Nvidia Stock: 2018 Crypto Winter Replay? (NASDAQ:NVDA)

Antonio Bordunovi

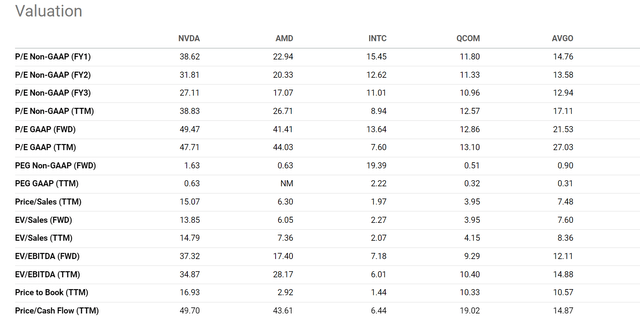

FYQ2 outlook and thesis

Things have changed quickly for Nvidia (NASDAQ:NVDA) during the last few months. Let’s start with a recap of Q1 FY2023 earnings reported on May 31, 2022, just less than 3 months ago. In that report there is gambling the segment was a bright spot. The segment achieved total revenue of $3.6 billion, a healthy 6% growth from the previous quarter and a whopping 31% year-over-year growth. The RTX 30 series has reported the best gaming product cycle ever.

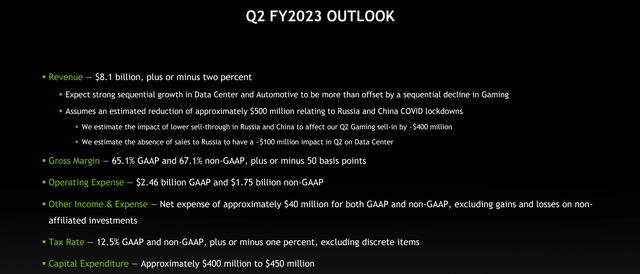

However, the business was already feeling weakness lurking. It provided sales guidance of $8.1 billion for Q2, representing a 2% decline compared to Q1, driven primarily by a sequential decline in the Gamin segment. Although the guidance still represents growth of 25% year-on-year.

NVDA Q2 FY2023 IS

Now the preliminary results for the second quarter turned out to be much worse than the guidance above. According to the following Reuters report, the key takeaways are (slightly edited and highlights added by me):

Nvidia Corp warned on Monday that second quarter revenue to fall 19% from last quarter about weakness in the gaming business … Nvidia said so the gaming unit’s preliminary revenueswhich includes the sale of high-end graphics cards for desktop and laptop computers, fell 44% from the previous quarter to $2.04 billion.

So second quarter revenue will be down 19% from last quarter instead of the expected 2%. And the gaming unit’s 44% contraction reminds me of the cryptocurrency winter it suffered in 2018, as discussed immediately below. This leads me to the main task here as well. I see similar effects from crypto crashes on both stock prices (through market psychologies) and fundamentals (through exposure to crypto mining).

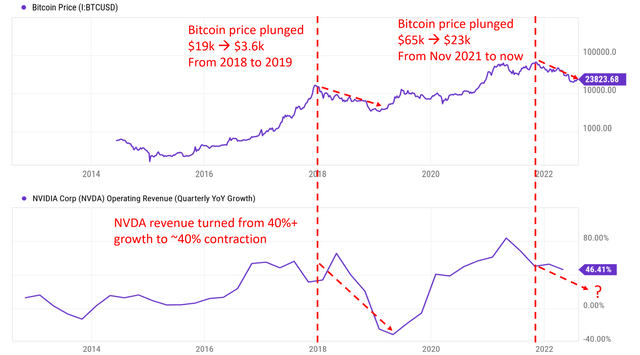

Anatomy of the crypto winter 2018

The following charts show the anatomy of the 2018 crypto winter, with the top panel showing Bitcoin USD (BTC-USD) prices and the bottom panel showing NVDA’s quarterly operating income growth on a year-over-year basis. As you can see from the top panel, Bitcoin prices collapsed from over $19,000 at the peak in 2018 to around $3.6,000 in a year (an 81% decline, which would take a 427% rally to breakeven ). And NVDA’s quarterly operating income turned from a 40%+ expansion to a ~40% contraction at the same time.

NVDA used to provide an estimate of its crypto mining exposure in the past. For example, in 2018, NVDA estimated that its crypto-related sales were around $0.6 billion (about 5.7% of its total sales of $10.6 billion). While another independent analyst (Mitch Steves at Business Insider) gave a much higher estimate of $1.95 billion of crypto/blockchain related revenue (about 18.4% of its then total revenue). I guess the true answer is somewhere between the two estimates above.

Currently, we are experiencing a similar collapse in bitcoin prices. Bitcoin prices plunged from over $65,000 in November 2021 to the current $23.8,000 (a 64% decline, which would require a 173% rally to break even). And now we have to estimate how much impact this collapse will create for NVDA this round.

Seeking Alpha

Will the 2018 crypto winter repeat itself?

NVDA no longer provides estimates for crypto-related sales, and the range of estimates has become even wider in my view. On the one hand, CFO Colette Kress (abbreviated and underlines added by me) commented during FY Q1 earnings that it’s difficult to get such an estimate, but NVDA expects a slowdown going forward.

…the extent to which cryptocurrency mining contributed to gaming demand is difficult for us to quantify with any reasonable degree of precision. The reduced increase in Ethereum network hash rate likely reflects lower mining activity on GPUs. We expect a decreasing contribution going forward.

On the other hand, its most recent 10-Q acknowledged the risks associated with crypto mining in fairly specific language (emphasis added by me):

Changes in cryptocurrency standards and processes including, but not limited to, the pending Ethereum 2.0 standard may reduce the use of GPUs for Ethereum mining, as well as create increased resale of our GPUs.affect the retail prices of our GPUs, increase the return on our products in the distribution channel, and may reduce demand for our new GPUs.

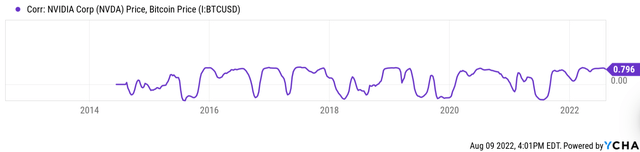

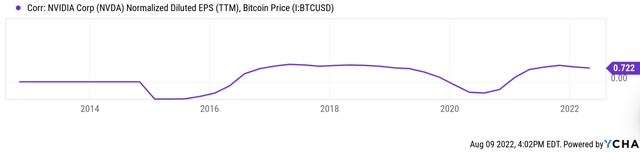

Although from all of these following data points that I have gathered, I suspect that NVDA still has a large exposure to crypto mining. First, this Reuters report estimated that NVDA has actually increased the supply of cryptocurrency mining processors in the last quarter, and that crypto-related sales contributed $266 million in Q2 last year. Second, the large exposure to crypto mining would help explain (but not prove) the 44% quarter-over-quarter decline in gaming segment revenue. Finally, as you can see from the following two charts, NVDA is quite highly correlated to bitcoin prices both in terms of stock prices and EPS. The first chart shows a fluctuating correlation between bitcoin prices and NVDA stock prices, which largely reflects market psychology. Although the long-term average is a positive 0.26, the correlation is currently near a peak of around 0.8. The second chart shows the correlation between bitcoin prices and NVDA EPS, which is more reflective of business fundamentals. And as you can see, the correlation here is more stable and also positive most of the time. The long-term average is also stronger at 0.49. And the current correlation of 0.72 is also near an all-time high.

Seeking Alpha Seeking Alpha

The difference between the 2018 episode and this one

Finally, my view is that the crypto crash of 2018 was largely caused by market psychology. This ongoing 2022 episode, on the other hand, has a fundamental aspect due to Ethereum’s pending network transition from proof-of-work to proof-of-stake (the so-called merger). The merger is expected to take place at the end of September 2022. This merger is expected to force the mining industry to find other ways to make money (thus affecting the fundamentals of the crypto business) and also to reduce processor usage (thus affecting the chip businesses like NVDA).

Final thoughts and other risks

In summary, I see the current development around cryptomining and NVDA as a replay of the cryptocurrency winter of 2018. During the 2018 episode, Bitcoin prices crashed by more than 80% in one year, and NVDA’s quarterly operating income growth turned from 40%+ to negative ~40%. In this 2022 episode, we see a 64% decline in bitcoin prices since November 2021 and a 44% QoQ decline in NVDA’s gaming revenue. Going forward, I continue to see signs that indicate NVDA’s significant exposure to crypto mining, either directly or indirectly. And as a result, I expect crypto crash pressure to persist on NVDA both due to market psychology and also fundamental business fundamentals.

In addition to the above exposure to crypto mining, NVDA also poses relatively high valuation risks, as you can see from the following chart. Compared to other chip stocks, NVDA is priced at a significant premium, both in terms of top line and bottom line. Take its FW PE as an example. Its FY1 PE currently stands at 38x even after recent major corrections. It is more than 65% higher than AMD and more than 2x or even 3x higher than other players such as AMD, INTC, QCOM and AVGO.

Seeking Alpha