Problems hit the NFT business

Investors who rushed into GameStop (GME) stock hopes that the company’s crypto business will boom, may have to rethink its strategy. It turns out that GameStop’s non-fungible token (NFT) marketplace sales, which were initially increasing, are now falling. The GME share is taking the heat amid shrinking NFT sales.

GameStop primarily operates a video game retail business. In July, it moved to try its luck in the crypto space, launching a platform for trading NFTs. GME shares rose on the back of the NFT market debut as investors cheered to welcome another opportunity for crypto stocks.

In the early days of the GameStop NFT marketplace, business was booming. On its first day, for example, the company generated $44,500 in fee income on a sales volume of $1.98 million. It was in the middle of July.

On August 22, GameStop’s daily NFT fee revenue fell below $4,000, according to DappRadar data. The company charges a fee of 2.25% on NFT trades that take place on the platform. GameStop’s NFT business has been on the decline recently, with sales volume, number of retailers and average item prices all falling. The weakened crypto business comes as GameStop also faces criticism for allowing the sale of copyright-infringing NFTs on its platform.

GameStop Joins Meme Stock’s Crash

GameStop shares fell about 5.5% to $34.50 on August 22. The decline came on a generally bad day for meme stocks, as AMC Entertainment (AMC) and Bed Bath & Beyond (BBBY) also plunged nearly 42% and 16%, respectively.

Is GME a good stock to buy?

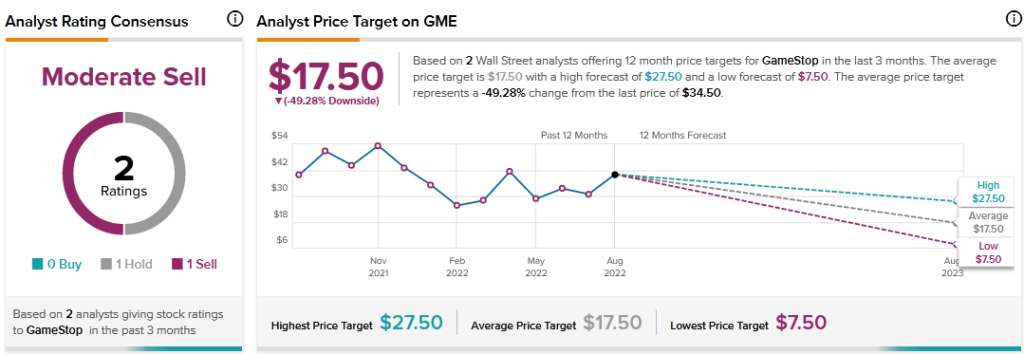

Despite the latest drop, GameStop stock is still up more than 40% over the past three months. However, Wall Street is not enthusiastic about the stock. According to TipRanks’ analyst rating consensus, GME stock is a Moderate Sell. The average GameStop stock price prediction of $17.50 implies over 49% downside potential.

GameStop remains one of the most discussed meme stocks on private investor forums like Reddit’s WallStreetBets and Stocktwits. In fact, many retail investors are willing to bet against Wall Street when it comes to GME stocks. TipRanks’ Stock Investors tool shows that investor sentiment is currently positive on GameStop. Over the past 30 days, 1.9% of the top performing portfolios tracked by TipRanks have increased their exposure to GME stocks. In a series of rounds, retail investors have won against Wall Street elites by triggering short squeezes in meme stocks like GME and AMC.

Last thoughtpp

While GameStop’s NFT business may not be in great shape right now, it could deliver if the company can find a way to turn it around. In 2021, NFT sales reached $25 billion. With GameStop’s total NFT sales volume at just $18 million since the marketplace debuted, the growth opportunities ahead remain enormous.

Read the full disclosure