OpenSea Pro takes over Blur as the market heats up

After losing the title of the world’s most popular NFT marketplace to Blur in February, Opensea has launched a major counter-offensive.

The week started with the launch of Opensea Pro. A marketplace aggregator that builds on Gem v2, which OpenSea has been running since it acquired Gem back in April 2022.

Using the relaunched aggregator, users can browse listings from over 170 NFT marketplaces, including OpenSea. It also equips them with aggregated data across markets and a variety of tools. Designed to help collectors and traders optimize how they buy and sell NFTs.

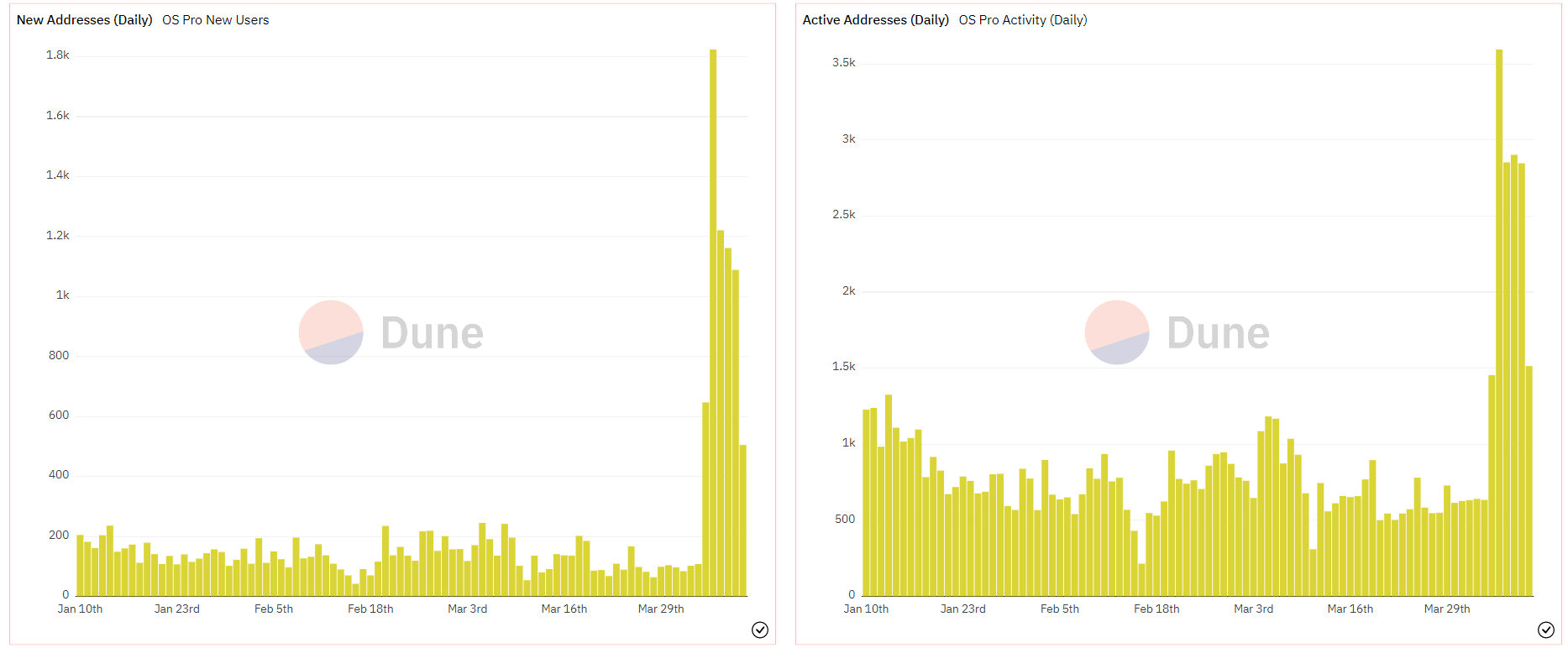

Significantly for OpenSea, the recent relaunch appears to have been well received by the community. Two key figures for platform usage – daily active users and new wallets created – increased significantly throughout the week.

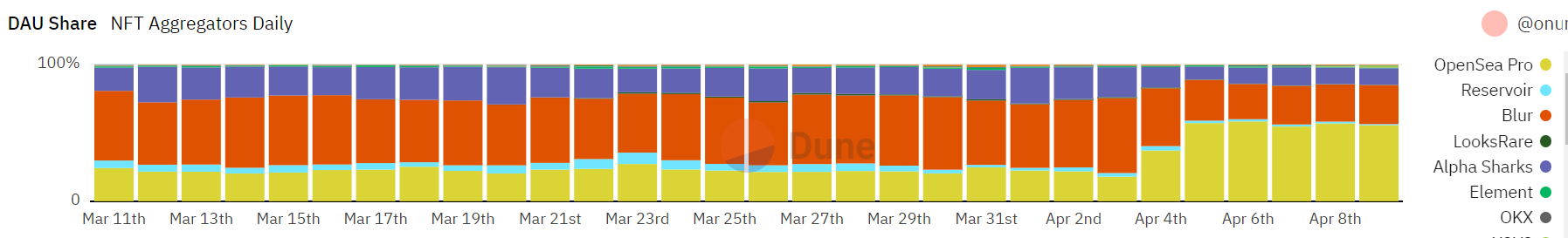

From a 54.8% share of all NFT aggregator users on Monday, by Saturday, Blur’s share had fallen to 27.%. Meanwhile, OpenSea Pro saw its daily user base increase from 18% to 57% of aggregator users in the same time period.

NFT rewards entice users

To celebrate the launch of OpenSea Pro, the company announced a new ‘Gemesis’ NFT drop. The Drop is a way to reward Gems early adopters. Anyone who bought an NFT on Gem before March or the end of March can claim a free Gemesis NFT between April 4th and May 4th.

In addition to the Gemesis NFTs, OpenSea hinted at several freebies with a mention of “community rewards.” This sent the internet rumor books into overdrive, with many online speculating that the company could drop NFTs into users’ wallets, a marketing tactic Blur has previously implemented with its “care packages.”

In its first season of three airdrops, Blur rewarded users based on their listing and bidding activity on the platform.

The distribution model works via a points system that builds liquidity by rewarding users. Essentially, each order is given a score that rewards users who place higher bids and set lower asking prices. Instead of holding NFTs and always bidding low, users are thus incentivized to fill Blur’s liquidity pool order books, creating a more streamlined exchange mechanism.

In fact, digital resource research platform Delphi Digital has called Blur’s airdrops “the biggest reason for Blur’s increase in market share, aside from low fees and fancy tools.”

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.