Quant Analyst PlanB Says Major Bottom Signal Blinks For Bitcoin As BTC Aims For $21,000 Level

Quantitative analyst Plan B says Bitcoin (BTC) is flashing signals that strongly suggest the leading digital asset by market capitalization is about to bottom and start a new market cycle.

The pseudonymous analyst tells his 1.8 million Twitter followers that on-chain data indicates that more than half of the BTC in circulation is now in a profitable state.

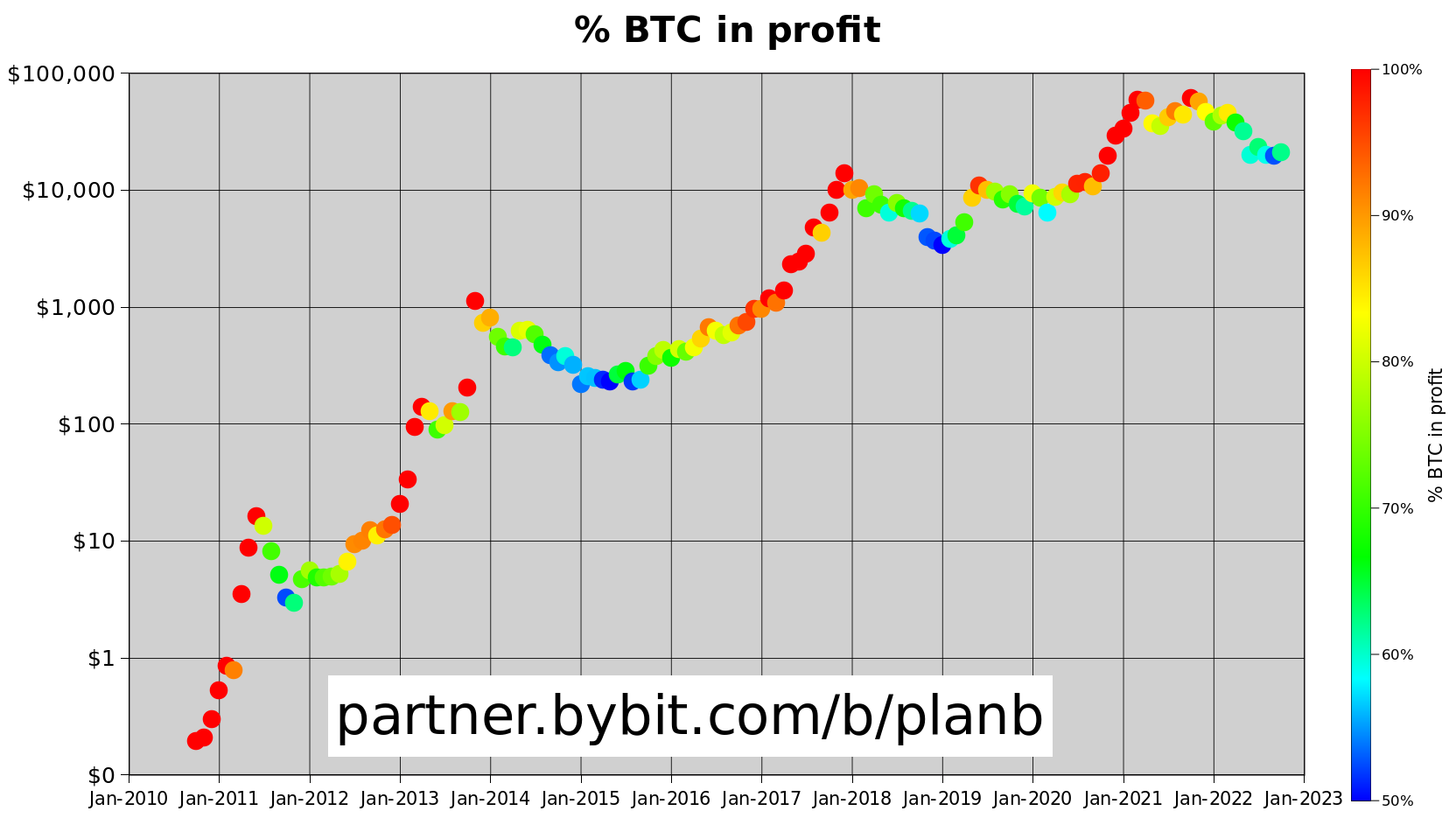

Plan B’s chart shows a cycle of BTC going from majority in profit, shown in red dots, to about half in profit, depicted in dark blue dots.

According to the analyst, coins in profit that go from 50% to over 60% are a strong bottom signal.

“More bottom signals: >60% of all Bitcoin is in profit”

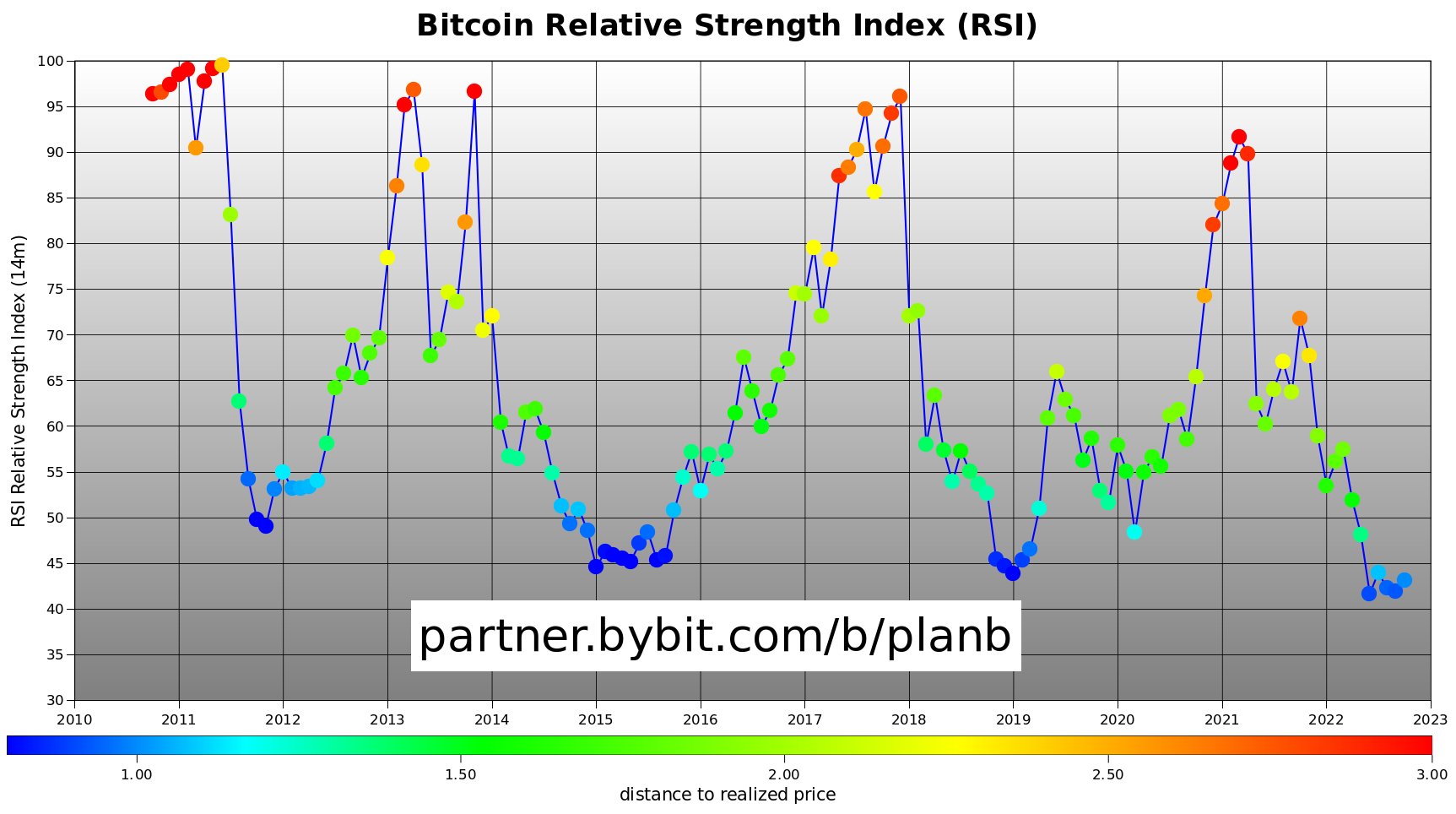

Plan B also has an eye on Bitcoin’s long-term relative strength index, one of the most widely used momentum indicators that aims to determine whether an asset is oversold or overbought. Using the indicator on a 14-month scale, Plan B points out that BTC’s RSI is at historic lows, suggesting that Bitcoin is deeply undervalued.

“Bitcoin RSI Won’t Stay Low Forever!”

Leading crypto analytics firm Glassnode has also reported that on-chain calculations suggest that Bitcoin is forming a bottom market. In a recent report, the firm said BTC’s Accumulation Trend Score, which shows the aggregate balance change intensity of active investors over the past month, reflects the bottoming process for 2018/2019.

says the research firm,

“During the capitulation in early 2022, the accumulation trend score indicates that significant accumulation of large units has taken place, as well as the seizure of the recent bear market rally to $24,500 for exit liquidity. Currently, this calculation suggests an equilibrium structure (neutral) in the market, which remains similar in early 2019.”

At the time of writing, Bitcoin (BTC) is trading at $20,767, flat on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Melkor3D