Old Bitcoin Supply Moves Into Derivatives, Whales Set Up Long Positions?

On-chain data shows that Bitcoin supply older than two years has moved into derivatives exchanges recently, suggesting that whales may be positioning themselves in the futures market.

Derivative exchange supply of Bitcoin supply older than 2 years has increased

As pointed out by an analyst in a CryptoQuant post, the recent dominant open interest has declined while some old coins have just been moved to exchanges.

The relevant indicator here is the “derivative exchange inflow”, which measures the total amount of Bitcoin moving into wallets on all derivatives exchanges.

A modified version of this metric, the “age intervals for input used output”, tells us what the individual contribution has been from the various age groups to the total inputs.

The investor groups of interest here are those who have held onto their coins for at least 2 years without selling or moving them (until now).

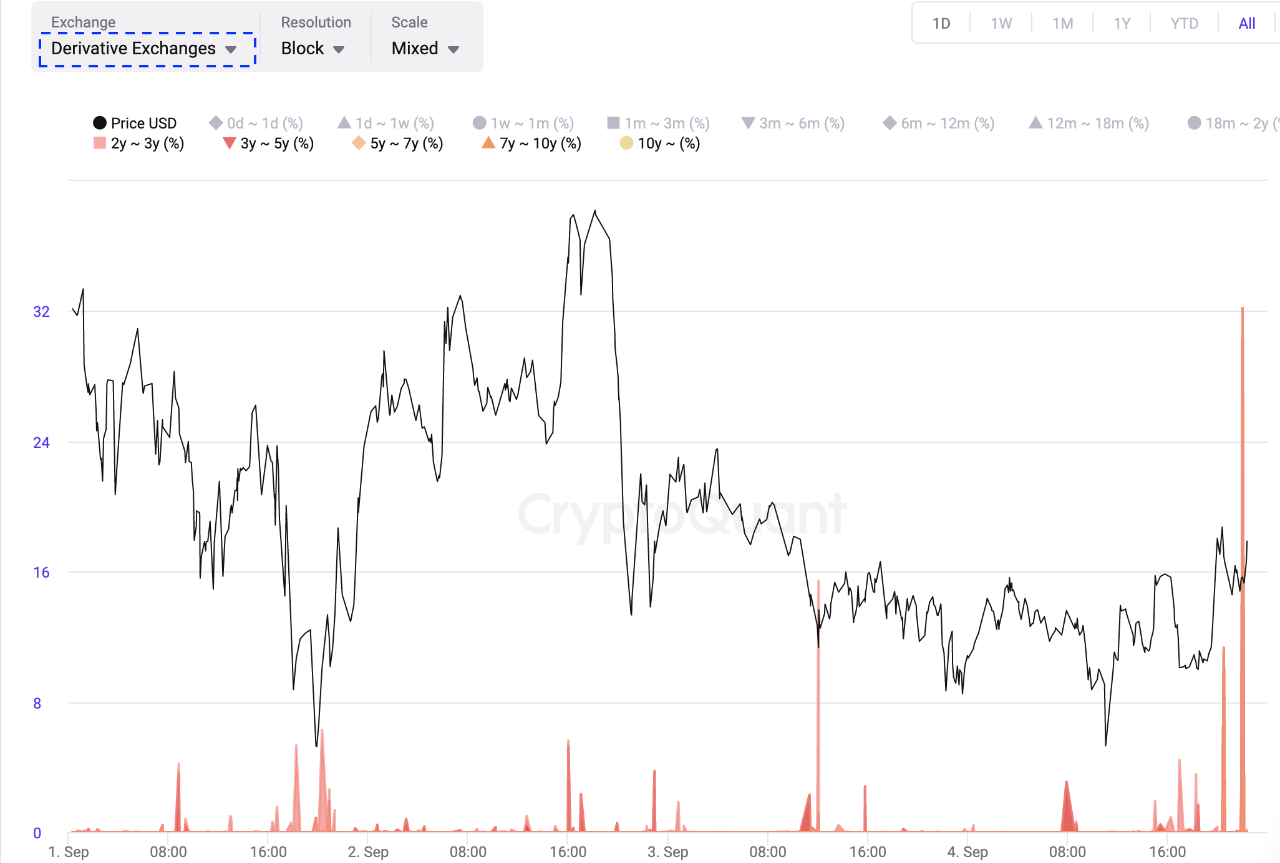

Looks like the value of the metric has spiked up over the past day | Source: CryptoQuant

As you can see in the graph above, Bitcoin derivative exchange inflows from the 2-year-old investor group have increased recently.

This shows that these BTC hodlers are moving significant amounts to exchanges to set up positions in the derivatives market.

It is unclear whether this transfer is with the intention of opening long positions, or whether it is to secure spot positions by using shorts.

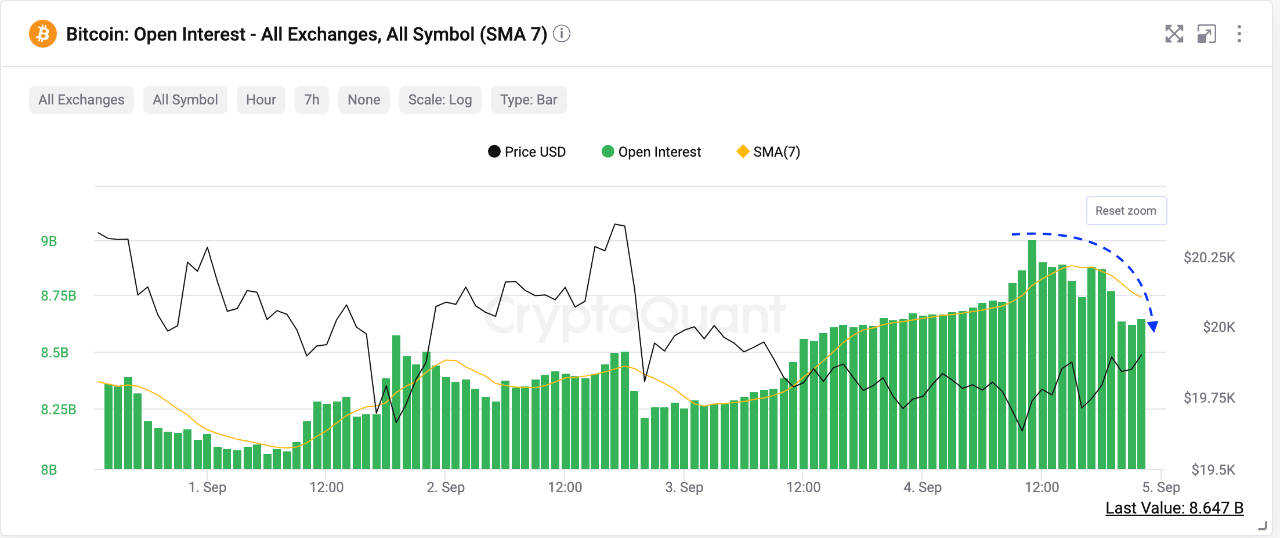

However, the trend in another indicator, the open interest, may contain hints as to the target of these inroads. This metric measures the total number of positions currently open on derivatives exchanges.

Recently, funding rates were slightly negative, which suggests that the open rate was short-dominant. However, as the chart below highlights, this indicator’s value has declined over the past 24 hours.

The value of the indicator seems to have slumped down after rising during the last few days | Source: CryptoQuant

The value of Bitcoin open interest falling may indicate that some of the short positions are now closed.

It now remains to be seen whether the market shifts towards a long dominant environment or not in the coming days as exchanges receive new big inflows like the last one.

BTC price

At the time of writing, Bitcoin’s price is hovering around $19.7k, down 2% in the last seven days. Over the past month, the crypto has lost 12% in value.

Below is a chart showing the trend in the price of the coin over the last five days.

The value of BTC hasn't showed much movement during the last few days | Source: BTCUSD on TradingView

Featured image from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com