On-Chain Signals Reveal Cardano (ADA) Is Significantly Undervalued: Crypto Insights Firm

Crypto analytics firm Santiment says on-chain signals for Cardano show that ADA is currently trading at a significant discount.

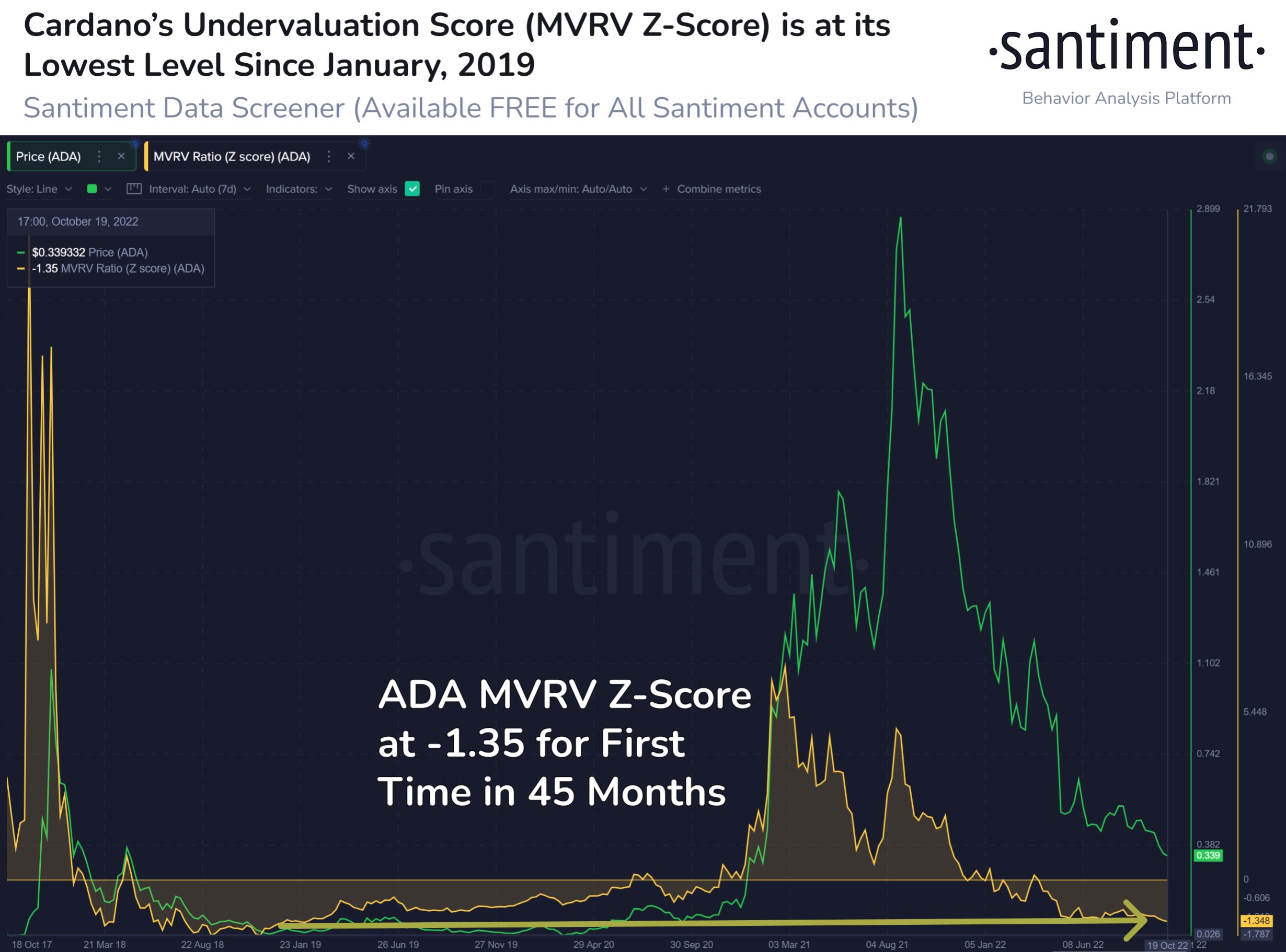

Santiment takes a look at Cardano’s MVRV Z-Score, which compares an asset’s total market value to its total realized market value.

Traditionally, a low Z-score suggests that an asset is undervalued. Santiment says the ADA’s MVRV Z-score is at its lowest level since January 2019.

“Cardano is now sitting at its lowest relative position compared to its realized value since January 2019. This is a sign of undervaluation based on average trader losses. ADA’s price doubled in the following three months the last time the MVRV Z-score reached this level.”

At the time of writing, ADA is trading at $0.34, down more than 88% from its all-time high.

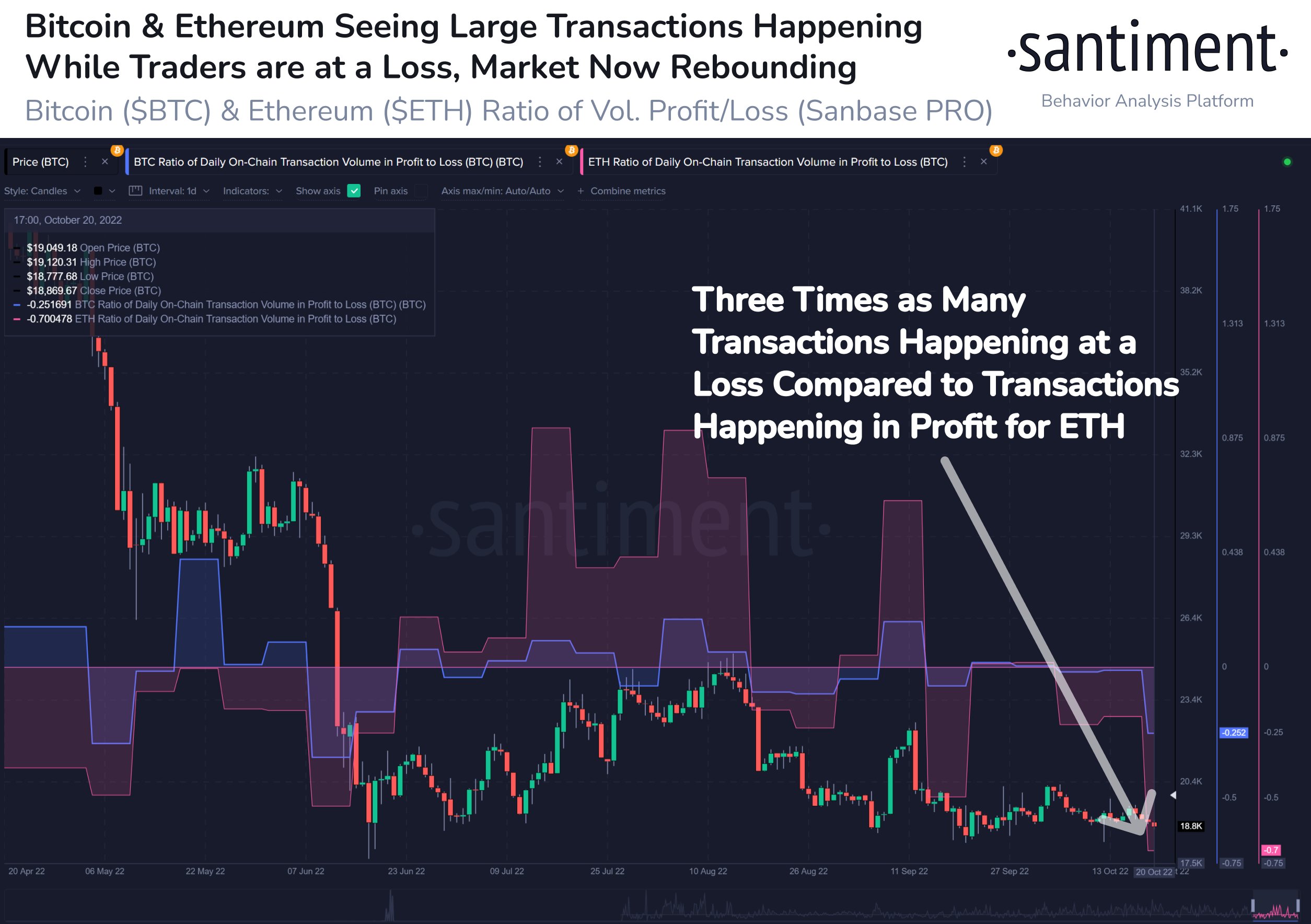

The research firm also says the overall crypto market is showing signs of capitulation, with many traders closing positions at a loss. According to Santiment, the capitulation is potentially starting with a market upswing.

“Signs of capitulation have emerged on Friday, including transactions from addresses that are swapping out their assets while running at a loss. Bitcoin sees lowest ratio of loss vs. profit transactions in 4.5 months, and Ethereum sees historic lows.

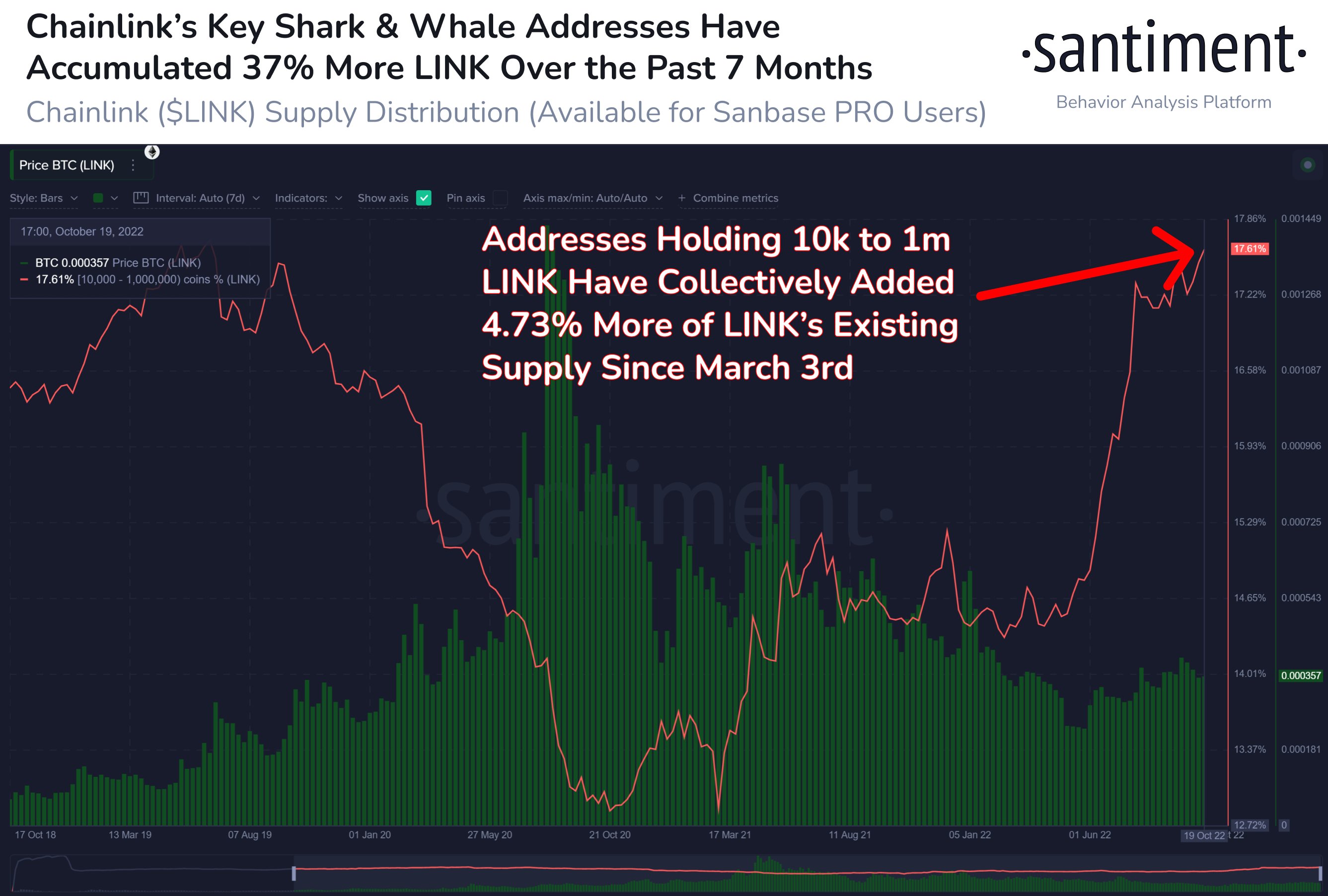

While many crypto assets are seeing signs of capitulation, Santiment has also seen heavy accumulation of altcoins by deep-pocketed investors.

Last week, the firm said major investors in decentralized oracle network Chainlink had accumulated more than $312 million in LINK since the start of the 2022 bear market.

“Chainlink’s shark and whale addresses (with 10,000 to one million LINKs) have been busy accumulating during the 2022 bear market. Since March 3, these addresses have added 47.31 million LINKs to their wallets, collectively. This corresponds to 312.7 million dollars more invested.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Bruce Rolff