On-Chain data shows that Bitcoin miners can prepare to dump

Data on the chain show that Bitcoin miners pulled a large amount of coins from their wallets yesterday, indicating that they may be planning to sell them.

Bitcoin Miners transferred 14k BTC without reserve yesterday

As pointed out by an analyst in a CryptoQuant post, the BTC mining reserve observed a drop over the last day.

“Miner reserve” is an indicator that measures the total amount of Bitcoin currently stored in the wallet of all miners.

As the value of the metric increases, it means that a net number of coins are currently entering the miner’s wallets.

Such a trend, when extended, may indicate that these chain validators are accumulating right now, and may thus be bullish on the crypto price.

On the other hand, a declining value of the reserve indicates that miners are currently withdrawing a net amount of BTC.

Related reading | Bitcoin volume saw false peaks due to Binance’s fee waiver

Since they usually transfer their coins to sell on stock exchanges, this type of trend can be bearish for the value of BTC.

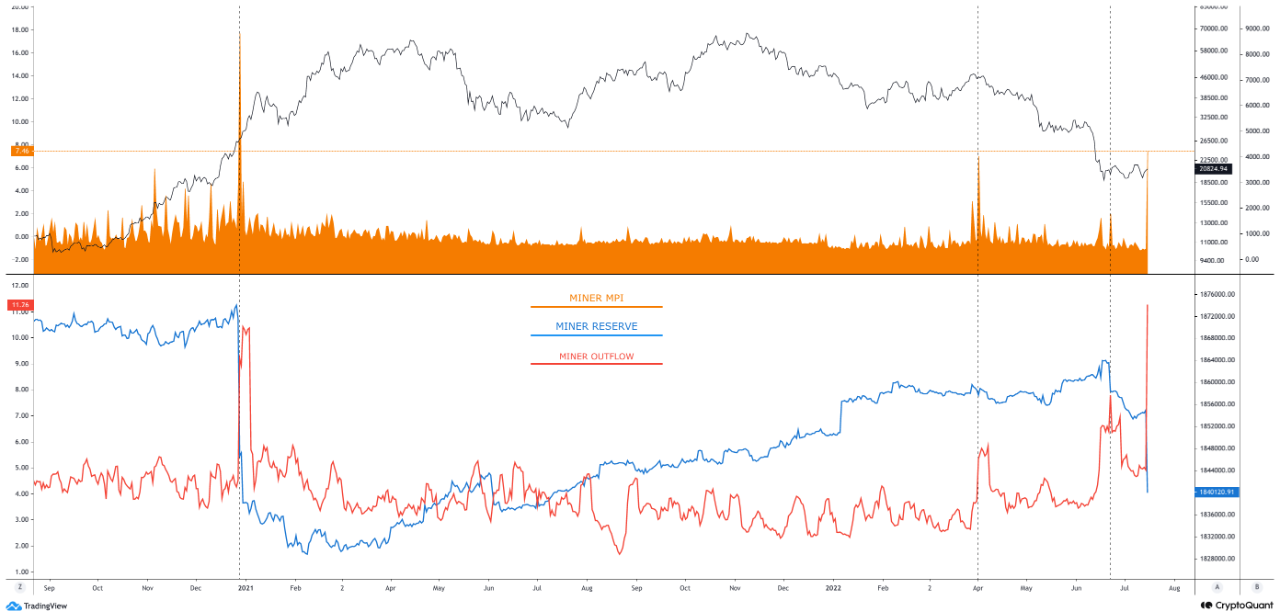

Now, here’s a chart showing the trend in the Bitcoin mining reserve over the last couple of years:

Looks like the value of the indicator has sharply declined recently | Source: CryptoQuant

As you can see in the graph above, the Bitcoin mining reserve has observed a significant decline in the last day.

The chart also includes data for two other indicators: BTC Miners’ Position Index and BTC Miner Outflows.

Related reading | Here’s who was behind Bitcoin’s recovery to $ 22,000 according to open interest

The outflow is just the total amount of coins coming out of the miner’s wallets. As expected from the precipice in the reserve, this metric has also fallen sharply in value.

What the “Miners’ Position Index” (MPI) does is that it compares this current outflow value with the 365-day moving average of the same.

This tells us how the current mining sales can be compared to what was observed during the last year.

This indicator recorded a large increase yesterday. The last two times such large peaks were seen, Bitcoin began to decline some time later (or immediately in the case of the peak in April).

If the latest trend is something to go by, this can probably turn out to be bearish for the value of the crypto.

BTC price

At the time of writing, Bitcoin’s price is floating around $ 20.7k, down 4% over the last seven days. Over the past month, the crypto has lost 8% in value.

The price of the coin seems to have stagnated during the past couple of days after a move up | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com