PagSeguro: Latam Fintech Leader Poised to Break Out (NYSE:PAGS)

blackCAT/E+ via Getty Images

PagSeguro Digital Ltd. (NYSE: PAGS) is a Brazil-based payment processor and online banking platform service. Despite impressive growth trends and strengthening financials, the stock has had a tough year amid extreme volatility, especially in this segment of emerging markets fintech. Beyond the poor trading action, PAGS is a high-quality stock with overall solid fundamentals and a strong long-term outlook.

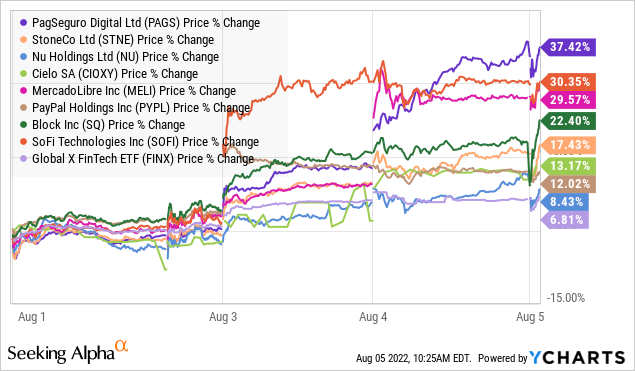

On a positive note, PAGS has caught a spark of momentum, rising more than 35% this week, supporting a view that lows for the year are in, with room for shares to break out higher. The setup here considers a broader rally in fintech globally and technology names in Latin America in line with more positive risk sentiment. We see important macro indicators from Brazil coming in better than expected, which could increase the company’s operational background. We last covered PagSeguro back in March, and today’s update summarizes some recent developments while confirming a bullish call.

Bullish on FinTech

It’s been a big week for fintech and Brazilian stocks, with PAGS sitting right in the sweet spot as a downbeat name with reset expectations trading near a 52-week low just last week. Earnings from global leader PayPal Holdings, Inc. (PYPL) beat expectations, setting the stage for a rally in the group on a narrative that payment volumes for digital transactions remain robust despite more challenging economic conditions.

Within Latin America, MercadoLibre, Inc. ( MELI ) delivered a massive second-quarter result that was strong enough to send shares up over 16% on the report. In this case, while MELI’s core business is in e-commerce across Latin America, the financial services segment was highlighted by strong growth and improved margins. With Brazil representing about 55% of MercadoLibre’s total business, its fintech services in the country alone generated $699 million in Q2 revenue, which rose 113%.

While MELI’s payments business differs from PagSeguro’s largely related to the e-commerce market, the reading here is that MELI ended up serving as a sort of preview of what to expect when PAGS reports its own Q2 results later this month. Other Brazilian payment players and fintech stocks such as StoneCo Ltd. (STNE), Cielo SA (OTCPK:CIOXY) and Nu Holdings Ltd. (NU) all posted solid gains this week while PAGS stood out as the biggest gainer in the group.

Brazil macro is improving

So to really explain the rally in PAGS, we mentioned the economic data from Brazil. While much of the world deals with recession worries and record inflation, Brazil appears to be bucking the trend. Citing positive monthly indicators, the Ministry of Finance revised higher its full-year GDP forecast to a growth of 2% from the previous 1.5%.

A recently passed fiscal spending and tax cut package has been credited with supporting the level of activity and the improved outlook. Similarly, the unemployment rate in Brazil has fallen and actually reached a seven-year low of 9.3% in June.

Inflation has been hot like much of the rest of the world, although the main difference here is that Brazil’s central bank proved proactive by raising interest rates earlier in the cycle, with signs that it has already started to cool. with room to trend down towards falling energy prices. In the case of PagSeguro, as a major financial player with exposure to consumer trends, the company is well positioned to benefit from this dynamic of strong economic conditions going forward.

PAGS key calculations

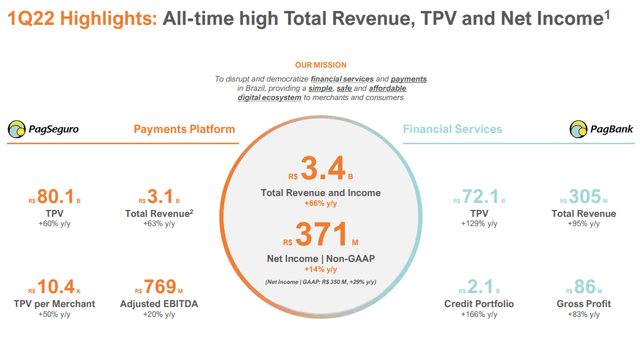

For investors unfamiliar with PagSeguro, this is a large company with a market capitalization of $5 billion. The company last reported first-quarter earnings back in June with revenue of BRL 3.4 billion, representing roughly $655 million, up 66% year-over-year. The company is profitable with net income on a GAAP basis, up 29% year-on-year in the quarter, or 14% on an adjusted basis to BRL 371 million.

The company IR

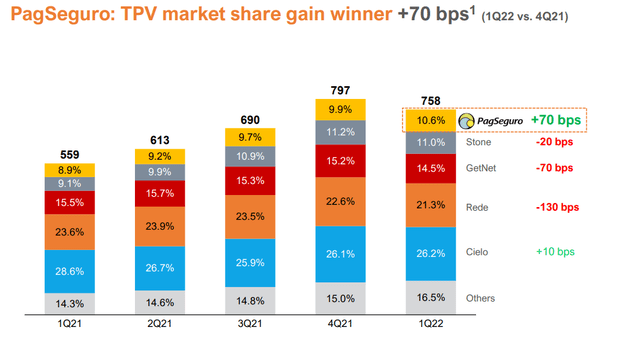

Part of the momentum here is taking into account the ongoing post-pandemic recovery in the region compared to disruptions in the first half of 2021. Yet there was also 6% revenue growth itself compared to the previous quarter, while the key theme here has been an expansion of market share. Management notes that the core segment “PagSeguro” payment platforms, which are based on merchant solutions including points of sale, rose to 10.6% of the entire Brazilian market, up from 9.9% in Q4 and 8.9% in Q1 2021 .growth has come at the expense of some older players such as “RedeCard”, suggesting that PAGS growth initiatives are paying off.

The company IR

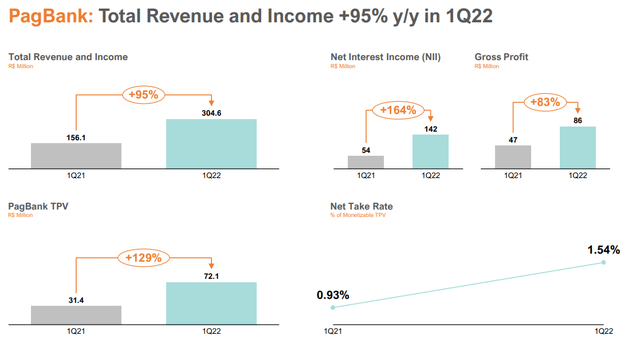

What is undoubtedly more exciting for the company are the trends with the digital banking and financial services branch of “PagBank”. The financial services include consumer tools such as bill payments and peer-to-peer transfers that leverage its business-to-business relationships with merchants to offer cash advances and lending products.

PagBank, which has separate calculations from the payments segment, reached 23.5 million customers in Q1, adding 8.7 million new accounts since the period last year. Segment TPV rose 129% YoY in Q1, leading to a 95% increase in segment revenue. The attraction here is that PagBank targets the segment of the Brazilian population that has been underserved. The company notes that for almost 50% of users, PagBank is their primary banking institution with an option to expand to more services.

The other important theme of PagBank is improving profitability, driven by an accelerating “net take rate”. Simply put, the scale of the operation has enabled the company to better monetize its total payment volumes, leading to an 83% year-on-year increase in the segment’s gross profit. We expect these trends to continue.

The company IR

PAGS share price forecast

We like the action in PAGS which has made a solid move higher, breaking through what had been a long-term downtrend in shares. The stock’s ability to hold a support level of $10.00 per share means that a solid bottom has been formed, with the bulls back in control. On the upside, $17.50 appears to be the next level of technical resistance, followed by $22.50 as the previous high at the end of Q1.

Seeking Alpha

Although the Q2 earnings report date is yet to be confirmed, we expect to see room for the combination of better-than-expected operating and financial trends along with positive guidance from management working as a catalyst for the next leg higher. Key monitoring points will be TPV growth rates from both operating segments along with performance metrics such as payments market share position and PagBank cap rate.

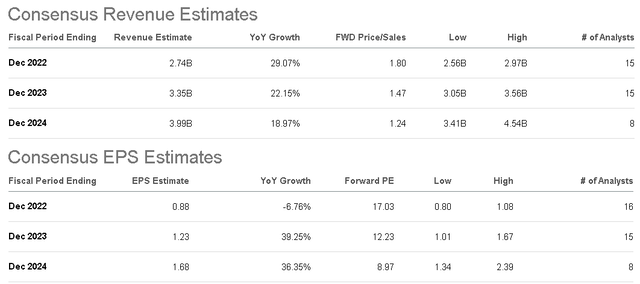

For the full year, consensus is for 2022 growth of 29%, which is then expected to average around 20% between 2023 and 2024. The market estimates PAGS EPS at $0.88 this year, down 7% from 2021, mainly based on weaker exchange rate, although the top line momentum should be enough to increase margins in the next few years.

Seeking Alpha

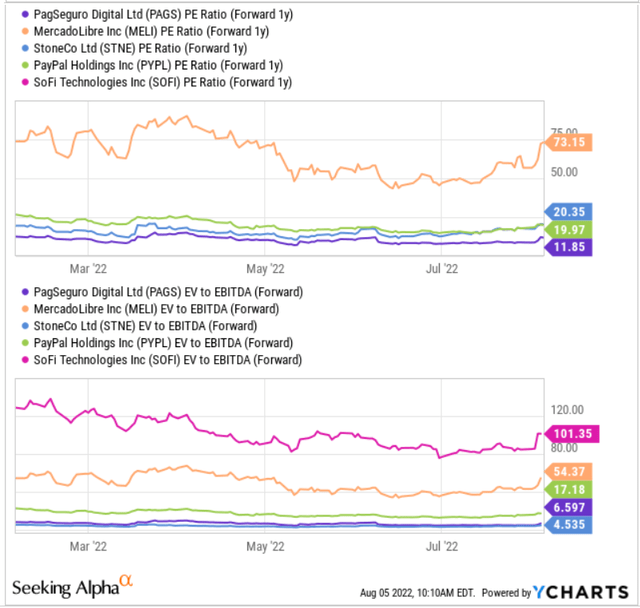

An outlook for EPS to accelerate 39% higher in 2023 highlights the appeal of PAGS as a compelling growth stock. In terms of valuation, PAGS trading at a 1-year forward P/E of 12x is a bargain in our view. This compares to MELI at 73x, Brazil Payments with StoneCo at 20x, and even PayPal is trading close to 20x. PAGS also trades at a discount in the form of its EV to forward EBITDA multiples. The positive thing is that the company will eventually exceed these estimates.

YCharts

Final thoughts

We rate PAGS a buy with a $25.00 price target for the year ahead, representing a 21x multiple to current consensus 2023 EPS. In particular, this is a level the share traded at at the start of the year, and our argument is that the outlook today is better than ever. Shares are undervalued with room for the earnings multiple to converge high against fintech peers, while its strong operating trends deserve a premium in our view.

To hedge risk, it is important to remember that as a foreign stock, the PAGS share price in dollars is exposed to exchange rate volatility as a deeper weakening of the local Brazilian real currency limits the value of earnings. Our view is that some of the more positive macro indicators from Brazil could support some currency stability, while an appreciation would further increase the PAGS upside potential. Weaker-than-expected results over the next few quarters will force a reassessment of the earnings outlook and likely lead to renewed volatility in the shares.