The last 12 months have been tough for digital currency investors as the crypto winter has caused a large amount of value to leave the once bustling economy. The privacy coin economy, for example, fell more than 55% against the US dollar as it fell from $11.7 billion in January 2022 to $5.22 billion today.

Privacy Economics Loses 55% Against The Greenback, EU Looks To Ban Anonymization Of Cryptos

Privacy coins are not talked about like before. These days, the hype and discussions surrounding decentralized finance (defi) and non-fungible tokens (NFTs) have eclipsed privacy coin conversations.

Furthermore, in the past 12 months, the privacy coin economy has fallen from $11.7 billion to today’s $5.22 billion. Last January, the top two privacy tokens included monero (XMR) and zcash (ZEC).

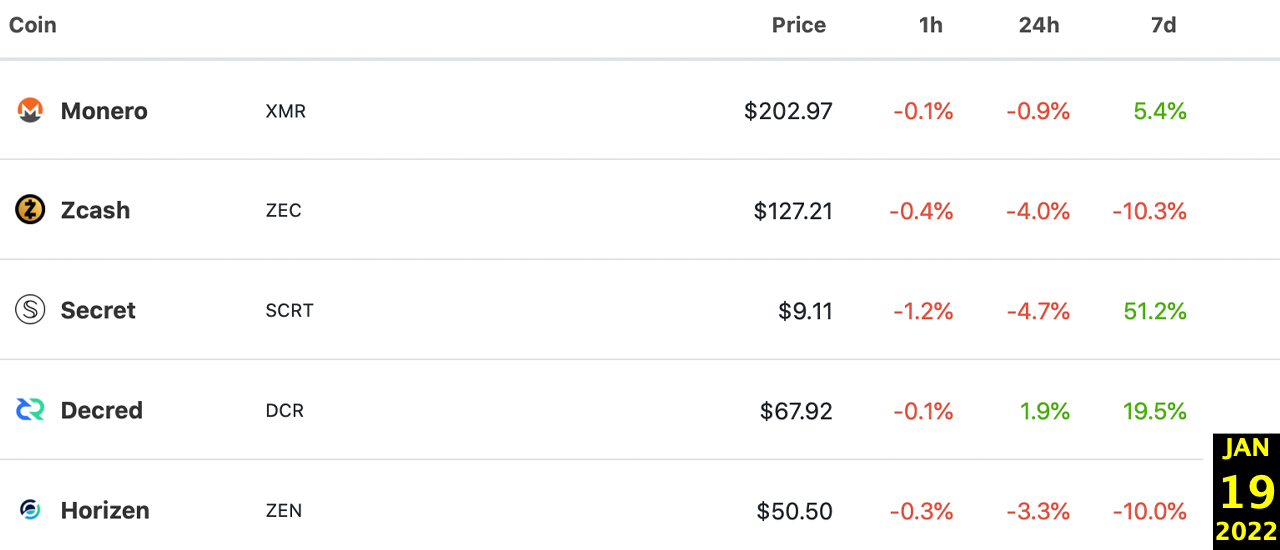

At the time, monero was the largest privacy coin by market capitalization and still is today. In January 2022, XMR’s price was around $202.97 per unit, and it had a market capitalization of around $3.66 billion on January 19, 2022.

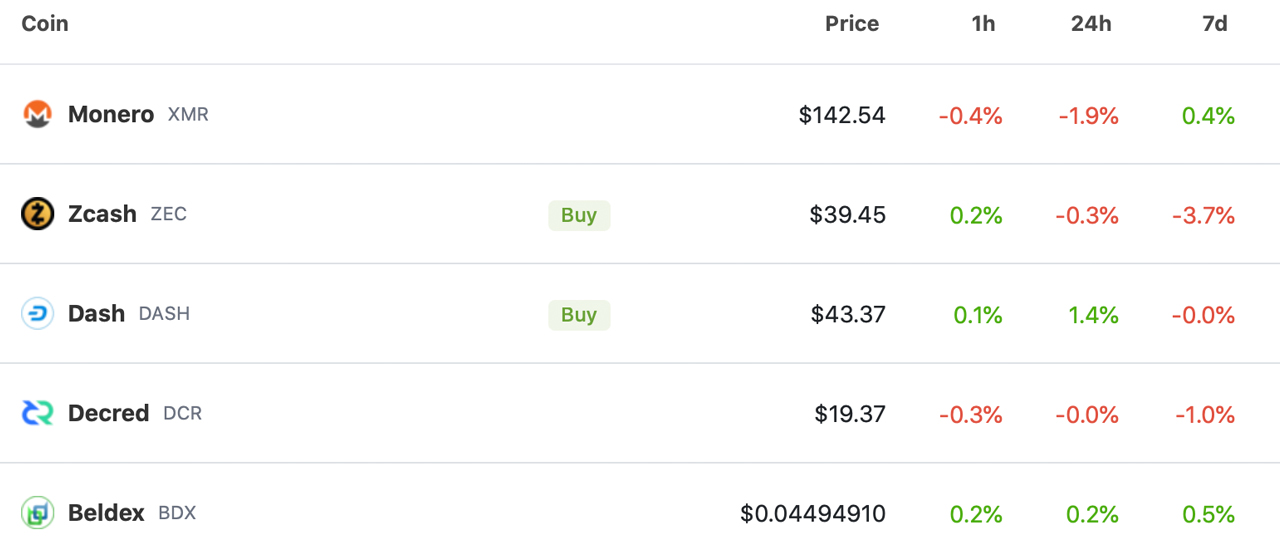

Today, XMR is changing hands for about $142.35 per coin, and it has a total market cap of about $2.58 billion. Zcash has the second largest privacy coin valuation this year, and in January it was around $1.53 billion.

By the end of December 2022, ZEC’s market value is down to $517 million. January 2022’s top five privacy coins by market cap included monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR), and horizen (ZEN).

December 2022 statistics show that the top five privacy coins include monero (XMR), zcash (ZEC), dash (DASH), decred (DCR) and beldex (BDX). XMR and ZEC’s market capitalization is roughly $3.1 billion, which is 59.4% of the entire privacy coin economy.

As of January 2022, XMR and ZEC were valued at $5.19 billion and represented only 44.36% of the entire privacy coin economy. Today, the top two privacy coins by market cap have much more dominance.

Last month it was reported that leaked EU plans could ban privacy coins like XMR, ZEC and DASH. “The European Union may ban banks and crypto providers from trading privacy-enhancing coins like zcash, monero and dash under a leaked draft of a money laundering bill obtained by Coindesk,” the publication noted on November 15, 2022.

Government policy decisions and proposed policies have caused a number of crypto exchanges worldwide to stop listing privacy coins such as XMR and ZEC. The lack of listings gives privacy coins much less liquidity, making them more susceptible to price fluctuations.

Tags in this story

Altcoins, bulletproofs, CoinJoin, Dandelion, dash, Decred, decred (DCR), horizen, Mixing Coins, Monero, Nucypher, Privacy, Privacy Assets, Privacy Coin DASH, privacy coins, privacy crypto, privacy techniques, privacy tokens, ring confidential transactions, Ring signatures, Secret, secret (SCRT), stealth addresses, xmr, Zcash, ZEC, zen

What do you think about privacy coins this year and their market performance over the past 12 months? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.