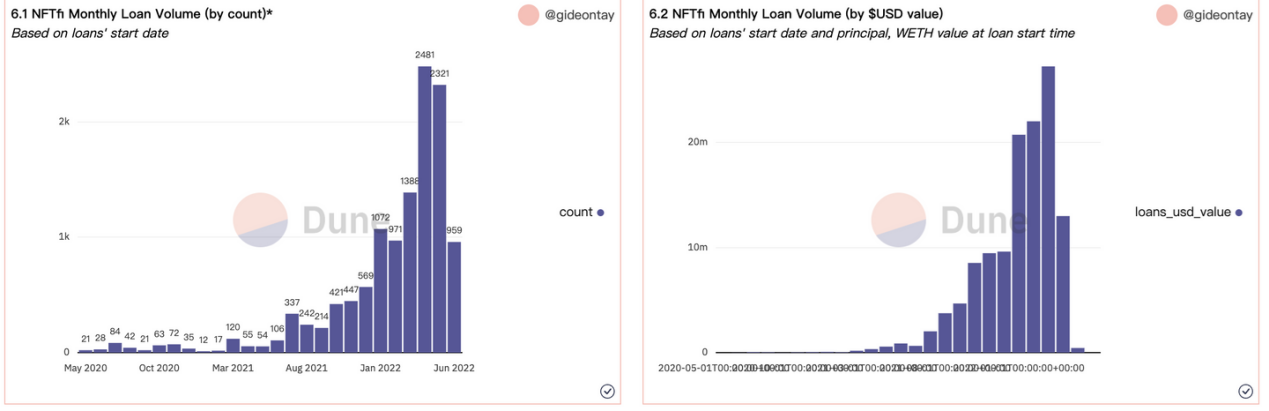

NFTfi is a lending market based on the P2P model. The amount, interest rate and duration of loans on NFTfi are jointly determined by liquidity providers and NFT lenders, which is more flexible with regard to the loan interest rate. The number of monthly loans offered via NFTfi increased from 21 in May 2020 to 2000+ in May 2022, and the maximum monthly loan amount reached $27.52 million (March 2022), but this figure represented only 1% of the market value of blue-chip NFT -s (as reported by NSN-BlueCHIP 10).

Figure 4: NFTfi monthly loan volume by number/value | Source: [email protected]

JPEG’d is also a lending protocol for P2P models, and it now only provides collateralized lending for Cryptopunks, EtherRocks, BAYC and MAYC. After staking the NFT, holders will receive PUSD, a stablecoin, provided by the protocol from the pool. In addition, JPEG’d also has a capital utilization limit of 32% on lending.

Of course, there are also other early-stage NFT derivatives platforms, but they haven’t introduced any mature products, so we couldn’t analyze their capital utilization. Despite that, it is predictable that such NFT derivatives will have higher learning costs as they are products designed for professional traders with a higher risk appetite. As such, their growth potential is limited in today’s NFT market.

Asset pricing and liquidation risk?

The pricing of NFTs has been so often discussed that it has now become a cliché. People are concerned about the issue because the price fluctuations of NFTs will expose NFT lending or derivatives to liquidation risk. As NFT prices fell during the last period, BendDAO has started several liquidation auctions.

Although most of the lending protocols out there have adopted overcollateralization, in the face of wild price swings, many NFTs would be liquidated and sold on marketplaces. This, combined with the poor liquidity of NFTs, can lead to panic selling, which will create downward price spirals, eventually turning the loans into bad debt.

The pricing of NFTs is subject to several factors. In addition, it is also easy to manipulate. For example, large holders can maliciously raise the floor price and then liquidate the NFTs on purpose, and an NFT can take a price drop due to hacking or loopholes in smart contracts. Moreover, NFT prices can also be affected by many intangible factors. For example, the price of an NFT can rise if a famous person suddenly buys it in large quantities or if it launches a new airdrop plan.

Since most lenders cannot accurately estimate the intrinsic value of their NFTs, they are vulnerable to liquidation if they borrowed or used leverage. This is also one of the reasons why NFT lending and derivatives have not gained mass adoption: blue-chip NFT holders are concerned that they may suffer losses in the above scenarios, which is why they are reluctant to short their NFTs .

Do blue-chip NFT holders really need NFT loans?

All NFT lending markets focus on blue-chip NFTs, but most blue-chip NFT holders do not have a large need for loans. To begin with, such holders care more about the ownership of the NFTs, just as billionaires would not use their collectibles as collateral for loans. Second, NFT loans come with unknown risks, and many blue-chip NFT holders refuse to apply for such loans after weighing the risks against the benefits. Thirdly, applying for NFT loans has high learning costs, and not all users can understand the principle behind such loans.

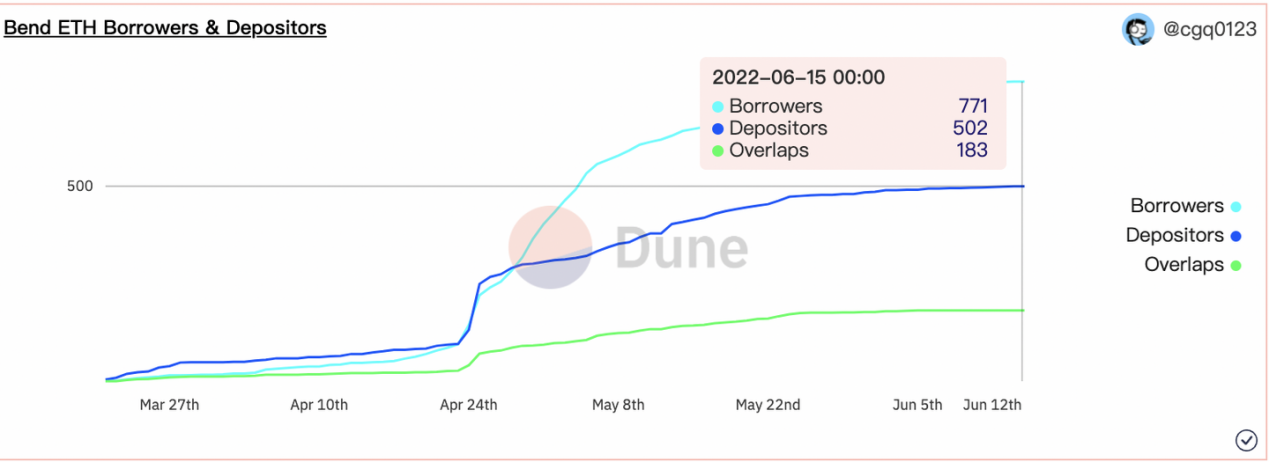

Let’s compare the user base of the major NFT lending projects. As of June 15, there are around 2.4 million holders in the NFT market, of which 27,833 hold blue-chip NFTs (a user will be considered a blue-chip NFT holder as long as he holds at least one such NFT ), according to NFTGO. There are 771 borrowers on BendDAO, 1038 on NFTfi and 51 on Arcade. As users must first deposit/collateralize their NFTs before applying for a loan, we can consider all these borrowers as blue-chip NFT holders. It is therefore clear that most blue-chip NFT holders are not users of NFT loan markets.

Figure 5: Bend ETH Borrowers and depositors | Source: [email protected]

Could NFT-fi projects retain users with the same old incentive?

Lending or derivative projects also have the task of improving the protocol’s liquidity. Most such projects offer native tokens as an incentive to recruit NFT holders and depositors as they go live. In this regard, these projects resemble DeFi liquidity mining platforms that attract speculators with high APYs. The problem, however, is that they would not be able to maintain such liquidity if the APYs went down. Attracting users with token incentives is still the same old approach. Although this strategy can create a large user base at the very beginning, no one knows if the protocol can retain users.

For example, when the project first launched, BendDAO sent BEND tokens to users who had deposited blue-chip NFTs and ETH. It also uses BEND as a subsidy when paying interest. However, the interest rate decreased as the BEND price fell, which slowed the growth of new users.

As such, attracting users with high APYs is only the first step. To retain new users, they need to further explore the lending mechanisms, address the oracle pricing issue, and reduce liquidation risk. Projects should develop more flexible products and at the same time expand the scope of NFT lending. Last but not least, they can also provide risk assessments, lower learning costs and offer more satisfying user experiences.

Conclusion

The evolution from NFT to NFT-fi is a process where a market grows from its infancy to a more mature stage. However, it is also inevitably a process full of doubts, pitfalls and problems. As NFT-fi projects seek to meet real demands, they will also need to doubt that they are making false claims. Today’s NFT market is like a newborn child that needs to grow up and sustain itself through challenges. While NFT-fi may be a great endeavor, there is still a long way to go and NFT-fi projects must continue to explore their underlying logic to gain market acceptance.