PE tests blockchain; high risk continues in the consumer sector

S&P Global Market Intelligence offers our top picks of global private equity news and more published throughout the week.

Blockchain technology increasingly looks like the key that could unlock a huge new market for private equity: the global mega-rich, a group that has about $80 trillion in investable capital, according to an oft-cited estimate by Blackstone Inc. President Jonathan Gray.

KKR & Co. Inc. in September became one of the latest and largest private equity companies to tokenize part of one of its funds on the blockchain. Each token represents a fraction of a stake in the fund, meaning individual investors can buy in at a fraction of the typical ticket size.

The tokens offer another important benefit to retail investors: liquidity. Capital invested in a private equity fund is usually tied up for several years, but anyone who owns a tokenized part of the KKR fund can trade their interests after a one-year lock-up period.

It is still early in private equity’s transition to the blockchain, and there are many technical and regulatory wrinkles to iron out. That’s especially true if the goal is not just to open up private equity to wealthy individuals, but to truly democratize the asset class by giving Main Street investors access to the funds.

Read more about these obstacles.

DRESS OF THE WEEK: Risky games in the consumer sector

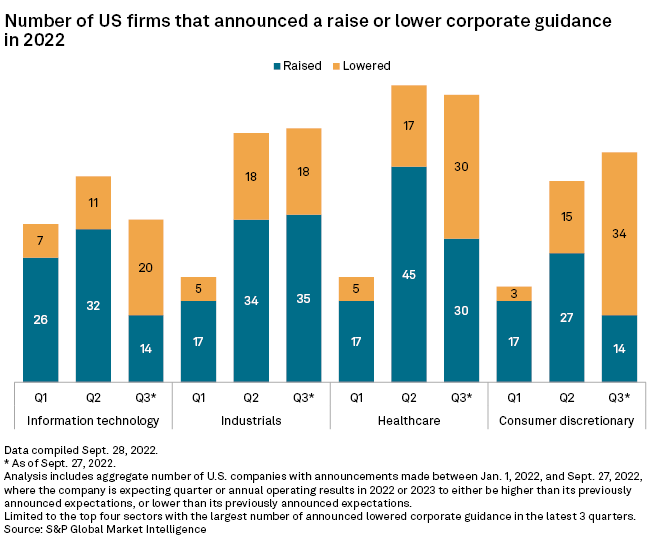

⮞ Consumer discretionary was the sector with the highest risk for investment in the third quarter, according to an S&P Global Market Intelligence analysis. The analysis ranked sectors according to three risk criteria: corporate guidance, short interest and default probability.

⮞ Risk affects company valuations, potentially creating buying opportunities in the private equity sector.

⮞ The number of companies in the consumer sector that lowered corporate guidance more than doubled to 34 in the third quarter compared to the second quarter.

BIDDING AND COLLECTION

* Fund managed by Apollo Global Management Inc. affiliates completed the acquisition of Lumen Technologies Inc. existing carrier operations and associated assets in a $7.5 billion deal. Separately, funds managed by Apollo bought an approximately 5% minority stake in alternative asset manager Diameter Capital Partners LP.

* Apax Partners LLP-advised fund agreed to sell its majority stake in Boasso Global Inc. to KKR, which is making the investment through its KKR Global Infrastructure Investors IV fund. The target company supplies depot, maintenance, cleaning and transport services to the ISO tank container market in Europe and North America.

* Thoma Bravo LP closed the sale of Frontline Technologies Group LLC to Roper Technologies Inc. for about $3.73 billion in an all-cash transaction. Frontline Education offers administration software purpose-built for K-12 teachers.

* KKR and The Goldman Sachs Group Inc.’s Petershill business provided anchor commitments to the first fund of Atwater Capital. Capital commitments of Atwater Capital Fund I LP now total more than $100 million.

SECOND PLACE IN THE INDUSTRY

* Bayer AG sold its professional environmental science business to Cinven Ltd. for 2.6 billion dollars. The acquired business offers solutions to control pests, diseases and weeds in non-agricultural areas.

* Kinderhook Industries LLC closed its acquisition of Gulf Tanks Holdings Inc. from WillScot Mobile Mini Holdings Corp. in a transaction of approximately $323 million.

* GPF Capital closed the purchase of an 80% stake in the Spanish company Lezama Demoliciones, which specializes in the demolition, recycling and rehabilitation of industrial land.

* HgCapital LLP made a majority investment in Trustquay, a the company’s services software business, marks an exit for Silverfleet Capital Partners.

FOCUS ON: ENERGY

* The funds managed by PAG completed the acquisition of First Solar Inc.’s Japanese solar energy operation and maintenance platform.

* TPG led a $450 million funding round for long-running energy storage upstart Form Energy Inc. Other investors in the Series E round included Singaporean sovereign wealth fund GIC Pte. Ltd. and the Canada Pension Plan Investment Board.

*Einfrastructure company for charging electric vehicles Loop Global Inc. raised $60 million, consisting of a $40 million Series A-1 round and a $20 million financing facility. The Series A-1 round was led by Fifth Wall Climate and Agility Ventures, with participation from Keystone National Group LLC, which provided the financing facility.