Paysafe: The Good Times for Fintech Are Over (NYSE:PSFE)

Scott Olson

Inflation is falling, the economy remains robust, and the stock market is on the rise. Therefore, even though we are only a few weeks into 2023, it already looks like Paysafes (NYSE:PSFE) best year on record with its ordinary shares up 48% so far this year. Zoom out over 12 months and the stock is down 51%, roll out further to its performance since it went public in March 2021 and the public is down 82%. Therefore, the last few weeks have presented a salvo for one of the largest fintech companies that went public during the SPAC boom in the pandemic.

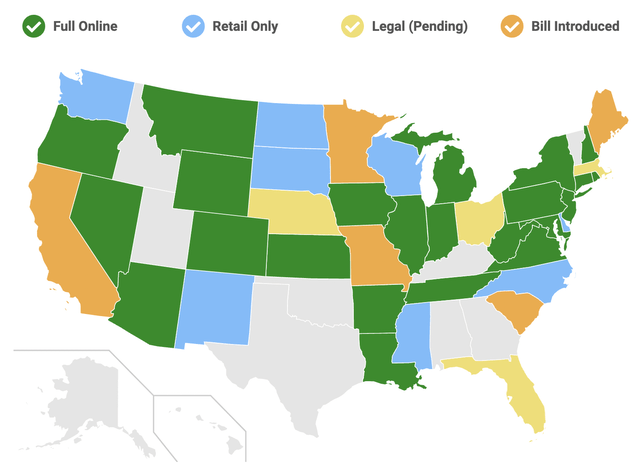

The London, England-based iGaming payment solutions provider still has plenty of promise on the back of the growing North American market for regulated sports betting. This forms the core of the long-term investment thesis with bulls focused on the great opportunities in the USA The total addressable market for iGaming would constitute a company whose revenues have substantially declined from before the pandemic. There’s a lot at stake here with the now $1.29 billion market cap company having a total debt balance of 2.54 billion dollarspartially offset by cash and equivalents of $220.2 million.

USB devices

The recent defeat in California of Proposition 26 and Proposition 27, two measures to legalize sports betting in the state, has thrown this task partially into disarray. Furthermore, while Paysafe is profitable and cash-generating, the company generates the bulk of its revenue from relatively mature European markets that are now subject to heavier iGaming regulations being assessed by respective national authorities. For example, the UK is set to launch a new gambling white paper which is expected to set out a more onerous regulatory environment than the existing regime.

Why the reverse stock split had to happen

Paysafe’s go-public valuation was perhaps too much at the upper end of the valuation range and faced an intense decline as soon as the Fed started raising interest rates. The market essentially switched overnight from euphoric bullishness to an almost visceral rejection of deSPACs and fintech companies.

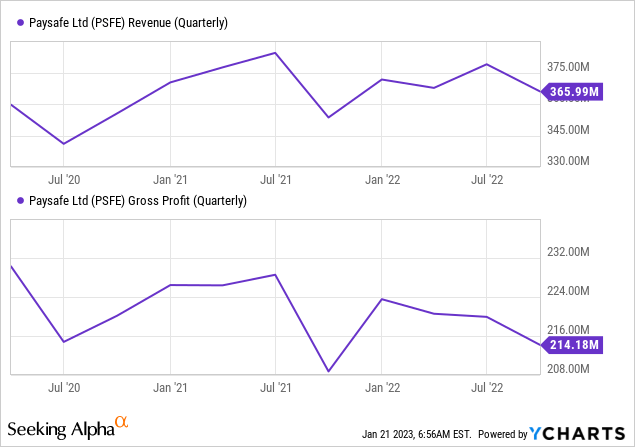

Paysafe last reported earnings for the third quarter of fiscal 2022, which saw revenue come in at $366 million, a 3.5% increase over the year-ago quarter and a $13.56 million increase on consensus estimates. This growth came on the back of total payment volume increasing 5% compared to the previous year to reach $32.5 billion.

Revenues have not grown beyond pre-pandemic levels with figures for the first three months of fiscal 2020 only $6 million lower than the latest numbers. Furthermore, Paysafe’s Q3 2022 gross profit of $214.18 million was a sequential decline from the previous second quarter, albeit up 2.6% compared to the same period last year.

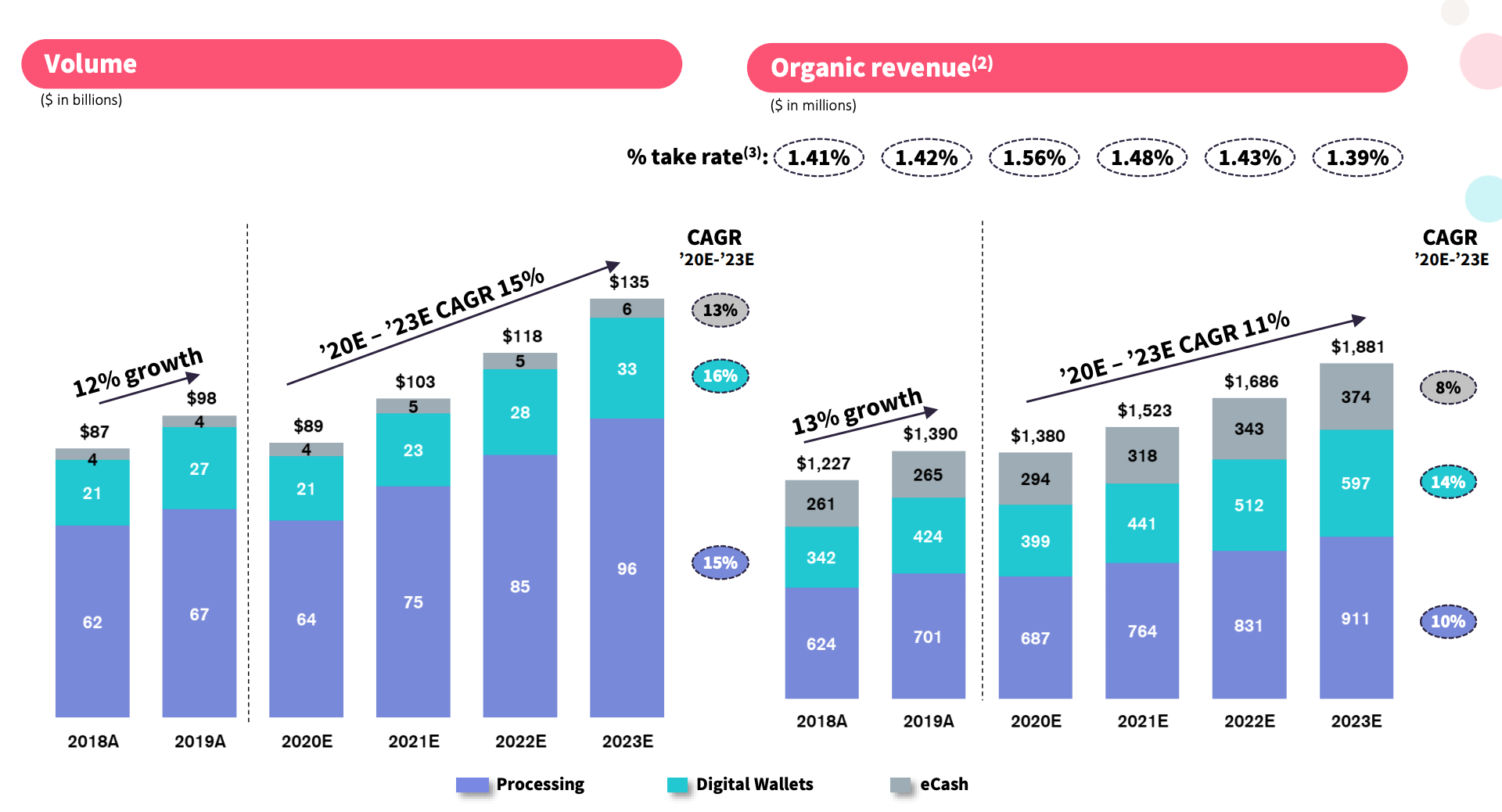

This tepid almost meandering growth has fueled much of the lack of initial enthusiasm Paysafe saw when it went public. To be clear here, Paysafe positioned itself as a bet on the increasing liberalization of iGaming and initially guided its revenues to grow at a compound annual growth rate of 11% from 2020 to 2023.

Paysafe

Therefore, with Paysafe stating that full fiscal 2022 revenue will be no more than $1.49 billion, this would be an 11.56% underperformance compared to the original guidance provided when the company went public. The revenue miss for next year is likely to get even worse with the growing specter of a recession likely to affect volume growth. Therefore, while Paysafe counts large companies such as DraftKings (DKNG) and cryptocurrency exchange Binance as customers, the overall trajectory of revenue growth has been disappointing.

Are the good times over?

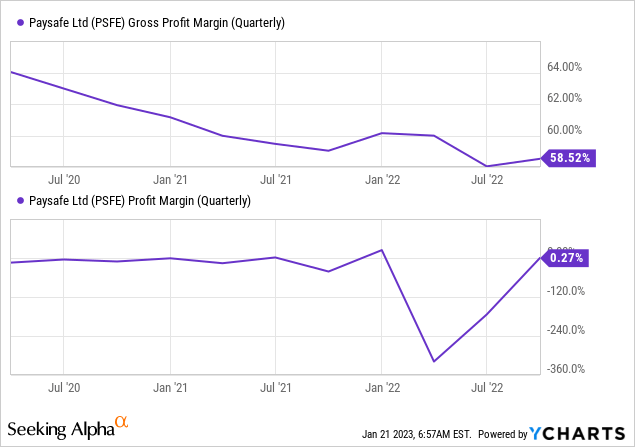

Adjusted net income for the third quarter came in at $29.2 million, down 25.88% from the year-ago figure. Overall, net profit margins have been flat in recent quarters, regularly dipping into negative territory. The company is largely cash-generating, but is using that to pay down its debt balance, whose third-quarter interest expense came in at $34.6 million, up $6 million from the previous second quarter.

Despite the nearly 50% rally, Paysafe faces one of the biggest tests of its life as a public company. The reverse stock split was important as it gave the company a lifeline and allowed them to stay well above the NYSE’s minimum listing requirements. And while the outlook for companies engineering reverse splits is normally pretty poor, Paysafe’s underlying problem doesn’t stem from recurring losses or share dilution, it’s from a lack of revenue traction and a near-managed nothing against a broader mature TAM.

Ultimately, Paysafe’s performance has now fallen far short of the positive vision written by management during the pandemic. While it is not entirely clear whether the share price will retain and build on current gains, earnings are likely to remain flat. Therefore, I am neutral on the stock.