Price Analysis of Bitcoin, Ethereum and Avalanche

by James · December 12, 2022

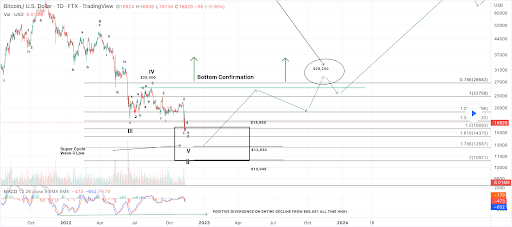

Bitcoin Analysis

Bitcoin’s price has printed three consecutive red daily candles, but the asset has only decreased cumulatively over this period by 0.79%. On Sunday, when traders settled on Bitcoin at the end of the session, BTC’s price was -$23.

The BTC/USD 1D Chart below from maikish this is where we begin this week’s price analyses. At the time of writing, BTC’s price trades between the 1.5 Fibonacci level [$15,693.00] and the 1,382 fib level [$17,132.00].

The overhead targets on BTC are the 1,382 fib level followed by 1,236 [$19,096.00]1 [$22,758.00]and 0.786 [$26,682.00].

Conversely, those still shorting the Bitcoin market have targets to the downside of 1.5, 1.618 [$14,375.00]1,786 [$12,687.00]and 2 [10,821.00].

BTC/USD 1D chart: price is trading between the 1.5 fibonacci level [$15,693.00] and the 1,382 fib level [$17,132.00]

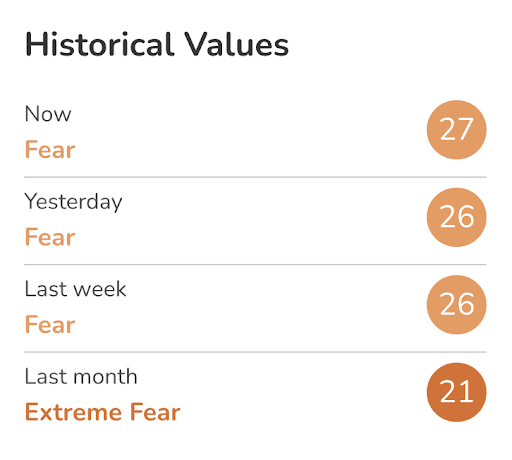

The fear and greed index is 27 Fear and +6 from last month’s reading of 21 Extreme Fear.

Bitcoin’s moving average: 5 days [$17,017.79]20 days [$16,661.39]50 days [$18,371.18]100 days [$19,832.81]200 days [$26,103.64]Year to date [$28,843.11].

BTC’s 24-hour price range is $17,092-$17,503 and its 7-day price range is $16,781.78-$17,362.29. Bitcoin’s 52-week price range is $15,501-$52,027.

The price of Bitcoin on this date last year was $50,123.

The average price of BTC for the last 30 days is $16,758.9 and +7.9% in the same period.

Bitcoin’s price [-0.13%] closed its daily candle worth $17,109 and in the negative for the third day in a row on Sunday.

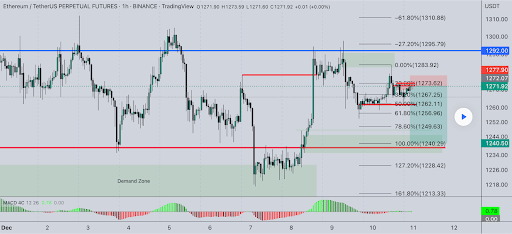

Ethereum analysis

Ether price also rallied on Sunday, but the damage from bearish traders on the world’s second-ranked cryptocurrency by market capitalization was minimal. When the light of day was painted, ETH’s price was -$3.22.

The second chart we analyze for this Monday is ETH/USDT PERPETUAL FUTURES 1HR Chart below of TREASUREVALUES_FX. ETH’s price is trading between 23.60% fib level [$1,273.62] and 0.00% fibonacci level [$1,283.92]at the time of writing.

Bullish traders has not been able to exceed the -27.20% fib level [$1,295.79] for a longer duration lately, but it is the target for bullish Ether traders if they can regain the 0.00% fib level. Above -27.20% fib level is -61.80% fib level [$1,310.88] which if bulls can recover could take the asset’s price back to the $1400 level in time.

The downside targets on ETH are 23.60%, 38.20% [$1,267.25]50.00% [$1,262.11]61.80% [$1,256.96]78.60% [$1,249.63]and the 100.00% fib level [$1,240.29] in short term.

Ether’s Moving Average: 5-day [$1,257.12]20 days [$1,221.12]50 days [$1,321.45]100 days [$1,460.10]200 days [$1,824.13]Year to date [$2,031.07].

ETH’s 24-hour price range is $1,255.85-$1,284.75 and its 7-day price range is $1,225.02-$1,302.22. Ether’s 52-week price range is $883.62-$4173.15.

The price of ETH on this date in 2021 was $4,131.84.

The average price of ETH for the last 30 days is $1,230.96 and +15.62% in the same interval.

Ether price [-0.25%] ended its daily session on Sunday worth $1,263.39 and in red numbers again after ending Saturday’s session in green numbers.

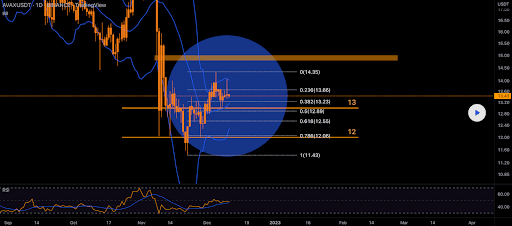

Landslide analysis

Avalanche’s price followed the macro lower on Sunday and came out worst in today’s price analyses. When traders ended trading in Avalanche’s token on Sunday, AVAX was -$0.52.

The AVAX/USD 1D Chart below from MonoCoinSignal is the final chart for analysis this Monday. Avalanche’s price is between the 0.382 fib level [$13.23] and 0.236 fib level [$13.66]at the time of writing.

We can see on the daily time scale that AVAX’s price jumped at 1 fib level and then bullish traders has claimed the asset’s momentum for the interim. Bullish AVAX market participants target 0.236 and a full retracement of 0 [$14.35].

Bearish AVAX traders conversely trying to stop the recent bullish ascent and reverse course before bullish traders regain the 0.236 fib level. The downside targets for bearish traders are 0.382, 0.5 [$12.89]0.618 [$12.55]0.786 [$12.06]and the 1 fib level [$11.43].

Avalanche’s 24-hour price range is $12.92-$13.5 and its 7-day price range is $12.92-$14.29. The AVAX 52-week price range is $11.49-$127.19.

Avalanche’s price on this date last year was $88.04.

The average price of AVAX in the last 30 days is $13.16 and +2.95% for the same duration.

Avalanche’s price [-3.85%] closed its daily candle on Sunday worth $12.98 and in the red for the first time in four days.