Nvidia (NASDAQ:NVDA): The stock for cautious crypto investors

While the cryptocurrency market has been a positive revelation this year, everyone knows that the space offers high risks. Therefore, if you’re just a little bit confident about crypto and want to exercise more caution, you might want to consider tech giant Nvidia (NASDAQ:NVDA). Thanks to its blockchain mining-friendly graphics processing units (GPUs), Nvidia offers indirect exposure to digital assets while aligning with other relevant sectors. Therefore, I am positive on the NVDA share.

Cryptos may be a buy, but who really knows?

On the surface, crypto seems like a no-brainer proposition. Data from CoinMarketCap reveals that at the beginning of this year, the total market capitalization of all blockchain-derived assets measured just under $800 billion. At the time of writing, the sector rose to just under $1.28 trillion. Hard-hit advocates now have serious momentum underfoot, boosting enthusiasm. Nevertheless, some debts remain.

Remember that at the beginning of last year, the total market cap of all cryptos was over $2 trillion. Then, with all the huffing and puffing, the market recovered a little less than half of what it lost. It’s not a big deal, but investors need to consider the broader context before committing to too many funds.

Additionally, crypto and the wider ecosystem can be unusually cruel. For example, crypto exchange FTX used to rank among the most popular platforms for investors and blockchain advocates. However, prosecutors later accused FTX founder Sam Bankman-Fried of “fraud of epic proportions.” More than likely, the bad taste left over from the failure will linger for years.

At the same time, this case also presents the NVDA share in a rather positive light. Nvidia produces dedicated GPU processors for professional crypto mining companies, essentially providing the infrastructure for the burgeoning market.

The company may not know which coin or token can make it big. However, most crypto projects use the proof-of-work (PoW) consensus mechanism that allows the underlying blockchain to work. With PoW protocols being processor intensive, the company should benefit from a continuous demand if cryptos move higher. Thus, an investment in NVDA appears sensible.

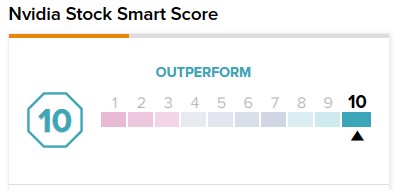

Bolstering the bull house, on TipRanks, NVDA stock has a “Perfect 10” Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

NVDA stock is poised to do well even if cryptos fail

Of course, with cryptos gaining a reputation for volatility, it is not out of the question for the sector to fall. In fact, potential traders should probably brace themselves for volatility or at least have a backup plan should it materialize. However, the compelling factor for NVDA stock is that the underlying business benefits from many other sectors it can address.

And to emphasize the point, investors should plan ahead for a range of outcomes if they choose to play in the crypto arena. Although the crisis in the banking sector that dominated the headlines last month doesn’t seem like a big concern right now, it very much is. Let’s be real – bank runs don’t materialize because people have confidence in the financial system.

Also, the surprise output cut by the Organization of the Petroleum Exporting Countries and non-member oil producing countries – an alliance known as OPEC+ – showed that the Federal Reserve is not the only major influencer on the US dollar’s trajectory. Given the many pressure points around, it is no wonder that some experts still believe that a recession could occur. If so, it would not be positive for crypto.

On the other hand, Nvidia continues to develop solutions for emerging sectors such as artificial intelligence (AI) and machine learning. So, a sector collapse is unlikely to dent the entire narrative.

Nvidia is overheated but reliable

To be fair, one factor may connect crypto and NVDA stock: both may be overheated. For the former asset category, investors can look at technical indicators for specific coins and tokens. As for the latter, NVDA is trading at a forward multiple of nearly 64. That’s well above the sector median of 21.8 times.

Nevertheless, due to Nvidia’s aforementioned relevances, in the medium to long term, NVDA stock arguably has more confidence. Furthermore, the economy supports the reliability angle. For example, Nvidia’s Altman Z-Score (a measure of solvency) pings at 22.8, reflecting high fiscal stability and low bankruptcy risk.

Operationally, the company enjoys three-year growth in earnings per share of 34.5%, outperforming 87.8% of its competitors listed in the semiconductor industry. The net margin is also 16.2%, above 69.5% of the sector players.

Is NVDA stock a buy, according to analysts?

As for Wall Street, NVDA stock has a strong buy consensus rating based on 29 buys, seven holds and one sell rating. The average NVDA stock price target is $286.94, suggesting 5.9% upside potential.

Takeaway: The NVDA stock provides the shotgun approach

Overall, the NVDA stock brings the shotgun to the duck hunt. Basically, Nvidia doesn’t need to aim for a direct hit. Rather, it just needs to shift the barrel toward the general vicinity of compelling market opportunities. Once fired, pellets of relevance should hit something. Although this approach is not particularly exciting, it is probably more effective in achieving some positive results.

Mediation