Nvidia has been both the benefactor and victim of the cryptocurrency boom/bust cycle. As crypto rose in value, so did Nvidia’s share price. When crypto crashed, Nvidia’s share price often fell with it. The company makes a product that for a long time was essential to the operation of most of the world’s largest cryptocurrencies outside of bitcoin, and that has been both a blessing and a curse.

Nvidia and crypto are a love/hate relationship. When things were going well, Nvidia would like to create entire product lines with the sole purpose of running algorithms to “mine” cryptocurrency, known as CMP or Cryptocurrency Mining Processor (opens in a new tab). But when crypto crashed, which it tends to do, Nvidia would often be saddled with excess inventory (opens in a new tab) of graphics cards and find new ways to sell them.

Nvidia is clearly in the hate stage of their relationship right now, according to recent comments to The Guardian (opens in a new tab) by Nvidia’s CTO on the value of cryptocurrency to society.

“All this crypto stuff, it needed parallel processing, and [Nvidia] is the best, so people just programmed it to use for this purpose. They bought a lot of stuff, and then it finally collapsed, because it doesn’t bring anything useful to society. AI does it,” said Nvidia CTO Michael Kagan.

It’s no surprise that Nvidia is keen to position itself as the preeminent AI company, but I didn’t expect the company to outright bash cryptocurrency in the process. However, Kagan’s comments touch on a debate that has raged for some time, and that is whether cryptocurrency is a worthy alternative to fiat money or more so a tool to generate profit. So far we have seen many examples of the latter, and not so many that prove the former.

“I never thought so [crypto] is something that will do something good for humanity,” Kagan continued. “You know, people do crazy things, but they buy your stuff, you sell it. But you don’t redirect the company to support whatever it is.”

Nvidia was inclined to downplay the role cryptocurrency played in the increased demand we saw for graphics cards in recent years, which combined with supply chain issues led to graphics card shortages worldwide. Nvidia even attempted to block cryptocurrency mining on its GeForce GPUs, although this was not said to be a very effective anti-mining measure (opens in a new tab).

However, cryptocurrency mining is no longer one of the main drivers of GPU sales, and could possibly remain so forever.

Ethereum was the main cryptocurrency driving demand for graphics cards in recent years and the crypto boom before that, which happened around 2017/18. For both booms, Ethereum relied on a Proof-of-Work concept, which required massive computing power powered by graphics cards to mine Ether, the platform’s currency. Since September 2022, Ethereum has used a Proof-of-Stake concept (opens in a new tab)which no longer requires a graphics card to function.

So far, no other cryptocurrency has grown enough to drive such high demand for graphics cards again. It’s possible it could happen, but we haven’t seen it yet. For the sake of the environment, let’s hope we don’t.

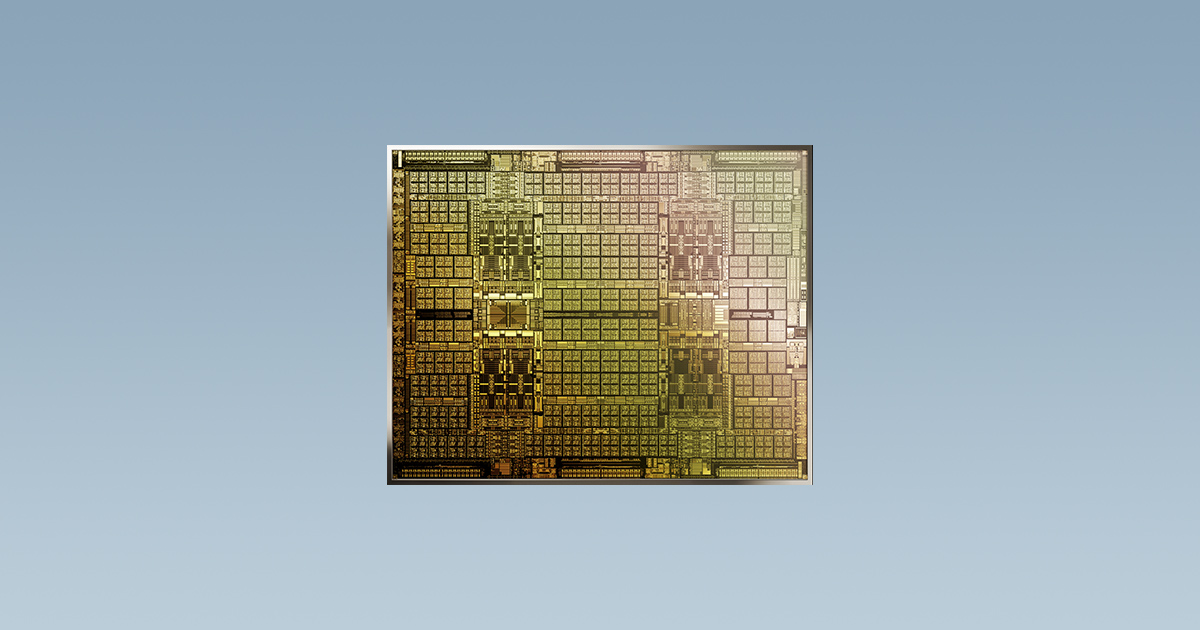

Meanwhile, people are clamoring to get their hands on Nvidia GPUs for use with AI applications. Nvidia powers many of today’s most popular AI applications, including OpenAI’s ChatGPT and Stable Diffusion, and more are coming on board. Over at GTC, the company’s developer conference, it was announced that Oracle, Meta, Amazon and Microsoft had recently invested in Nvidia’s H100 GPUs to “address rapidly growing demand for generative AI training and inference.”

All of this sounds like Nvidia wants to move on from crypto in a big way.