Oldest Bitcoin Holders Begin Selling; FTX court filings reveal SBF’s $1 billion loan from Alameda

The biggest news in the cryptoverse for November 17 includes the high selling trend of Bitcoin holders older than 10 years, SBF’s $1.6 billion personal loan from Alameda Research, and the emergence of Bitcoin and Ethereum as the second and third most shorted cryptoassets.

CryptoSlate Top Stories

Who sold the most BTC in the wake of the FTX collapse? 10-year bonds are selling at the highest price ever

The collapse of FTX put enormous pressure on investors, while the price of Bitcoin (BTC) fell as low as $15,000.

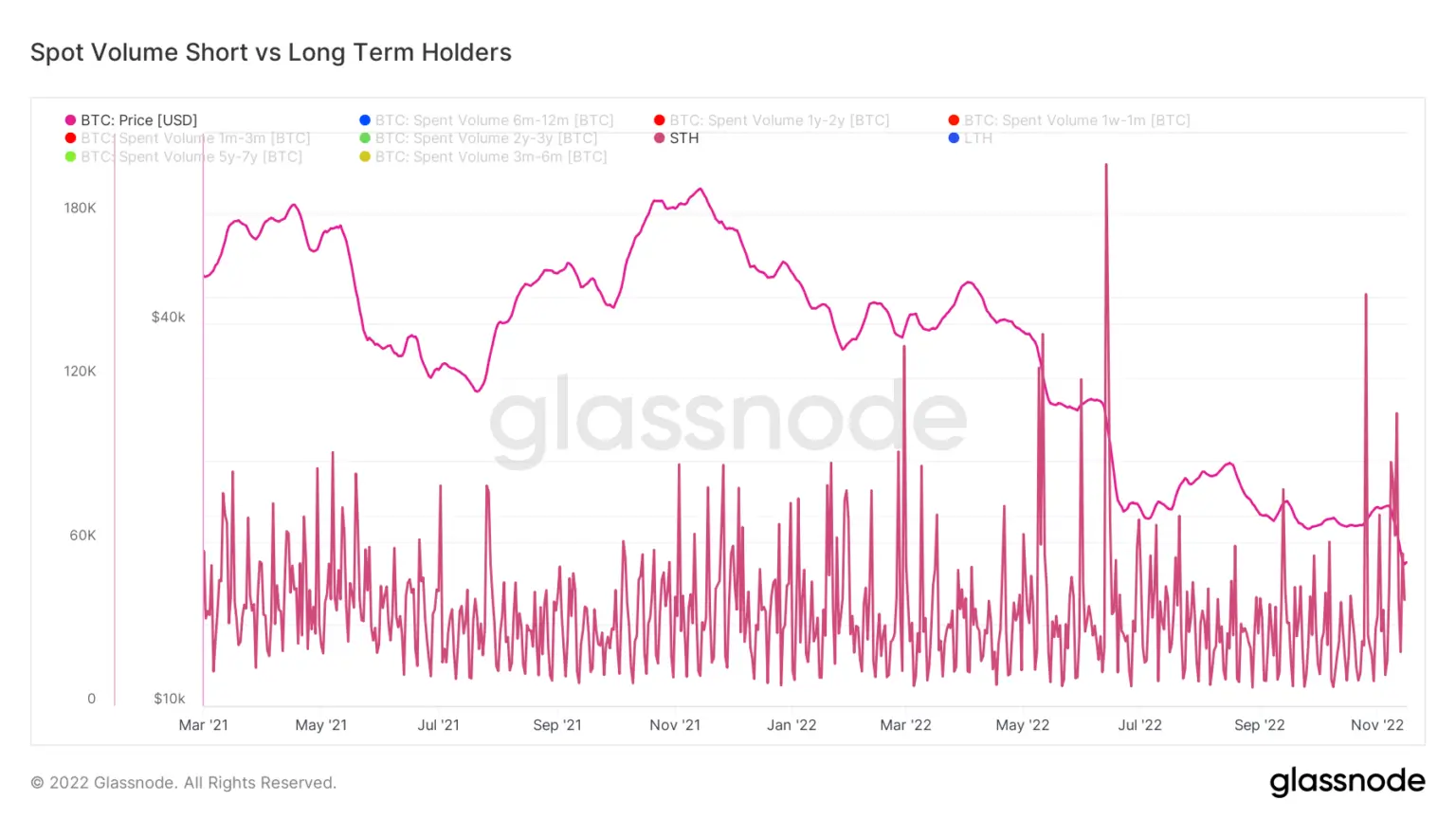

To reveal where the selling pressure was coming from, CryptoSlate analysts surveyed short-term (STH) and long-term (LTH) holders.

While history shows that LTH is the first to sell its coins when the numbers start to fall, the turmoil after the FTX collapse did not calm the confidence of long-term holders.

Instead, the market recorded its fifth largest number of STH sellers since March 2021, which equates to around 400,000 Bitcoins sold by STH between November 10th and November 17th.

FTX bankruptcy court reveals Alameda made $1.6 billion in loans to SBF, others

FTX’s new CEO John Ray III’s proceedings revealed that Sam Bankman Fried (SBF) received $1 billion in personal loans from Alameda Research.

Ray referred to the situation as a “complete failure of corporate controls and such a complete absence of reliable financial information.”

The filing also revealed that Alameda loaned $543 million to FTX Director of Engineering Nishad Singh and $55 million to FTX Co-CEO Ryan Salame.

FTX collapse causes Bitcoin, Ethereum to be shorted the second and third largest amounts

After the FTX collapse, Ethereum (ETH) became the second most shorted crypto in the market, followed by Bitcoin as the third.

According to the average funding rate set by exchanges for perpetual futures contracts, long positions pay periodically, while shorts pay whenever the interest rate turns positive. The recent deep negative fund yields indicate a coming depression before the markets begin to heal.

Genesis applied for a $1 billion emergency loan, but never got it

Crypto lender Genesis sought a $1 billion emergency loan from investors but never got it, as the Wall Street Journal reported.

The reports noted that Genesis sought the funds due to a “liquidity crisis due to certain illiquid assets on the balance sheet.”

The FTX attacker continues to exchange tokens; trades $7.95 million BNB for BUSD, ETH

The FTX attacker kept his hands busy on November 17, draining around $600 million in one day. In three transactions, they exchanged 30,000 BNB tokens for Ethereum and Binance USD (BUSD).

The exploiter currently holds $11.8 million in BNB and ETH, worth around $346.8 million at today’s price level.

President Bukele reveals that El Salvador will buy 1 Bitcoin daily

El Salvador’s President Nayib Bukele announced that the country will begin buying one Bitcoin daily, starting November 18.

We buy one #Bitcoin every day starting tomorrow.

— Nayib Bukele (@nayibbukele) 17 November 2022

El Salvador has been heavily criticized for its Bitcoin investments. However, the country did not fall and continued to express its confidence in crypto. El Salvador spent over $100 million to acquire the 2,381 Bitcoins it has today.

Mainstream media called for gaslighting over Sam Bankman-Fried’s good guy tale

The crypto community responded to the mainstream media to publish articles favoring SBF, even after FTX’s collapse.

The community recalled the imprisonment of Tornado Cash developer Alexey Pertsev and expressed their frustration that SBF was free.

Circle lowers yield to 0%

USD Coin (USDC) issuer Circle cut the APY rate for its yield product to 0% and said the yield product is over-collateralized and secured by “robust security agreements.”

An announcement on Circle’s official Twitter also detailed the oversecured fixed rate product.

1/ Circle Yield is an oversecured fixed interest product. Genesis is Circle’s counterpart in this product. Total outstanding customer loans with Circle Yield are $2.6 million as of 11/16/22 and are protected by robust collateral agreements.

— Circle (@circle) 16 November 2022

Singapore’s Temasek Writes Off $275M FTX Investments Had Misplaced Faith Sam Bankman-Fried

Singapore-based investment fund Temasek said it was writing off its $275 million investment in FTX, saying it had misplaced its “faith in the actions, judgment and management” by placing them on SBF.

The company said:

“The brief for our investment in FTX was to invest in a leading digital asset exchange that gave us protocol agnostic and market neutral exposure to crypto markets with a fee income model and no trading or balance sheet risk.”

News from the entire Cryptoverse

Research highlight

Research: 78% of all staked ETH is across 4 centralized providers; 74% of all blockchains are OFAC compliant

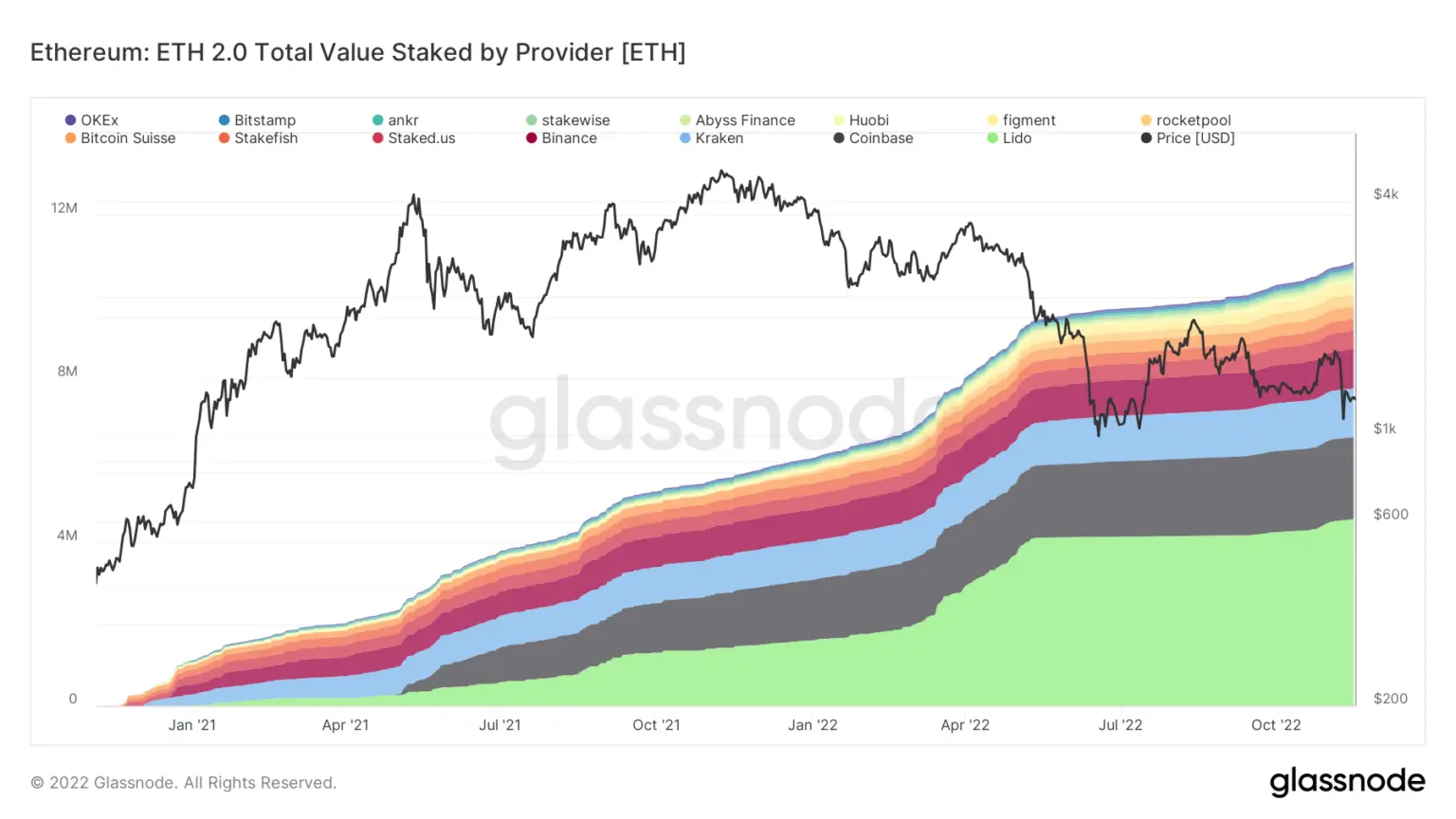

CryptoSlate analysts examined Ethereum staking on-chain data and revealed that around 78% of all staked Ethereum is spread across four centralized providers.

There are currently 8-9 million Ethereum staked on Lido (4.5 million), Coinbase (2 million), Kraken (1.2 million) and Binance (1 million).

Almost 75% of all Ethereum blocks are considered OFAC compliant. 15% of all blocks produced by Ethereum are still non-OFAC compliant, and the other 11% are non-MEV-Boost blocks.

Crypto market

Over the past 24 hours, Bitcoin (BTC) gained 0.58% to trade at $16,678, while Ethereum (ETH) fell 0.73% to trade at $1,202.