Quant Network believes Blockchain needs an operating system

LeoWolfert/iStock via Getty Images

Blockchain interoperability is a key bull theme at Coin Agora, and building an allocation towards interoperable blockchain solutions during the bear market should outperform the broader crypto market in the next bull cycle. Quant Network (QNT-USD) and their Overledger Operating System (OS) is a unique approach to an integrated blockchain universe with a current focus on cross-border banking and payments.

Why do blockchains need interoperability? Because the future is one with multiple blockchains. We believe Ethereum (ETH-USD) will be the dominant blockchain, but there is plenty of room for others, especially as more blockchain use cases are created. More importantly, blockchain technology remains difficult to use, especially for businesses. An interoperable blockchain solution like Quant Network’s Hyperledger OS seeks to not only incorporate multiple blockchains, but also strives to provide a user-friendly user interface to harness the power of these blockchains.

Launched in 2018, Quant Network seeks to be the ramp aimed at businesses to connect their business to various blockchain networks, as Quant Network sees a gap between traditional business technology and blockchain. Quant Network ranks as one of the highest valued cross-chain products and is a leader in the field. It is a closed source project that requires a license to use, which is a unique approach compared to their on-chain competitors; not only is Quant Network more geared towards business solutions rather than retail, but Hyperledger OS is not actually a blockchain at all. More on this later.

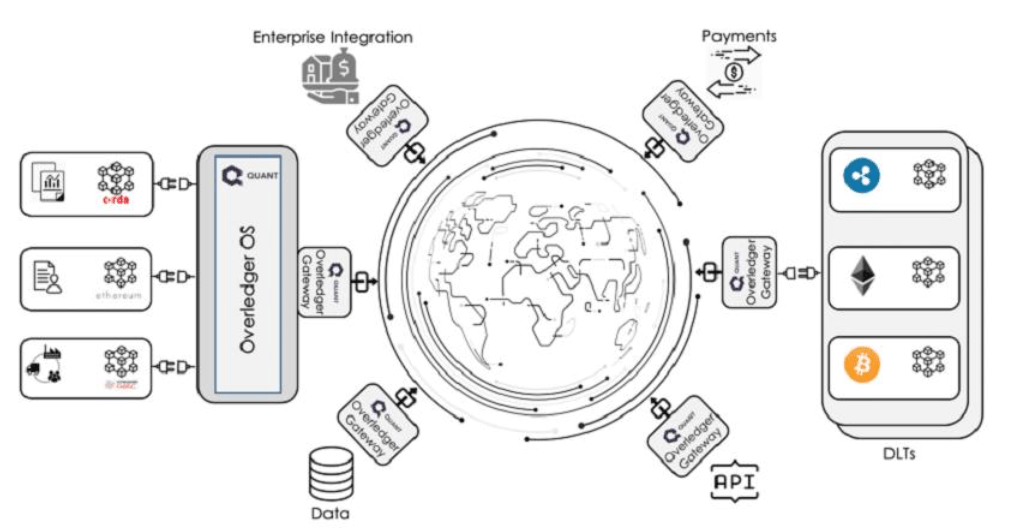

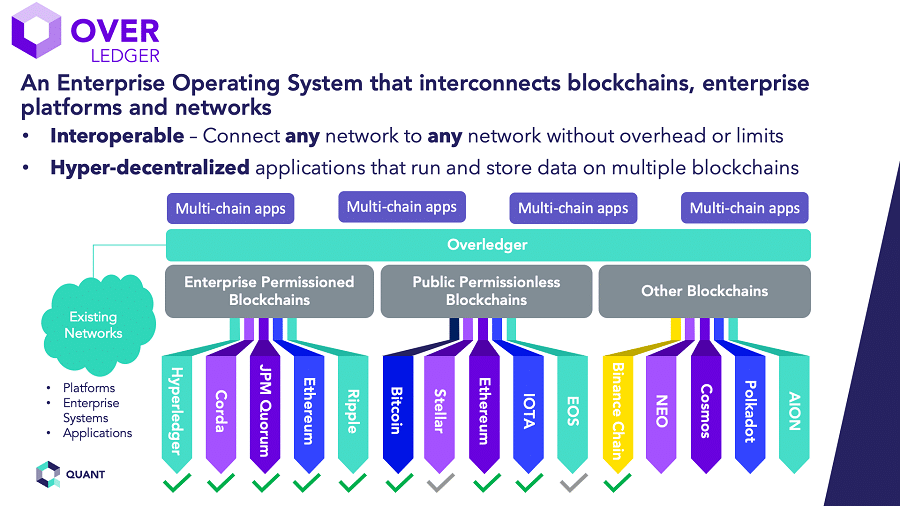

Overledger OS, their flagship product, is a cross-chain operating system to facilitate decentralized multi-chain applications (Dapps). It currently supports Bitcoin, Ethereum, Ripple, Stellar, EOS, IOTA, Constellation, JP Morgan’s Quorum blockchain, and Hyperledger Fabric blockchains. In a nutshell, Quant Network is trying to create a multi-blockchain interface for users to leverage multiple blockchains in a simple and consolidated way.

Hyperledger Operating System (Quant Network)

Price action

While Quant Network’s valuation has exploded over the past few years, it is about 75% of its all-time high at the time of writing. It remains an altcoin ranking in the top 50 cryptocurrencies by market capitalization.

Who are Quant’s target customers?

Quant seeks to address the needs of banks, asset managers, financial institutions, fintech developers, and technology-related businesses by selling licenses to their Overledger OS, which targets traditional developers.

The blockchain world can be divided into two categories: public chains and enterprise chains. Public chains (permissionless chains), like Ethereum or Solana, can be accessed by anyone and transactions are public. Enterprise chains (permission chains) can only be accessed by specific parties via a license agreement and transactions are private. Quant Network’s Hyperledger OS is more similar to the latter.

What Quant does

According to Quant Network, their goal is “to connect all the world’s distributed ledgers for faster and more efficient growth”. Quant Network’s goal is to integrate all blockchains into a user-friendly operating system.

Hyperledger OS (Blockfyre Research)

The main value proposition of Overledger OS is that developers can interact with multiple blockchains and IT systems simultaneously on the same platform. It is marketed as the Windows or macOS of the future where we live and breathe a network of blockchains. However, because it is not a blockchain, the security of their operating system must be questioned. How centralized is the Hyperledger operating system? How scalable is the system? And most importantly, how secure is Hyperledger OS?

According to a report by Fast Company, Quant spearheaded the Blockchain ISO standard TC307 which was adopted by 57 countries and organizations worldwide and resolved interoperability with the creation of one of the world’s first blockchain-agnostic API gateways, Overledger. It has proven to be a hit thanks to the use of low code, which enables users to create interoperable smart contracts and tokens cheaper, easily and in minutes instead of months, as it does not require the use of specialized programming languages .”

Who runs the show?

Gilbert Verdian is founder and CEO of Quant. Gilbert has an impressive background considering his titles and organizations that have employed him, which include PwC, BP, the Bank of England and the US Federal Reserve. However, he never stays for long, with his longest tenure in HM Treasury at 27 months. A track record of quick stints at various companies could mean he’s extremely effective, but it could also be a potential red flag that his personality or work style is causing friction. At least that’s something to note.

Usage cases

According to Quant Network’s website, Quant’s use cases include: digital currencies, payments, supply chain and trade finance, capital markets, compliance and insurance. According to the same Fast Company article, one of their more high-profile projects is LACChain, which seeks to help Latin American businesses with their global banking needs. LACChain was founded in 2018 but brought in Quant in 2021 to help with cross-border payments, domestic payments and remittances using the Overledger operating system. According to a recent Fast Company article, “LACChain uses blockchain and integrates it into core banking infrastructure, allowing users to receive payment in the form of a new digital Latin American dollar instantly and then redeem it as local currency from their bank.”

It is unclear how LACChain’s success could affect the QNT token’s value, but if LACChain is adopted and becomes a model for connecting banking systems around the world to different blockchain networks, Quant Network could be in a prime position to take advantage of this inevitable the trend of cross-border payments and improved global banking.

Industry ties

Below is a list of Quant Network’s “partners”, which should always be taken with a grain of salt. The term “partner” can encompass a wide range of actual business relationships.

Quant Network Partners (quant.network/ecosystem/partners/)

One concrete business relationship, however, is one with Oracle (ORCL), which designated Quant Network as an interoperability solution for its Oracle Blockchain platform. How did this come about? Quant joined the Oracle for Startups program in 2019 and was able to leverage their platform to work directly with Oracle’s existing customer base and blockchain affiliates.

A key component of Quant Network’s growth strategy is staying compliant with global financial regulatory bodies, including the Financial Action Task Forces (FATF) framework for virtual asset service providers (VASPs). In addition, the US Financial Stability Board published a roadmap in 2020 with respect to cross-border payments infrastructure, this roadmap clearly focuses on API-driven solutions, which happens to be the main focus of Quant as well. Finally, there is speculation across the Quant Network community that the US government is working with Quant representatives to find favorable approaches to blockchain and digital asset regulations.

Tokenomics and how Quant makes money

The main source of income for the company is the sale of annual licenses to access Overledger OS, as well as transaction-based fees, both of which are paid in QNT. For the annual license fees, the Quant Network tax locks the QNT received for 12 months or until the license expires, after which the QNT is converted to US dollars. This artificially limits the supply of QNT in circulation, and the more demand they have for licenses, the more the circulating supply should decrease, increasing the price of QNT.

An operational risk for this strategy is the price fluctuations of QNT during the lock-up period and the difficulty this presents in forecasting or budgeting for the Quant team. This makes it difficult to determine a valuation for the QNT token and the Quant organization as a whole.

Tokenomics for Quant Network is also somewhat worrying. They held an initial coin offering in 2018 that wasn’t met with much fanfare. As a result, they announced they would burn approximately 14.6 million tokens, only to then burn 9.5 million tokens with little explanation. You can see here that the largest “token holder” on Etherscan is the wallet that contains the burned QNT. While this is not overly concerning, tokenomics is a key focus here at The Coin Agora and should be noted when evaluating any crypto investment.

Recommendation

Here at Coin Agora, we believe that the cross-chain or “multi-chain” sector has great price potential and the entire sector has a target allocation of 10% in our model portfolio. Does Quant Network deserve to be part of this 10% allocation? We currently rate QNT-USD as a HOLD. On the positive side, they have really adopted the LACChain project in South America and they are connected to the Oracle ecosystem. On the downside, since they are not technically a blockchain themselves, visibility into their organization is opaque at best. It is nearly impossible to determine whether their $1.5 billion market cap is overstated or understated since revenue and adoption metrics are not available. Additionally, the announced amount of tokens burned versus the actual amount of tokens burned mentioned earlier is a concern. And finally, the project’s founder and CEO Gilbert Verdian’s brief tenure at various organizations throughout his career raises concerns that he has the commitment to see this project through.

Quant Network is an exciting project, especially if it continues to gain traction in the cross-border banking and payments ecosystem. The continued success of LACChain will be crucial and if they announce additional sovereign partnerships that will be a bull catalyst for the QNT token. As new information becomes available, and some of the red flags are laid to rest, QNT-USD may find a place in our model portfolio. For now, we wait and see.