Quant: The New Crypto Darling (Cryptocurrency: QNT-USD)

pixelparticle/iStock via Getty Images

Overview

Quant (QNT-USD) was founded in 2015 by Gilbert Verdian with the vision of creating a fully interoperable blockchain environment. Many blockchains cannot operate with each other, which stands in the way of innovation. Quant is essentially a blockchain operating system. The software connects different blockchain networks through Overledger OS.

In theory, this technology has the potential to create a fully integrated blockchain ecosystem. The lack of interoperability between blockchains has been one of the biggest obstacles to the rapid adoption of crypto, NFT, metaverse and every imaginable system and application that can be built in Web3.

Quant will also facilitate the transfer of value between different distributed layer technologies (DLT). With the technology Quant is building, organizations will be able to orchestrate transactions between different authorized DLTs.

Quant’s interoperability vision and the Overledger operating system

Quant aims to become the go-to protocol for Web3 just as TCP/IP became the protocol standard for Internet networking. TCP/IP stands for Transmission Control Protocol/Internet Protocol; the invention of TCP/IP allowed siled parts of the Internet to communicate with each other, regardless of location or operating systems used.

Quant aims to connect different blockchain networks regardless of their consensus mechanism or distributed ledger. Blockchains are currently almost completely isolated from each other and find it difficult to interact. To interact with two blockchains simultaneously, developers need to understand how both blockchains work, and develop an application accordingly.

Bridges to move tokens from one blockchain to another are created by blockchain companies to facilitate this inter-chain interaction; bridges create wrapped tokens to replicate a token on another blockchain by locking the real token in a contract, exchange or atomic swap. However, bridges are difficult to create, extremely complex, and often vulnerable to destructive hacks.

Quant’s solution to the blockchain interoperability problem focuses solely on the information contained in a blockchain transaction and does not care about the channel from which the transaction originates. Quant uses Application Programming Interfaces (API) to create the parameters that allow blockchains to exchange data with each other without having to know everything about the channel the data originates from or the sender of the data.

The Quant network achieves this chain-agnostic data transfer method by using different layers in the data transfer process.

-

Transaction layer: When transactions are initiated, this layer stores and queues them. This layer also performs cross-consensus and transaction validation operations.

-

The messaging layer: This layer takes care of the data transfer of smart contract data, metadata and transaction data. The message layer extracts the main information needed to process and send data. At this layer, Metadata is used to interpret and translate messages for each blockchain to understand.

-

The filtering and ordering layer: This layer checks whether sent data and messages meet the requirements of the receiving channel. For example, a Multi-Chain Decentralized Application (MAPP) may accept only a minimum number of coins. If the coins are below this minimum, the transaction will be rejected. The filtering layer does the job of checking in advance whether certain requirements are met.

The flagship system developed by Quant Network, called the Overledger Operating System (OS), allows developers to build MApps. MApps are decentralized applications that store data and perform transactions on multiple blockchains or systems simultaneously. According to Quant, Overledger is not another blockchain; Overledger sits on top of blockchains and provides a meta-gateway.

The beauty of MApps is that they can be built using different blockchains. Quant will allow developers to easily write code that interacts with all the blockchains in a coherent way.

Deploying Overledger for an organization is very easy, it only takes 3 lines of code to connect to the API. Overledger also acts as a “node provider”, like Infura or Quicknode. Overledger offers access to all nodes, DLTs and databases created and managed by other users.

Of course, QNT is the original token of QUANT and it is necessary to perform transactions.

Quant Network has secured interesting partnerships, including one with the American software giant Oracle. In 2019, Quant Network was accepted into the Oracle Start-up Ecosystem.

Technical analysis

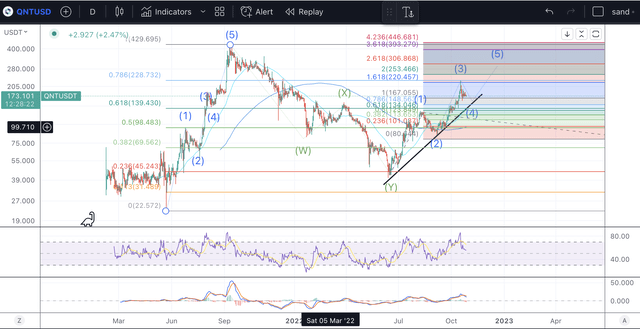

The chart on QNT has given us some clear indications that the token may have bottomed out already, but a major pullback is still on the cards.

QNT Price Analysis (Author’s work)

We can see that QNT completed a five-wave rally in September, which took it all the way to $429. Since then, we have retraced all the way down to the 76.4% retracement, where we may have bottomed in June.

Since then we have formed a clear five wave structure and it looks like we are now in wave 4. Using trend based fib extensions we can see that wave 3 reached the 1,618 target and I expect the final wave 5 for to take us all the way towards $253.

Remember, this will mean the end of an initial large degree wave I up, which means we should get a retracement in wave II that could take us back towards the $70 level. This would be the ideal entry in terms of risk/reward.

Risks

Quant is a solid and ambitious project, but its MApps are unlikely to take over DApps. Some developers will cite latency concerns as MApps must first communicate with Quant’s Overledger before data is routed by the filtering layer to the specific blockchain in the transaction; meanwhile, DApps work directly on the chain without intermediaries.

Quant requires identity checks before a user can access the mainnet. This has been largely criticized by the crypto community.

Overledger APIs are also not full-fledged yet; only options such as “Create and sign a transaction”, “Search for addresses” and “Subscribe to address changes” are currently available. After finishing its ICO in 2018, Quant has under-delivered for four years, which is a lot of time to develop a quality product, full-fledged.

Some of Quant’s partnerships are also stuck in the mud. The announced partnership in 2020 with Sia has not yielded any results in terms of products of active collaboration. Most of Quant’s other partnerships are similarly “stagnant”.

Remove

Quant has done a good job marketing its brand, even without a real, working solution to the interoperability challenges it claims to solve.

QNT has very attractive tokenomics. Its total supply is 14,612,493 QNT, of which more than 80% is in circulation, and no further minting of QNT will occur. With almost all of the existing supply in circulation, there is no inflation risk. Quant is highly hyped. It has had a good price increase as a result of the hype. Generally, in crypto, good hype equals good token price. Enjoy the Quant hype while it lasts!