Ray Dalio’s Bridgewater Loads Up on 2 Fintech Growth Stocks

Ray Dalio (Trades, Portfolio) is the founder of Bridgewater Associates, the world’s largest hedge fund with ~$18.32 billion in 13F holdings as of its latest 13F filing for Q4 2022. The firm owns shares in 821 stocks and is known for its strategy about being highly diversified across sectors and at the forefront of economic models.

Dalio recently stepped back to take on a more mentoring role at the company, part of his long-term plan to transition Bridgewater to an employee-owned model. In the fourth quarter, Dalio’s firm has been very active, adding 87 new shares. In this article, I’ll cover two fintech growth stocks the firm added according to its latest 13F; let’s dive in.

Investors should be aware that 13F reports do not provide a complete picture of a guru stock. They include only a snapshot of long equity positions in US listed stocks and US depositary receipts at the end of the quarter. They do not include short positions, non-ADR international holdings or other types of securities. But even this limited archiving can provide valuable information.

1. Blocks

Block (NYSE:SQ), formerly known as Square, is a leading fintech company specializing in a variety of industries, from PoS (point of sale) products for small businesses to the popular CashApp.

Block’s goal is to create a financial ecosystem where users can spend, save, borrow and even invest. The company has gradually expanded CashApp to include many features that help achieve the aforementioned goals. This includes Bitcoin trading, stock investing and of course P2P payments via the popular Cashtags.

The company’s founder and CEO is Jack Dorsey, who is also one of the founders of Twitter. On the positive side for Block, now that Dorsey has left Twitter, he has more time to focus on improving Block, which is a strong benefit for shareholders.

Growing economy

Block generated strong financial results for the third quarter of 2022. Revenue was $4.52 billion, which was up a solid 18% year-over-year and beat analyst forecasts by ~$47 million.

The growth would have been much greater without the significant decline in the price of Bitcoin, which has led to a decline in Bitcoin trading. The price of Bitcoin is down 57% from its all-time highs in November 2021. However, since January it is up a solid 45% year-to-date.

Excluding Bitcoin trading and its Buy Now Pay Later revenue, revenue was up a brisk 41% year-over-year, which was a big positive.

Block also has a business segment called Spiral that focuses on creating Bitcoin open source projects to increase the chance of it becoming the world’s currency of choice. Therefore, it is clear that the company has not given up on the digital resource.

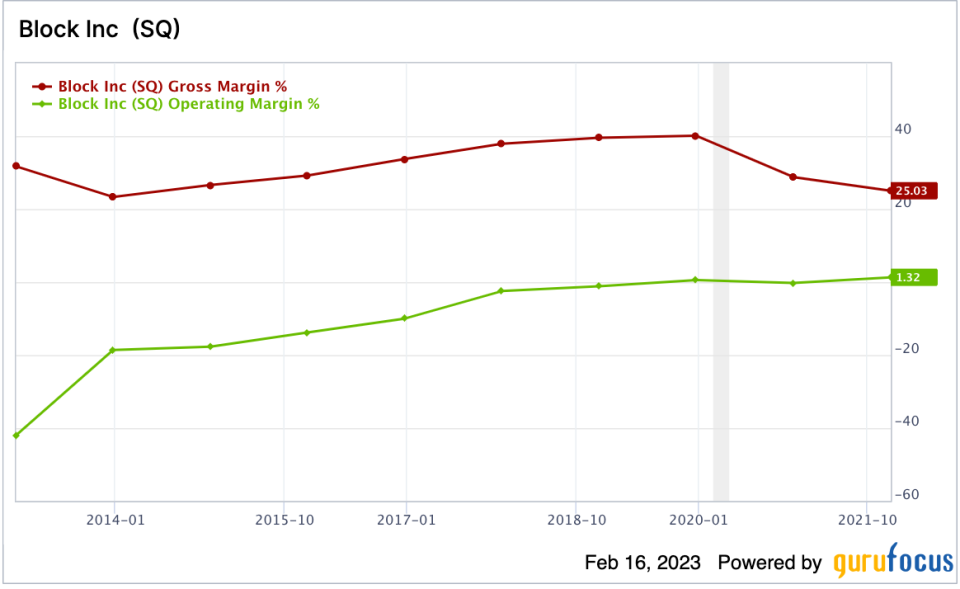

Moving on to profitability, Block reported an operating loss of $39.8 million in the third quarter of 2022. This was significantly worse than the positive $29 million in operating income reported in the fourth quarter of 2021. A positive adjusted earnings per share was 0.42 dollars, which beat analysts’ forecasts by $0.19 per share.

The company has a strong balance sheet with $6.5 billion in cash, cash equivalents, marketable securities and restricted cash. Block has long-term debt of ~$4.5 billion, but only $460 million of that is current debt, which will mature within the next two years. Therefore, I believe this debt is manageable given Block’s strong cash position.

Valuation and guru investors

Block trades at a price-to-sales ratio of 2.66, which is 63% cheaper than its five-year average.

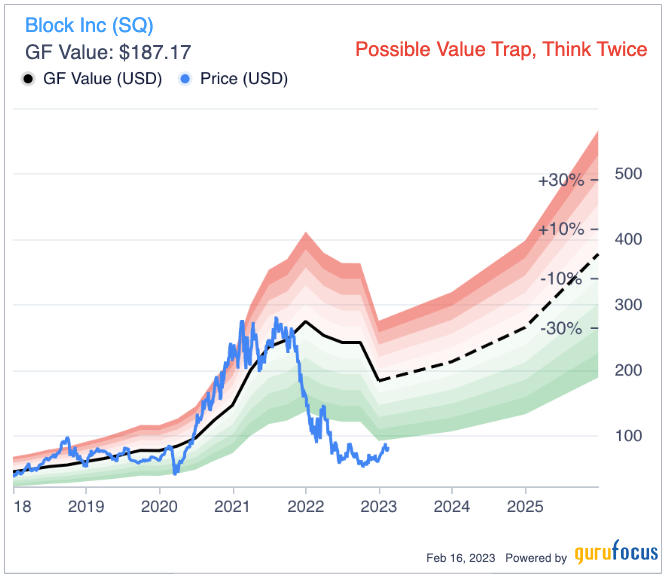

The GF Value chart indicates a fair value of $187 per share, thus the stock is trading below the fair value estimate, as its ~$83 share price at the time of writing is much lower. The system warns of a possible value trap due to declining business results and lack of profitability, but I believe this is unjustified given that the company has been mainly affected by the decline in Bitcoin trading volume.

Bridgewater purchased ~871,118 shares of Block during the quarter, trading at an average price of ~$62. This is ~34% cheaper than where the share is traded at the time of writing. Other guru owners of the stock include Frank Sands (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Catherine Wood (Trades, Portfolio).

2. Upstart

Upstart (NASDAQ:UPST) is an online lending platform that offers a variety of services from personal loans to auto refinancing and even credit card consolidation. The company has created a marketplace system through partnerships with 42 banks and over 150 asset managers.

What is unique about this company is that it uses artificial intelligence (AI) to generate loans and then sell them to institutional investors. AI stocks have seen tremendous momentum in the past month, thanks to the popularity of OpenAI’s ChatGPT.

The upstarts share price rose by a rapid 28% in a single day on the back of solid momentum and the recently announced strong earnings for the fourth quarter of 2022.

Mixed economy

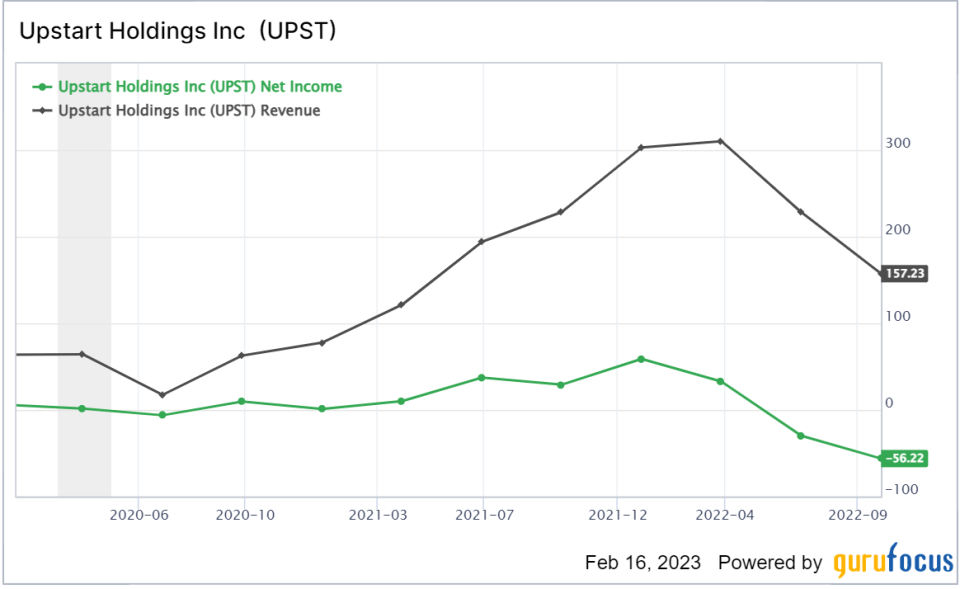

Upstart reported strong earnings for the fourth quarter of 2022. Revenue was $146.9 million, which beat analysts’ expectations by $14.8 million, despite a 52% year-over-year decline. This was mainly driven by the macroeconomic environment, which resulted in a 69% year-on-year decline in loans to 154,000 loans. One positive was that the average loan size actually increased by 22% year-on-year.

Additionally, for the entire year 2022, over 24,000 small personal loans originated, and 88% of these were automated. This is a real game changer as it means that significant paperwork is not required and this reduces friction in the entire loan process.

The company has also continued to grow its total dealers with 778 reported, up 90% year over year. Its AI-powered loans to the automotive industry have proven popular with about one in four of the Upstart-powered loans being fully automated.

UPST data by price-to-sales ratio of 1.96, which is significantly cheaper than the price-to-sales ratio of over 38 in the fourth quarter of 2021.

UPST data by GuruFocus

Bridgewater bought 10,069 shares of the Upstart stock in Q4 2022, where the shares were trading at an average price of $19.32, which is a bit cheaper than the stock price of ~$22 at the time of writing. Steven Cohen (Trades, Portfolio) also bought the stock during the quarter, as did Jefferies Group (Trades, Portfolio).

Final thoughts

Both Upstart and Block are two fantastic fintech companies. Upstart is the lesser known company but seems to have powerful AI technology that has proven popular for AI lending – I think this is going to be the future of the industry. In addition, I believe the initial momentum around AI stocks has also helped the recent nearly 30% increase in the share price. Block is a more established player, but has great growth potential across its vast fintech ecosystem.

This article first appeared on GuruFocus.