Offline Customers Stick to Digital Habits – Global X ETFs

Consumers may go offline and back to stores to shop, but when they do, they will go digitally to pay. Smartphone payments and payment options continue to be accepted, driving the shift away from cash and card swipes as merchants rapidly install modular point-of-sale (POS) systems. Makropress took some of the air out of fintech in general in 2022, including the emerging online lending and buy-now-pay segments. However, it’s important to remember that the pandemic spurred growth for many fintech companies. With nearly 1.4 billion people over the age of 15 worldwide still unbanked, fintech has a critical role to play in expanding access to financial services.1

Even in the midst of challenging economic conditions, we believe that the Fintech mega-theme can provide growth and gain transformative terrain, especially at the point of sale.

Important takeaways

- Customers increasingly prefer their time in store to be as limited and efficient as possible, and POS systems have emerged as a sophisticated and cost-effective solution to meet this demand.

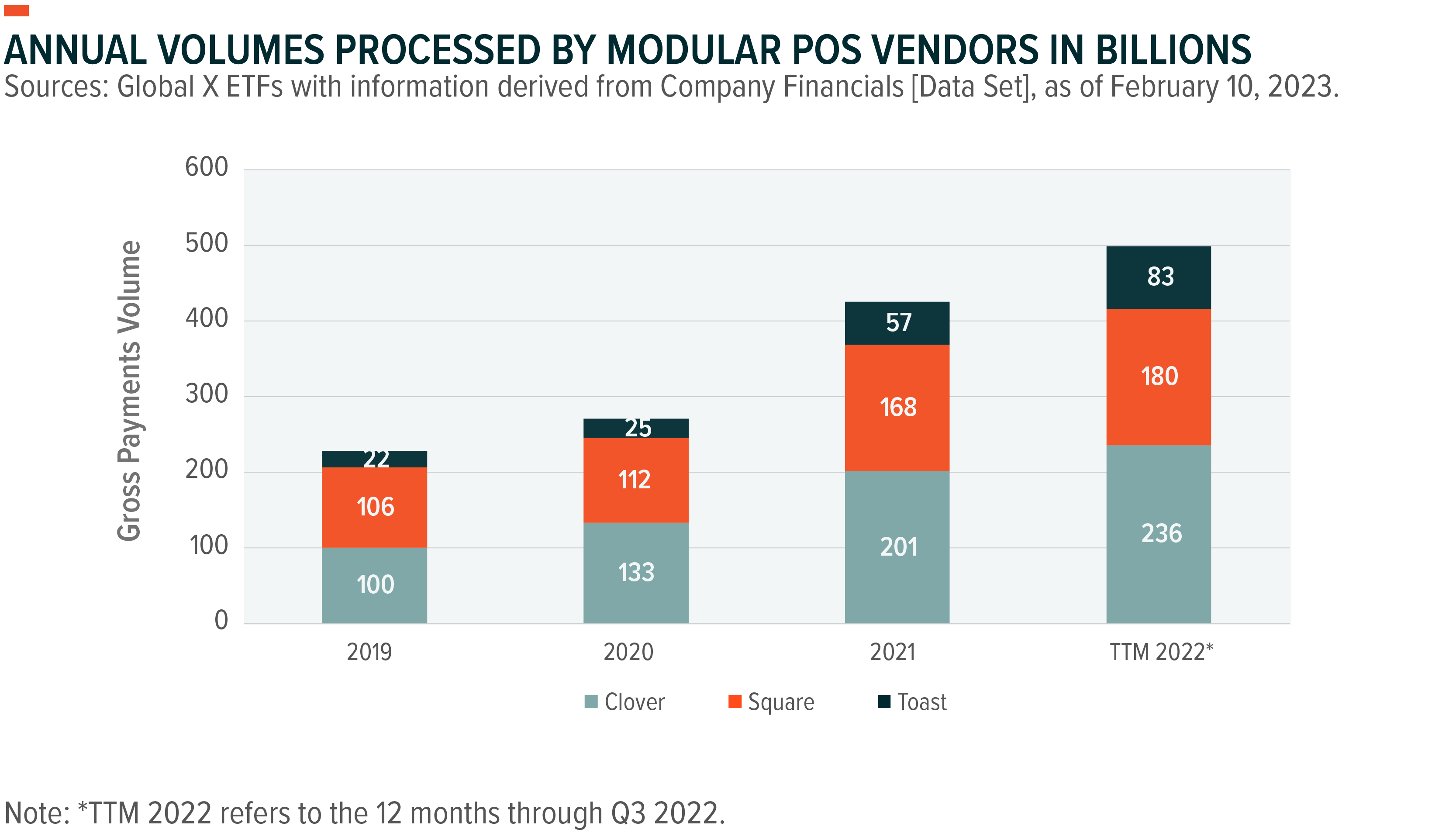

- Increasing payment volume for first movers and industry leaders, including Square, Toast and Clover, has brought Big Tech into the fold.

- As major players such as Apple adopt POS capabilities, traditional fintech companies are adapting through collaboration and new business verticals.

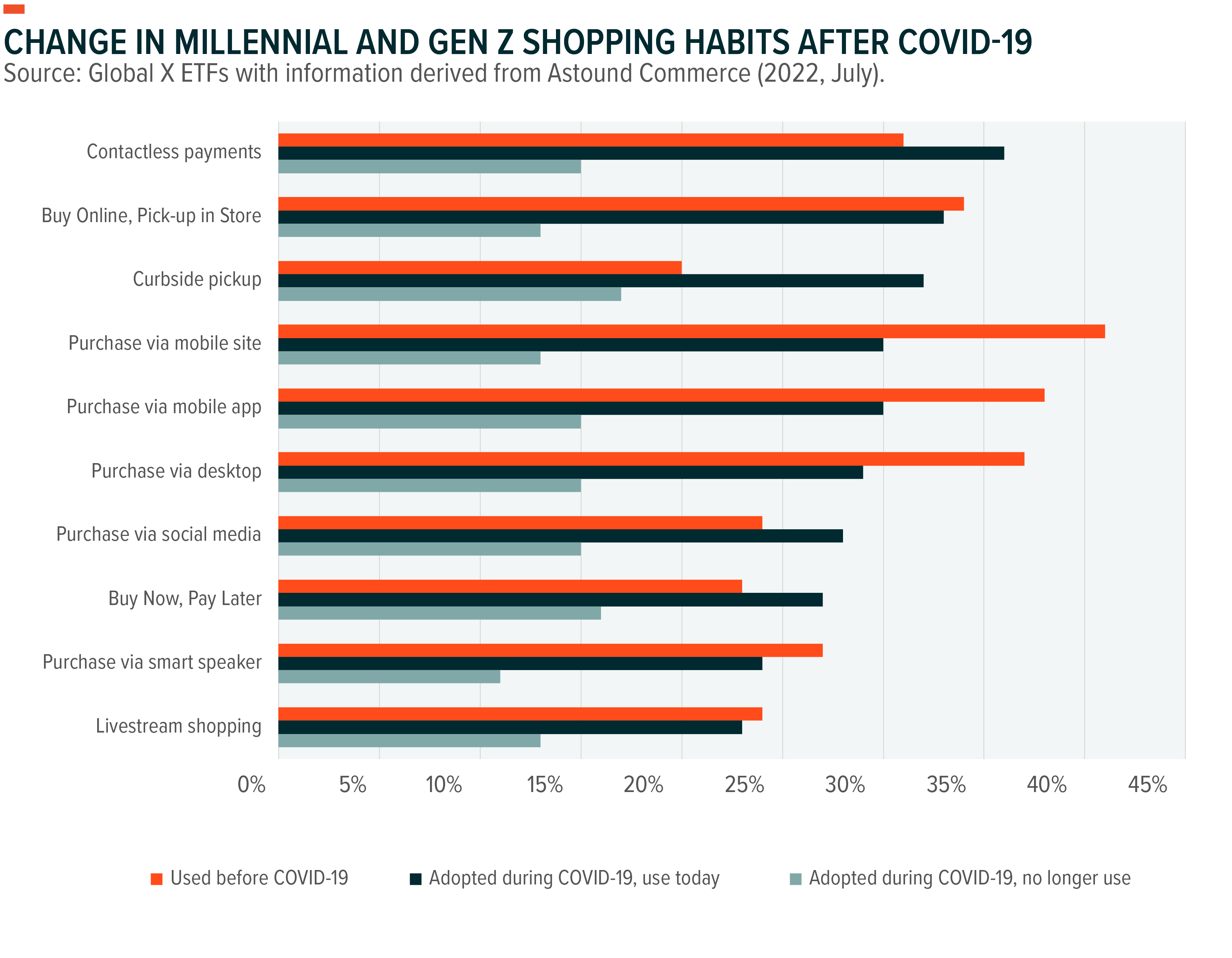

Consumers’ pandemic shopping habits are here to stay, forcing innovation

The way the average shopper needed to acquire products and services changed drastically during the pandemic. COVID-19 gave rise to consumer expectations for cashless payment methods, leading to an increase in the use of mobile wallets and contactless payments at the point of sale.

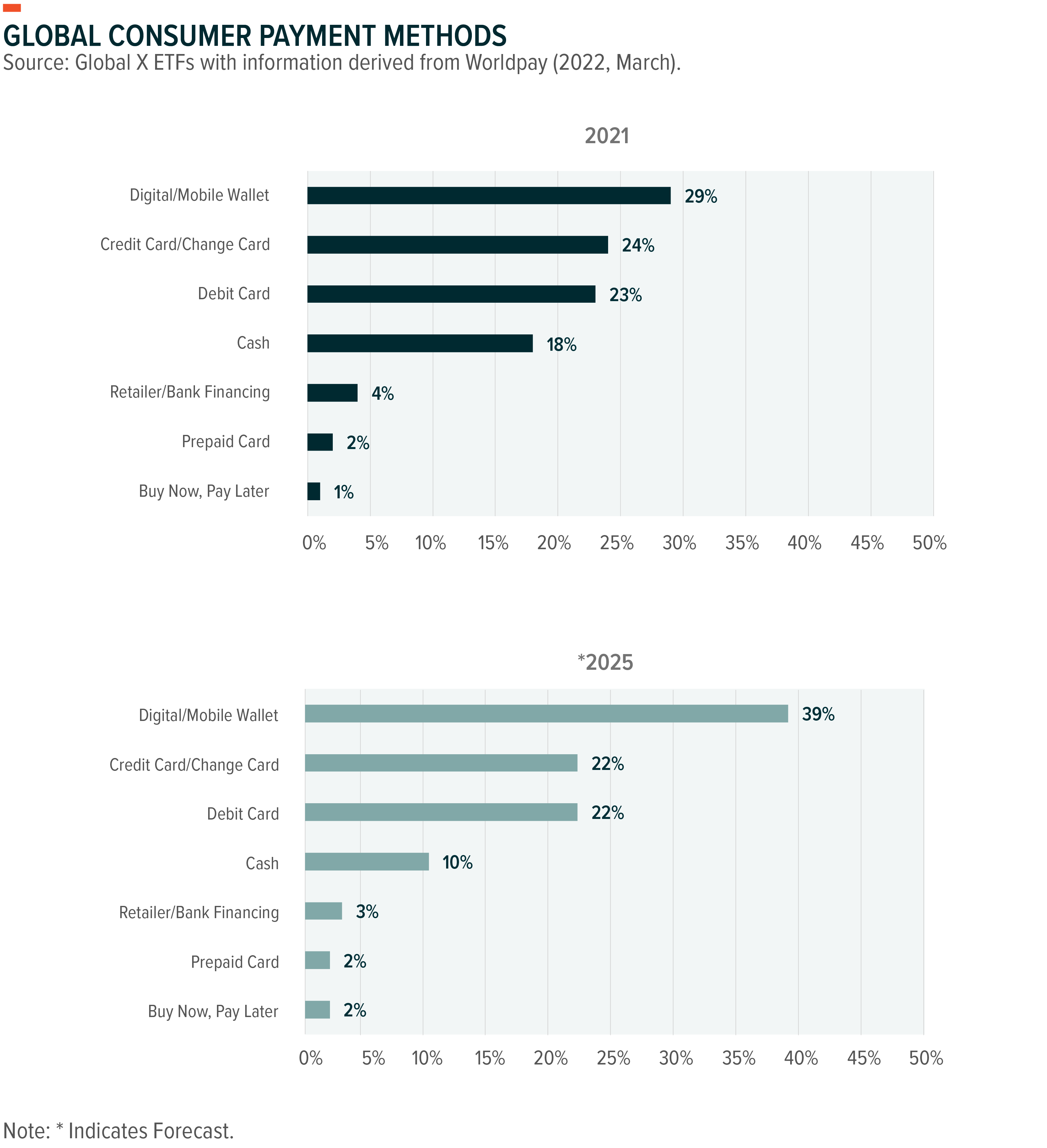

In 2021, mobile wallet payment was the most used POS method globally, accounting for 29% of the market share, up from less than 26% in 2020.2.3 By 2025, mobile wallets are estimated to account for nearly 40% of all POS transactions worldwide.4 Despite progress in mature economies such as the US, cash still accounts for 11% of the point-of-sale payment market, indicating meaningful growth potential.5 In emerging markets, where digital payments penetration is much higher due to financial inclusion opportunities and favorable demographics, China leads the POS payments market with 54% of consumers, followed by India with 25%.6

Customers increasingly prefer their time in store to be as limited and efficient as possible. Emphasizing cash is one step towards this kind of shift, but efficient POS processing is just as important. In a recent Visa survey, 41% of consumers surveyed in nine markets around the world said they had abandoned their shopping carts in a brick-and-mortar store because it did not have digital payment options.7 Global POS transaction values are estimated to approach $58.9 trillion by 2025.8 Alongside this rapid digitization of the global economy is the decline in physical cash payments, which are expected to fall from 18% in 2021 to 9.8% of the total share by 2025.9

As a result of these evolving consumer habits and system shifts, today’s POS systems are much more sophisticated than they were a decade ago. Small businesses required multiple solutions from POS vendors to serve omnichannel operations, and platforms committed, now selling services such as inventory management, back-office software, time management tools, and internal accounting. Businesses also evolved to access, analyze and control customer information generated at the point of sale, through a single interface. Over the past few years, this has begun to allow retailers to run loyalty programs, offer promotions and power effective social marketing.

Fintech’s success is encouraging Big Tech to seize an opportunity

Disruptive fintech platforms achieved great success in helping the local provider to digitize. Square, the pioneer of the smartphone-based POS system, processed $180 billion on an annualized basis through Q3 2022 following the strong resurgence of the offline consumer.10 Toast, which sells modular POS solutions to restaurants, reported top-line growth of 55% and payment volume growth of 53% during the same period.10 Legacy payment processors such as Fiserv and Fidelity National also reported strong growth, particularly for their modular solutions. Fiserv, which owns Clover, reported that gross payment volume (GPV) grew to $236 billion in the 12 months through Q3 2022.12 This is compared to $196 billion in the same period a year ago.1. 3

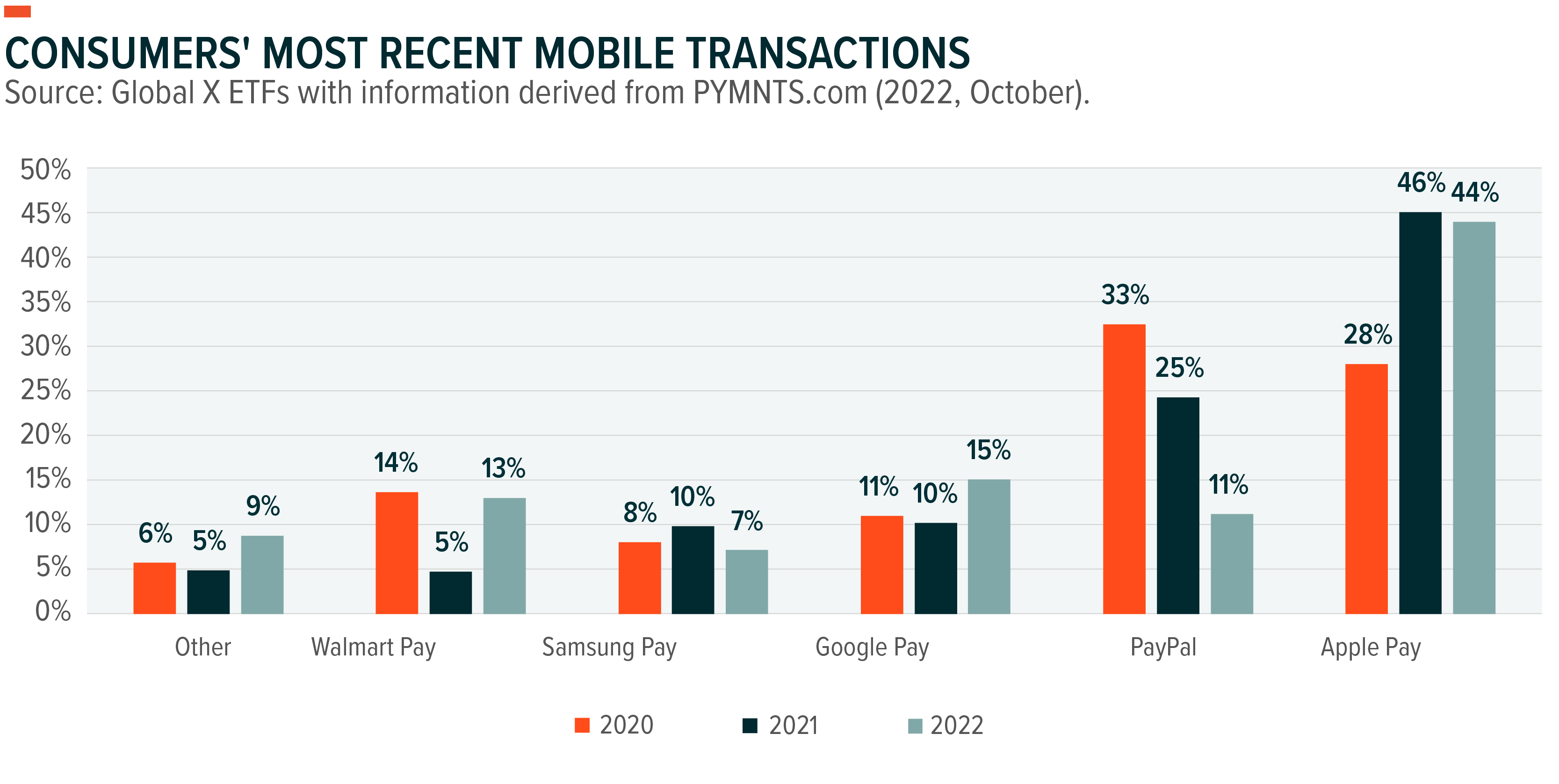

The success of disruptors such as Square, Toast, Clover and technology-first companies in digital wallets and POS systems did not go unnoticed by the largest technology companies. Apple Pay is the leader in mobile payment platforms, capturing nearly 44% of in-store mobile wallet transactions as of Q3 2022.14 On a relative basis, Apple cardholders numbered 6.4 million in the US in May 2021—70% of whom are in their 20s and 30s.15

New product launches outline big tech’s vision. For example, in June 2022, Apple announced its upcoming buy now, pay later service known as Apple Pay Later. The feature integrates seamlessly into the pre-installed Wallet app and, when available, will appear as another option on the Apple Pay payment screen. In addition, Apple Pay Later works with any credit or debit card that Apple Pay supports.

The pandemic helped digital channels such as POS systems quickly gain traction among younger, tech-savvy generations in developed countries. Digital wallet adoption by these demographics shows clear growth in recent years. Sixty-five percent of young millennials used a digital wallet in 2021, compared to 59% in 2020. For Gen Z, digital wallet usage increased to 57% in 2021 from 50% a year earlier.16 With a combined spending power of nearly $350 billion in the US, these consumers are an increasingly powerful target for businesses, and investments here also act as a hedge against demographic change.17

Tap to Pay, Fintech’s Next Big Thing?

One of the most important implications of POS system upgrades is the increase offered by contactless payments, further fueling the growth of fintech offerings from major technology companies. Print to pay volumes continue to increase in the US. For 2022, US loss to pay expenses per user is expected to grow 30% year-over-year (YoY) to $4,177.18 Major technology and fintech giants are jumping to make the most of the opportunity.

In February 2022, Apple unveiled its Tap to Pay feature, which allows users to pay someone by tapping their iPhone against theirs. With Apple Pay accepted at more than 90% of US retailers already, merchants of all sizes are expected to gravitate towards Tap to Pay.19 For small businesses, Apple’s Tap to Pay can be particularly beneficial because merchants can accept contactless payments without the need for additional hardware, making it a cheaper option. Google is another tech giant that stepped into the faucet to pay for space. In 2022, the company launched Google Wallet to connect it to Google Pay. Google Wallets have a Near Field Communication (NFC) card interface, underscoring the rise of POS.

The vast reach of companies like Google and Apple, which serve billions of consumers globally, could increase the use of digital payments globally for merchant processing. With a smartphone, merchants do not need to invest in a POS machine. The implications of affordable mobile processing gaining momentum in underbanked emerging markets such as Africa, Asia and Latin America could be transformative, in our view.

By 2027, 99% of smartphones will be capable of making contactless payments, and contactless payments in the US are projected to nearly double to 8.3 billion transactions.20 This growth translates into promising prospects for fintech companies playing in this arena , especially those who work closely together. with major technology players.

For example, Square Seller Services and Cash App are established partners with Apple Pay. Even PayPal implements Apple Pay in its back-end payment platform, Braintree. These partnerships also help accelerate the transition of modern POS vendors away from selling hardware to small retailers, allowing them to focus on monetization through services and subscriptions where they earn a large portion of their gross profit.

POS payments are projected to grow at a consistent 6% compound annual growth rate (CAGR) globally through 2025, with the strongest growth in Latin America at 8% and Asia Pacific at 7%.21 However, we believe that actual growth could easily exceed these estimates.

Conclusion: Digital payments a new standard

Modular POS solutions are rapidly gaining ground as small and medium-sized businesses (SMBs) digitize to meet new consumer preferences, especially those of younger generations. The growing use of digital payments in the US is driving the demand for payment options and providing cost-effective options for merchants to go digital. In addition, fintech companies are expanding their offerings to include functions such as lending, accounting and back office operations. Despite current economic conditions limiting growth in 2022, we expect widespread adoption of these fintech solutions in the long term as the consumer becomes even more digital – positioning these companies for upside surprises.

Related ETFs

FINX – Global X Fintech ETF

EBIZ – Global X E-commerce ETF

EWEB – Global X Emerging Markets Internet & E-commerce ETF

Click on the fund name above to view current holdings. Stock is subject to change. Current and future holdings are exposed to risk.