Panic among Bitcoin investors intensifies: When will it end?

Devrimb/iStock via Getty Images

After a period of low cryptocurrency volatility, the price of Bitcoin (BTC-USD) fell sharply from $21,400 to $17,150 and is currently trading in a narrow price range of $18,100-$18,500 after a slight recovery. As described in my previous Bitcoin article, the main reason for the drop below the psychological threshold of $20,000 per Bitcoin is the Fed’s fourth consecutive increase in the Fed’s interest rate to a record high in the last sixteen years. Investors continue to massively pull out of risky assets, which only adds to the tension in both the stock and cryptocurrency markets, while more conservative participants with significant financial resources seek to wait out the period of macroeconomic instability in assets that provide dividends or coupon payments.

Source: N_Aisenstadt — TradingView

This article will present factors that indicate continued downward pressure on the price of Bitcoin, but at the same time some of them begin to indicate the appearance of the first glimmers of hope for the end of the bearish trend in the medium term.

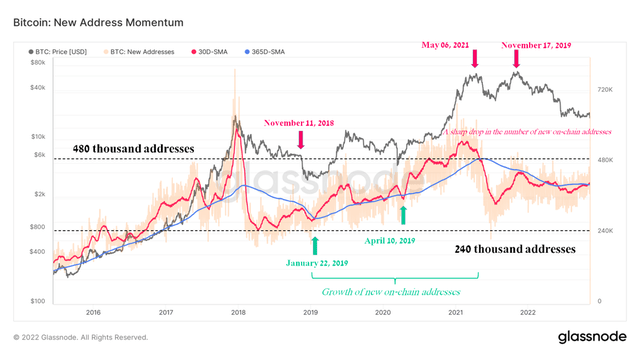

Bjørner controls the situation in the cryptocurrency market

One of the most effective tools for tracking and modeling changes in cryptocurrency market trends and sentiment among Bitcoin users is the analysis of activity on the chain. The dynamics of new chain addresses continues to decline from multi-year highs reached in May 2021, when mass euphoria swept almost all markets and new entrants opened wallets and invested in “digital gold”. But even then, the first signs of a decline in interest in Bitcoin appeared, as the average monthly rate of new addresses fell below the 365-day simple moving average marked in pink in the chart below. Moreover, a similar situation was observed in February 2018, after which the price of Bitcoin collapsed by 73% in less than a year. At the moment, the momentum of New Addresses is close to another upward spurt, as it happened in November 2018 after a multi-month period of low volatility and marked by a revival of hopes for the start of a new cycle of growth in demand for Bitcoin. However, this was a vain hope, as the price of Bitcoin collapsed from $6,600 to $3,300, thus ultimately dissuading the majority of potential investors from buying “digital gold”. Moreover, in times of maximum stress among market participants and the subsequent formation of a bottom, the number of new addresses always reached a value of 240 thousand, which we still have not seen. As a consequence, this once again indicates that the current price range is not a bottom before a new up cycle begins.

Source: Author’s elaboration, based on Glassnode

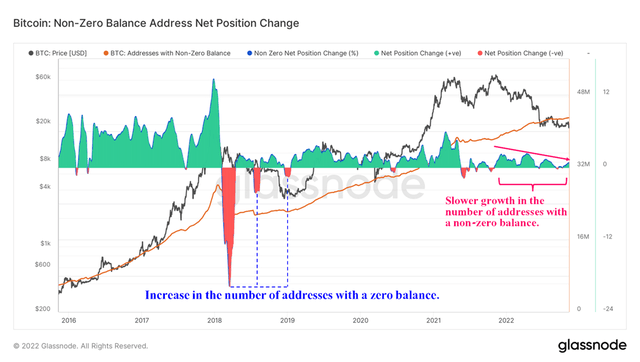

The logical consequence of the slowdown in the opening of new crypto wallets is a slowdown in the growth of the number of addresses with a non-zero balance, as most investors continue to exchange Bitcoin for fiat money and reinvest it in financial assets with less risk. . A similar situation could be observed in the first three quarters of 2018, when the price of Bitcoin, after a sharp fall, remained in a narrow price range of $3,200-$4,000 for several months, while the S&P 500 ( SPY ) and the Nasdaq 100 ( QQQ ) continued its upward movement.

Source: Author’s elaboration, based on Glassnode

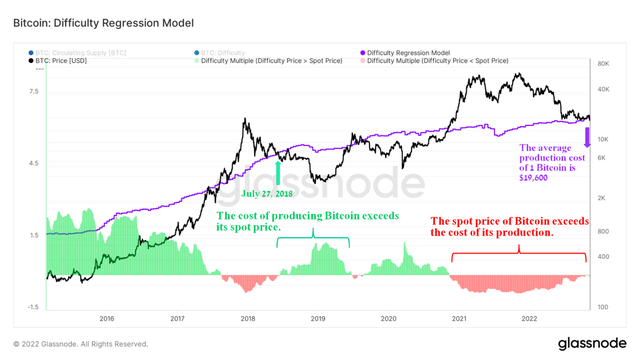

Miners are still experiencing the hardest times

In my previous article, “Antipating Crypto Crisis: Bitcoin Price Might Drop 35%”, I pointed out the continued dire situation in the mining industry, with hashrate and network difficulties setting new records and thus provoking companies to sell more coins to continue their activities . As of November 9, 2022, Bitcoin’s average production cost is $19,600 while the spot price has fallen below $18,000. The last time a similar situation occurred was four years ago and ultimately led to a mass capitulation of miners. Currently, miners earn only 3.47 BTC per day for each Exahash, or 62.5 thousand in dollars, which is 25.2% less than the previous quarter. Increased competition between such industry giants as Riot Blockchain (RIOT) and HIVE Blockchain Technologies (HIVE) does not lead to the recovery of the cryptocurrency market, but only worsens the situation and the longer this happens, the longer the recovery period. will continue. I expect the sideways trend in the $12,700-$13,600 price range, where more patient investors will accumulate coins in their wallets, to last a bit longer than before. As a consequence, this will lead to a significant decrease in the investment interest of those trying to make a quick profit in this market, and will also maintain downward pressure on the share prices of crypto miners.

Source: Author’s elaboration, based on Glassnode

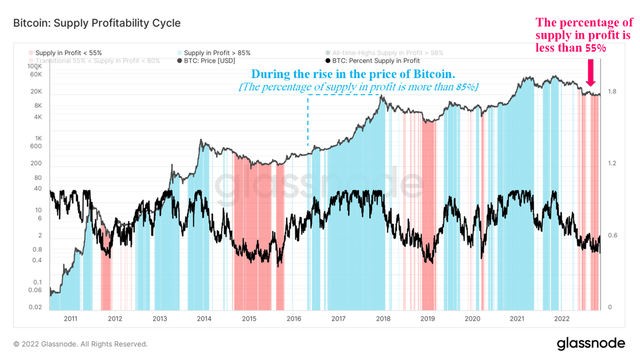

A period of apathy among crypto market participants due to a sharp drop in the profitability of their investments leads to the transition to Bitcoin from more impulsive investors to those who understand the value of cryptocurrencies. These trends can be analyzed using the percentage of supply in profit, which provides information about the state of the market cycle. At the moment, this indicator continues to be in a downward trend, thus demonstrating the dominance of the share of offers in losses and, as a result, the preservation of bearish sentiment in the cryptocurrency market.

Source: Author’s elaboration, based on Glassnode

Holders continue to accumulate Bitcoin

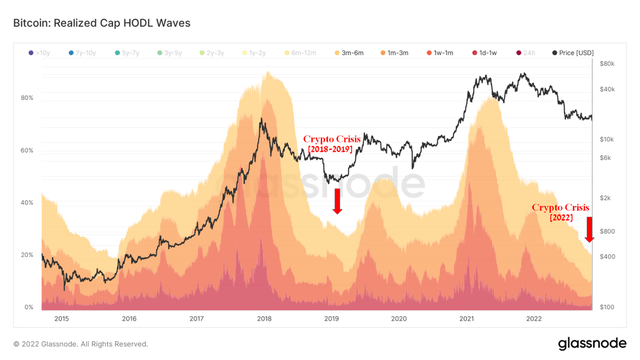

Despite the decline in interest and confidence in cryptocurrencies, long-term investors do not lose optimism about the future of Bitcoin and continue to accumulate it. The share of US dollar wealth held in BTC that hasn’t moved in the past six months has hit a multi-year low. In previous Bitcoin cycles, such extremely low values were characterized by the formation of the bottom of the main cryptocurrency, and in my opinion, a similar situation will repeat itself in 2022-2023.

Source: Author’s elaboration, based on Glassnode

Conclusion

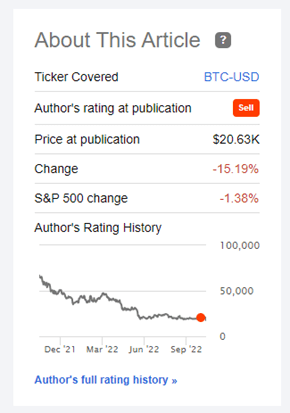

Since I wrote my last bearish article in October 2022, the price of Bitcoin has fallen by more than 10%, which is consistent with my expectations for the behavior of the cryptocurrency market, which is experiencing capital outflows to less risky assets.

Source: Nathan Aisenstadt — Seeking Alpha

The panic among high-risk assets, including those traded on the stock market, does not contribute to the transition of Bitcoin from a bearish trend to a bullish one. The network difficulty is setting new multi-year records, reducing investment in the mining industry, which is in dire need of additional funding to purchase more efficient equipment. Moreover, the increase in downward pressure on the price of Bitcoin comes at a time when one of the global cryptocurrency exchanges, namely FTX (FTT-USD), is facing a liquidity crisis and thus only increases the likelihood of a domino effect on other market players.

On the other hand, the conditions for the end of the bearish trend are starting to appear due to an increase in the number of long-term owners who are confident in the bright future of cryptocurrencies. Additionally, I expect a slowdown in Fed rate hikes in 2023 due to the slowdown in US inflation and the Republican victory in the House of Representatives elections. As a result, the Democrats will not be able to advance all their ideas, which required multi-billion dollar investments with the subsequent increase in inflation, and as a result, this will lead to an easing of the Fed’s monetary policy. As a result, investors will begin to consider investing in high-risk assets such as Bitcoin, Dogecoin (DOGE-USD), Ethereum (ETH-USD), and Cardano (ADA-USD). From the point of view of technical analysis, as in the previous article, I expect the price of Bitcoin to fall to the $12,700-$13,600 range, after which there will be a multi-month period of accumulation and the cycle will start again.