Quantitative Analyst Plan B Says Bitcoin’s ‘Weak Hands’ Indicator Blinks – Here’s What It Means For Crypto Markets

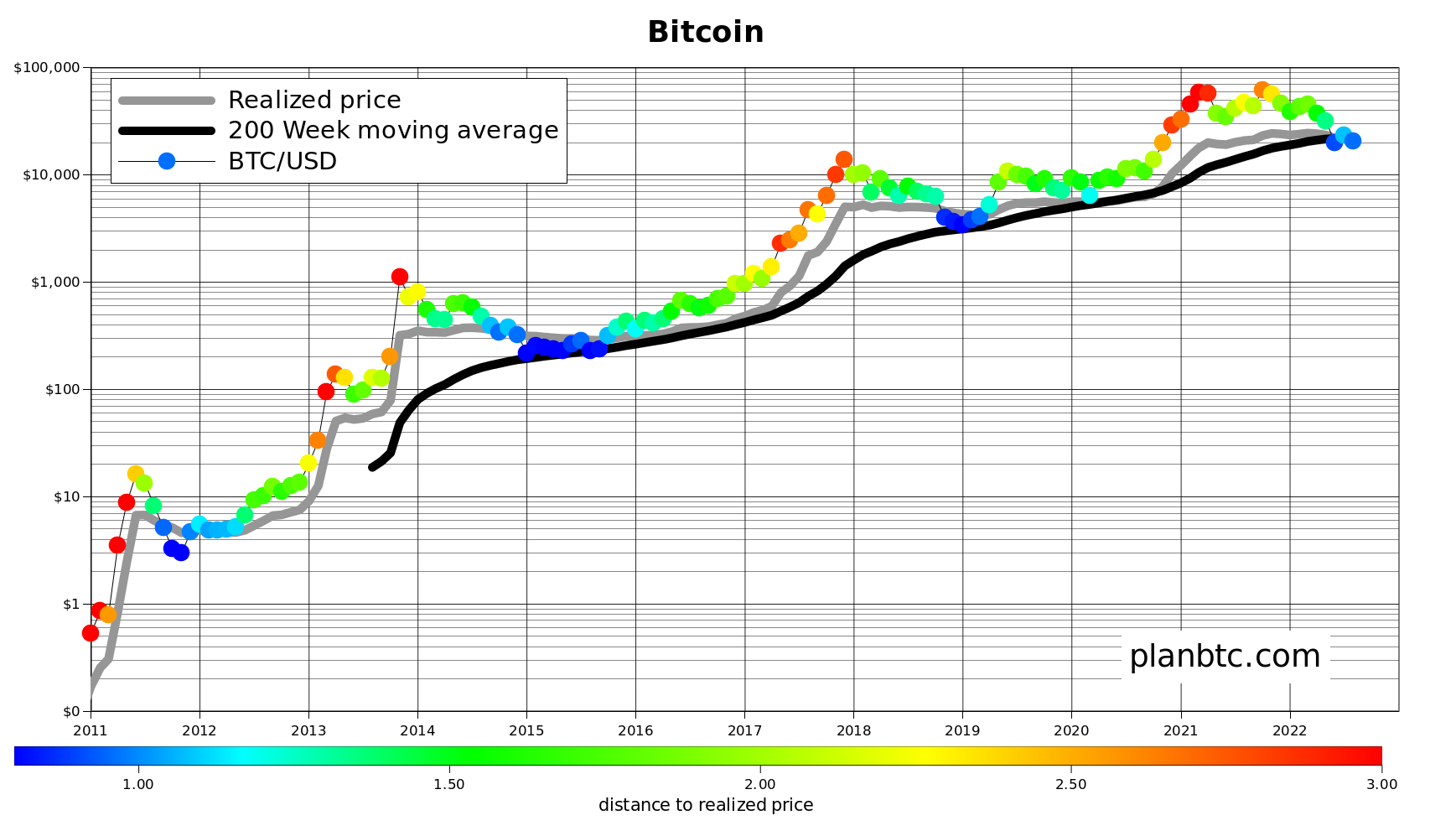

Quantitative crypto analyst Plan B says Bitcoin (BTC) is now trading below its realized price and 200-week moving average, an indicator of whether the top coin is in a bull or bear market.

This is only the eighth time the cryptocurrency broke the historical level since its inception.

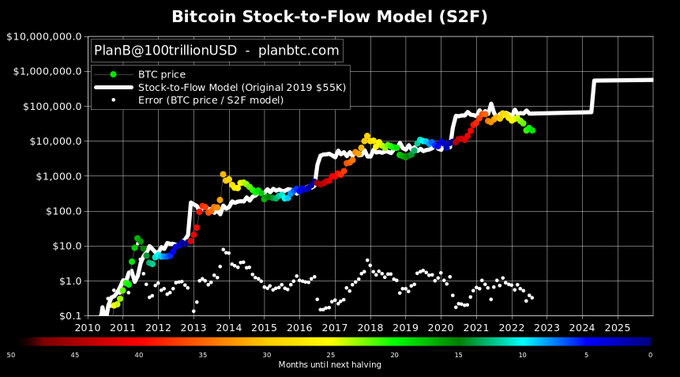

Plan B tells its 1.8 million Twitter followers that Bitcoin is also well below the projected trajectory based on the stock-to-flow (S2F) model as it hovers at $20,000.

“Bitcoin Below 200 Week Moving Average AND Below Realized Price…

Bitcoin August Approaches $20,059.”

The analyst says the trend line suggests that the weak-handed investors who lack the resources or conviction to hold their investments have already capitulated and sold off their holdings.

While the current downturn has some resemblance to the bear market of 2015 when Bitcoin fell but eventually recovered, Plan B says the situation is now different in that seven years ago, BTC’s realized price managed to stay above the 200-WMA.

“Some compare the current situation with 2015 and conclude that we will remain low/blue for several months. A big difference: in 2015, the realized price (grey line) was still 2x above the 200-week moving average (black line). Currently realized is below 200WMA, i.e. weak hands have already sold.”

However, he is optimistic that the bearish outlook for Bitcoin will eventually change.

“This won’t stay blue forever. Macro and markets may be different but people don’t change, human behavior is driven by greed (red) and fear (blue).”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Timofeev Vladimir/Chuenmanuse